Region:Europe

Author(s):Dev

Product Code:KRAB5439

Pages:82

Published On:October 2025

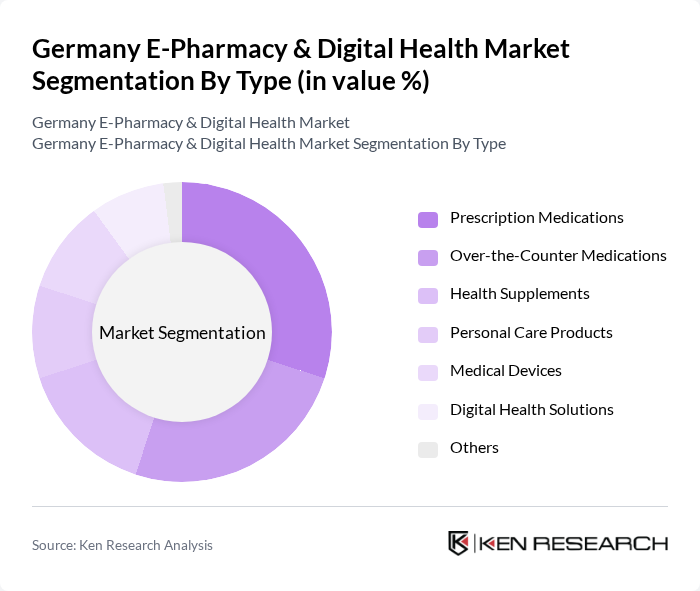

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter Medications, Health Supplements, Personal Care Products, Medical Devices, Digital Health Solutions, and Others. Each of these segments plays a crucial role in catering to the diverse needs of consumers and healthcare providers.

The Prescription Medications segment is currently dominating the market due to the increasing prevalence of chronic diseases and the growing demand for effective treatment options. Consumers are increasingly turning to e-pharmacies for their prescription needs, driven by the convenience of online ordering and home delivery services. Additionally, the integration of telemedicine with e-pharmacy services has further enhanced the accessibility of prescription medications, making it a preferred choice for many patients. The rise in digital health solutions is also contributing to the growth of this segment, as healthcare providers leverage technology to improve patient outcomes.

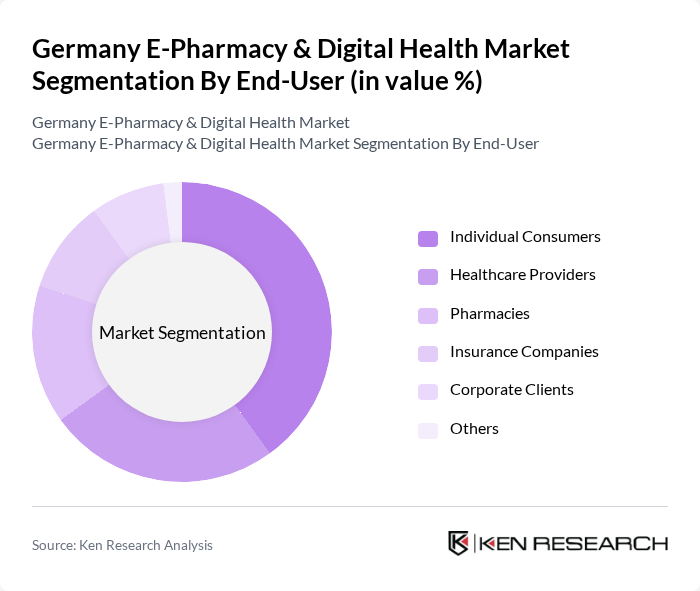

By End-User:The market is segmented by end-users, including Individual Consumers, Healthcare Providers, Pharmacies, Insurance Companies, Corporate Clients, and Others. Each segment reflects the diverse range of stakeholders involved in the e-pharmacy and digital health ecosystem.

The Individual Consumers segment is leading the market, driven by the increasing adoption of online shopping for healthcare products. Consumers are seeking convenience, competitive pricing, and a wider selection of products, which e-pharmacies provide. The rise of health-conscious consumers and the growing trend of self-medication have also contributed to the growth of this segment. Additionally, the COVID-19 pandemic has accelerated the shift towards online healthcare services, further solidifying the position of individual consumers as the primary end-users in the e-pharmacy market.

The Germany E-Pharmacy & Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocMorris, Shop Apotheke, Apotal, Zur Rose Group AG, Medpex, mycare.de, 1A Pharma, Sanicare, PharmaSGP, Vitalsana, E-Pharmacy Group, HealthHero, Zava, TeleClinic, HealthTap contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-pharmacy and digital health market in Germany appears promising, driven by technological innovations and changing consumer behaviors. As telehealth services expand, more patients are likely to embrace online consultations and medication delivery. Additionally, the integration of artificial intelligence in healthcare is expected to enhance personalized medicine, improving patient outcomes. These trends indicate a shift towards a more digital and patient-centric healthcare system, fostering growth in the e-pharmacy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter Medications Health Supplements Personal Care Products Medical Devices Digital Health Solutions Others |

| By End-User | Individual Consumers Healthcare Providers Pharmacies Insurance Companies Corporate Clients Others |

| By Sales Channel | Online Pharmacies Mobile Applications Direct Sales Third-Party Platforms Others |

| By Distribution Mode | Home Delivery Click and Collect In-Store Pickup Subscription Services Others |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Health Status Others |

| By Product Category | Chronic Disease Management Preventive Care Wellness Products Emergency Care Others |

| By Pricing Strategy | Discounted Products Premium Products Bundled Offers Subscription Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-Pharmacy User Experience | 150 | Regular E-Pharmacy Users, First-Time Users |

| Healthcare Professional Insights | 100 | Pharmacists, General Practitioners, Specialists |

| Digital Health Adoption Trends | 80 | Health Tech Innovators, Digital Health Consultants |

| Consumer Attitudes Towards E-Pharmacy | 120 | Consumers Aged 18-65, Health-Conscious Individuals |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Germany E-Pharmacy & Digital Health Market is valued at approximately USD 5.5 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and online pharmacy services, enhancing healthcare accessibility and efficiency.