Region:Europe

Author(s):Shubham

Product Code:KRAB1333

Pages:88

Published On:October 2025

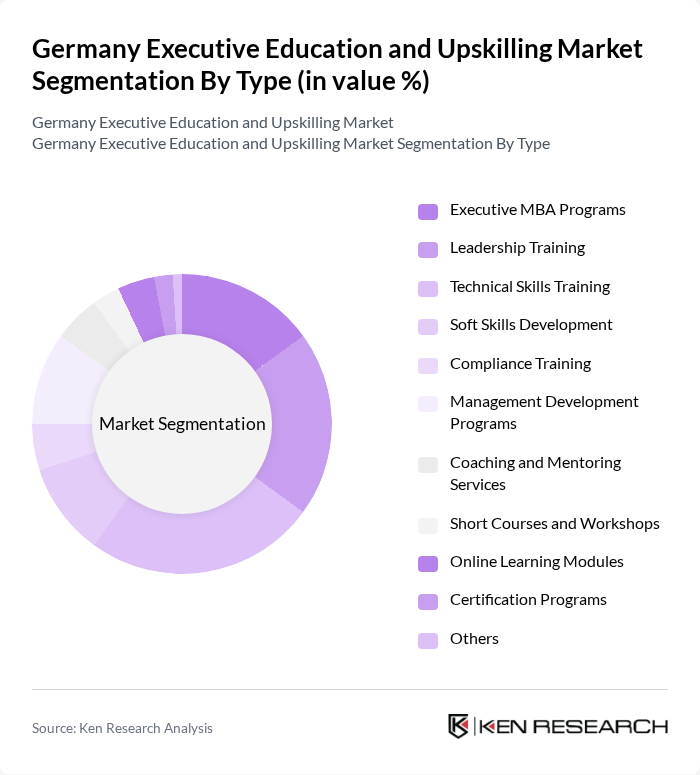

By Type:The market is segmented into various types of educational programs that cater to the diverse needs of professionals and organizations. The subsegments include Executive MBA Programs, Leadership Training, Technical Skills Training, Soft Skills Development, Compliance Training, Management Development Programs, Coaching and Mentoring Services, Short Courses and Workshops, Online Learning Modules, Certification Programs, and Others. Each of these subsegments plays a crucial role in addressing specific skill gaps and enhancing the overall competency of the workforce. Leadership Training and Technical Skills Training are particularly prominent, reflecting the emphasis on digital transformation and agile leadership in German enterprises.

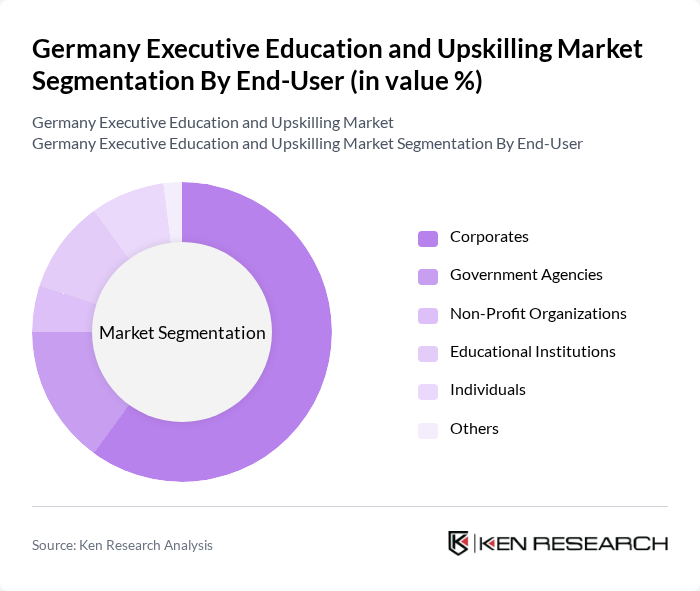

By End-User:The market is segmented based on the end-users of executive education and upskilling programs. The primary end-users include Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Each segment has unique training requirements, with corporates being the largest consumers due to their need for tailored training solutions to enhance employee performance and productivity. The trend is reinforced by compliance requirements, digital transformation, and the need to foster a culture of continuous learning.

The Germany Executive Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as WHU – Otto Beisheim School of Management, ESMT Berlin, Mannheim Business School, Frankfurt School of Finance & Management, HHL Leipzig Graduate School of Management, University of Mannheim, University of St. Gallen, ESCP Business School, TUM School of Management (Technical University of Munich), Cologne Business School, FOM University of Applied Sciences, Hochschule für Wirtschaft und Gesellschaft Ludwigshafen, International School of Management (ISM), Hochschule für Technik und Wirtschaft Berlin, IU Internationale Hochschule, Haufe Akademie, WBS TRAINING AG, Deutsche Akademie für Management, IHK Akademie, Quadriga Hochschule Berlin, EBS Universität für Wirtschaft und Recht, Steinbeis Hochschule, RWTH Aachen University, Ludwig Maximilian University of Munich, University of Cologne contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education and upskilling market in Germany appears promising, driven by the increasing integration of technology in learning environments. As organizations continue to embrace digital tools, the demand for innovative training solutions will rise. Additionally, the focus on personalized learning experiences is expected to grow, with providers adapting their offerings to meet the specific needs of businesses and individuals. This evolution will likely enhance engagement and effectiveness in skill development initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Training Technical Skills Training Soft Skills Development Compliance Training Management Development Programs Coaching and Mentoring Services Short Courses and Workshops Online Learning Modules Certification Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Blended Learning Mobile Learning On-Demand Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Industry Focus | IT and Technology Finance and Banking Healthcare Manufacturing Services Retail Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Accredited Certifications Non-Accredited Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Sponsorship Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | Program Directors, Corporate Trainers |

| Upskilling Initiatives in Tech Sector | 90 | HR Managers, Learning & Development Specialists |

| Leadership Development Workshops | 80 | Senior Executives, Organizational Development Consultants |

| Industry-Specific Training Programs | 70 | Training Coordinators, Industry Experts |

| Online Learning Platforms for Professionals | 100 | eLearning Managers, Content Developers |

The Germany Executive Education and Upskilling Market is valued at approximately USD 5 billion, reflecting significant growth driven by the demand for skilled professionals, technological advancements, and the adoption of hybrid and digital learning formats.