Region:Europe

Author(s):Rebecca

Product Code:KRAD0275

Pages:85

Published On:August 2025

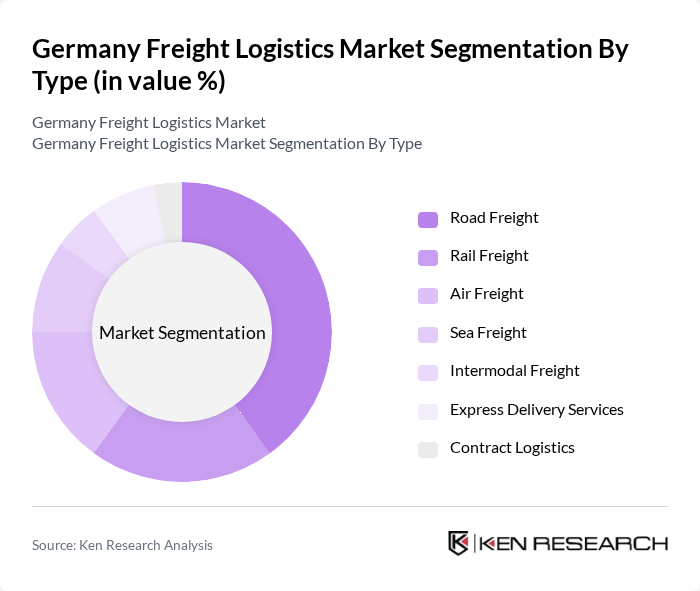

By Type:The freight logistics market can be segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express Delivery Services, and Contract Logistics. Road Freight remains the most dominant segment due to its flexibility, door-to-door service, and extensive national network. Rail Freight is significant for bulk goods and long-distance transport, while Air Freight is preferred for high-value and time-sensitive shipments. The rapid growth of e-commerce has notably boosted Express Delivery Services, which now represent a key area of innovation and expansion. Intermodal Freight is gaining traction as companies seek integrated, multimodal solutions to optimize cost and sustainability .

By End-User:The end-user segmentation of the freight logistics market includes Manufacturing, Consumer Goods and Retail, Automotive, Food and Beverage, Healthcare and Pharmaceuticals, Construction, Chemicals, IT Hardware and Telecom, Oil and Gas, and Others. The Manufacturing sector is the largest end-user, reflecting Germany's industrial strength and the need for efficient supply chain management. Consumer Goods and Retail is a major segment, driven by e-commerce and omnichannel retailing, which require rapid and flexible logistics solutions. The Automotive sector remains a core pillar, relying on just-in-time logistics for both parts and finished vehicles. Food and Beverage, Healthcare, and Pharmaceuticals are also significant, with growing demand for temperature-controlled and time-sensitive logistics .

The Germany Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Post DHL Group, DB Schenker, Kuehne + Nagel International AG, DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Dachser Group SE & Co. KG, Rhenus Logistics, FIEGE Logistik Stiftung & Co. KG, Geodis, CEVA Logistics, DB Cargo AG, DPDgroup (GeoPost), UPS, FedEx Express, Nippon Express Co., Ltd., Kintetsu World Express, Inc. (APL Logistics Ltd.) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the German freight logistics market appears promising, driven by ongoing digital transformation and a heightened focus on sustainability. As companies increasingly adopt smart logistics solutions, the integration of IoT and AI technologies will enhance operational efficiency and reduce costs. Furthermore, the push for greener logistics practices will likely lead to innovative solutions that align with environmental regulations, ensuring that the industry remains competitive and responsive to market demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express Delivery Services Contract Logistics |

| By End-User | Manufacturing Consumer Goods and Retail Automotive Food and Beverage Healthcare and Pharmaceuticals Construction Chemicals IT Hardware and Telecom Oil and Gas Others |

| By Service Type | Freight Forwarding Warehousing and Distribution Customs Brokerage Inventory Management Value-Added Logistics Services Supply Chain Management Last-Mile Delivery Others |

| By Region | North Rhine-Westphalia Bavaria Baden-Württemberg Eastern Germany Northern Germany Central Germany Others |

| By Delivery Mode | Standard Delivery Express Delivery Scheduled Delivery On-Demand Delivery Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Platforms Automated Logistics Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Coordinators, Fleet Managers |

| Rail Freight Services | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 50 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Logistics | 40 | Port Operations Managers, Shipping Line Executives |

| Third-Party Logistics Providers | 70 | Business Development Managers, Client Relationship Managers |

The Germany Freight Logistics Market is valued at approximately USD 215 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and advancements in digital technologies like IoT and AI.