India E-Health and Telemedicine Market Overview

- The India E-Health and Telemedicine Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health solutions, rising healthcare costs, and the need for accessible healthcare services, especially in rural areas. The COVID-19 pandemic has further accelerated the shift towards telemedicine, as patients and healthcare providers seek safer alternatives to traditional in-person consultations.

- Key cities dominating the market include Bengaluru, Delhi, and Mumbai. These cities are hubs for technology and healthcare innovation, housing numerous startups and established companies that provide e-health and telemedicine services. The presence of a large urban population, coupled with high internet penetration and smartphone usage, contributes to the growth of telemedicine in these regions.

- In 2023, the Indian government implemented the National Digital Health Mission (NDHM), aimed at creating a digital health ecosystem. This initiative includes the establishment of a digital health ID for every citizen, promoting the use of telemedicine and e-health services. The NDHM is expected to enhance healthcare delivery and accessibility across the country, supporting the growth of the e-health and telemedicine market.

India E-Health and Telemedicine Market Segmentation

By Type:The market is segmented into various types, including Teleconsultation, Remote Patient Monitoring, Mobile Health Applications, E-Prescription Services, Health Information Exchange, Teletherapy, and Others. Among these, Teleconsultation is the leading segment, driven by the increasing demand for remote consultations, especially during the pandemic. Patients prefer the convenience and safety of virtual visits, which has led to a significant rise in teleconsultation services.

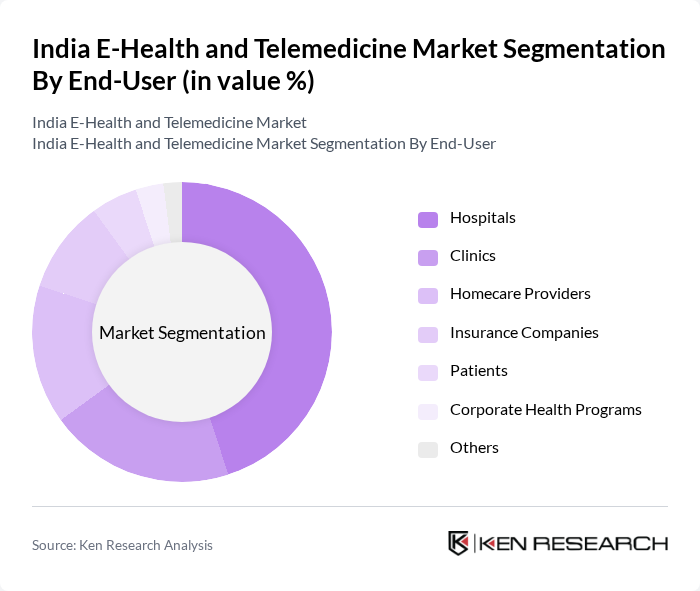

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Providers, Insurance Companies, Patients, Corporate Health Programs, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt telemedicine solutions to enhance patient care and streamline operations. The need for efficient healthcare delivery and the integration of telehealth services into hospital systems are driving this trend.

India E-Health and Telemedicine Market Competitive Landscape

The India E-Health and Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Practo Technologies Pvt. Ltd., 1mg Technologies Pvt. Ltd., Medlife International Pvt. Ltd., Apollo Hospitals Enterprise Ltd., Tata Consultancy Services (TCS), Philips Healthcare India, mFine, DocOnline, HealthifyMe, Zyla Health, Qure.ai, Practo Technologies Pvt. Ltd., Portea Medical, Medtronic India Pvt. Ltd., CureMetrix contribute to innovation, geographic expansion, and service delivery in this space.

India E-Health and Telemedicine Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, India is projected to have over 1.3 billion smartphone users, a significant increase from 1.1 billion in the previous year. This surge in smartphone adoption facilitates access to e-health applications, enabling patients to consult healthcare professionals remotely. The World Bank reports that mobile internet subscriptions in India reached 1.2 billion in the previous year, further supporting the growth of telemedicine services, particularly in urban areas where smartphone usage is highest.

- Rising Demand for Remote Healthcare Services:The COVID-19 pandemic has accelerated the demand for remote healthcare services, with teleconsultations increasing by 350% in the previous year. According to the National Health Authority, approximately 80 million teleconsultations were conducted in the previous year alone. This trend is expected to continue, driven by the need for accessible healthcare solutions, especially among the aging population, which is projected to reach 350 million in future, further boosting telemedicine adoption.

- Government Initiatives Promoting Digital Health:The Indian government has launched several initiatives to promote digital health, including the National Digital Health Mission (NDHM), which aims to create a digital health ecosystem. As of future, the government has allocated ?2,500 crores (approximately $300 million) to enhance telemedicine infrastructure. This funding is expected to improve access to healthcare services, particularly in underserved regions, thereby driving the growth of the e-health market.

Market Challenges

- Limited Internet Access in Rural Areas:Despite the growth of internet connectivity, approximately 45% of rural households in India still lack reliable internet access as of the previous year. The Telecom Regulatory Authority of India (TRAI) reported that only 35% of rural areas have broadband connectivity, which poses a significant barrier to the adoption of telemedicine services. This digital divide limits the reach of e-health solutions, particularly in remote regions where healthcare access is already constrained.

- Data Privacy and Security Concerns:With the rise of telemedicine, data privacy and security have become critical challenges. A survey by the Internet and Mobile Association of India (IAMAI) indicated that 70% of users are concerned about the security of their health data. The lack of robust data protection regulations has led to apprehensions among patients regarding the confidentiality of their medical information, which could hinder the growth of e-health services if not addressed effectively.

India E-Health and Telemedicine Market Future Outlook

The future of the India e-health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning into healthcare services is expected to enhance diagnostic accuracy and patient engagement. Additionally, the government's commitment to improving digital health infrastructure will likely facilitate broader access to telemedicine, particularly in rural areas. As healthcare providers adapt to these changes, the market is poised for significant growth, addressing both urban and rural healthcare needs effectively.

Market Opportunities

- Expansion of Telemedicine Services in Rural Regions:There is a substantial opportunity to expand telemedicine services in rural areas, where healthcare access is limited. By leveraging mobile technology, healthcare providers can reach underserved populations, potentially increasing patient engagement and improving health outcomes. The government’s initiatives to enhance internet connectivity will further support this expansion, making healthcare more accessible.

- Integration of AI and Machine Learning in Healthcare:The integration of AI and machine learning technologies presents a significant opportunity for the e-health market. These technologies can streamline operations, enhance diagnostic capabilities, and personalize patient care. As healthcare providers increasingly adopt these innovations, they can improve service delivery and patient satisfaction, driving further growth in the telemedicine sector.