Region:Europe

Author(s):Shubham

Product Code:KRAC0824

Pages:89

Published On:August 2025

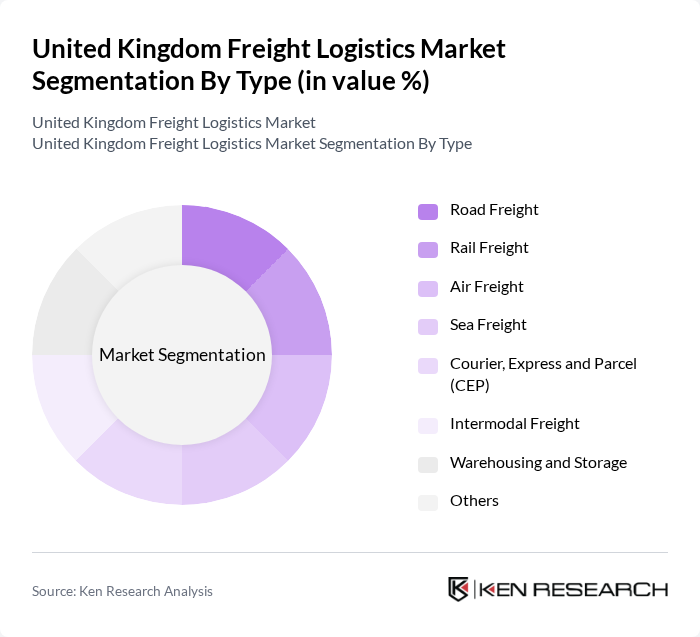

By Type:

The freight logistics market can be segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Courier, Express and Parcel (CEP), Intermodal Freight, Warehousing and Storage, and Others. Among these,Road Freightremains the dominant segment, accounting for the largest share of market activity. This dominance is attributed to the UK’s extensive road infrastructure, the flexibility and reliability of road transport for both short-haul and long-haul deliveries, and the surge in e-commerce which demands rapid, door-to-door distribution. The integration of real-time tracking and route optimization technologies further enhances the efficiency and appeal of road freight for businesses .

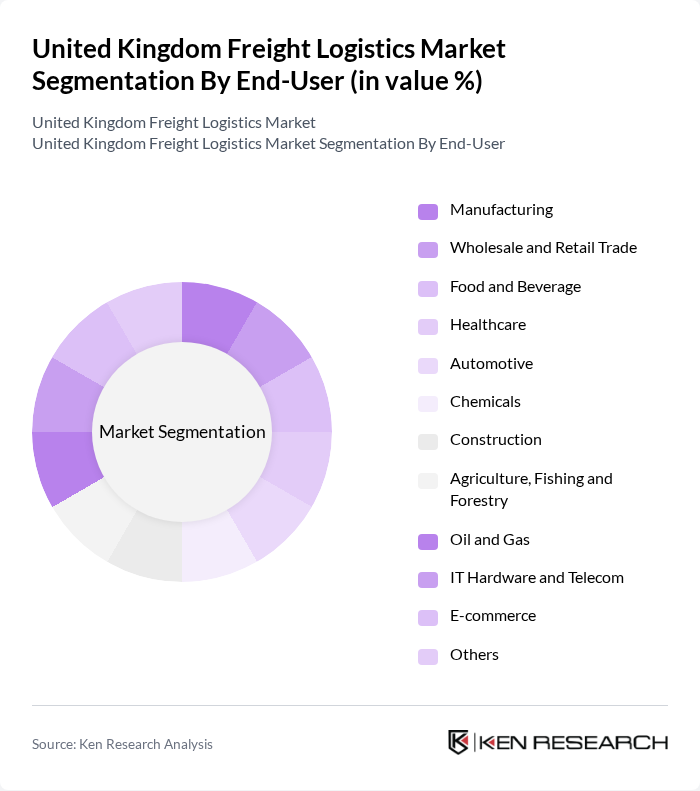

By End-User:

The end-user segmentation of the freight logistics market includes Manufacturing, Wholesale and Retail Trade, Food and Beverage, Healthcare, Automotive, Chemicals, Construction, Agriculture, Fishing and Forestry, Oil and Gas, IT Hardware and Telecom, E-commerce, and Others.Wholesale and Retail Tradeis the leading end-user segment, accounting for the largest share, driven by the robust growth of e-commerce and omnichannel retailing. The E-commerce sector, while rapidly expanding, is a major growth driver within both retail and CEP segments, prompting logistics providers to invest in advanced distribution networks, automation, and technology to meet consumer expectations for speed and reliability .

The United Kingdom Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, DPD Group, FedEx, UPS, Geodis, CEVA Logistics, Wincanton, Palletways, Eddie Stobart Logistics, Tuffnells, Yodel, Clipper Logistics, Royal Mail Group, Amazon Logistics UK, Gist Limited, Europa Worldwide Group, Freightliner Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK freight logistics market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve significantly. Additionally, the emphasis on green logistics will likely lead to innovative practices that reduce environmental impact. These trends will shape the logistics landscape, fostering a more resilient and adaptive industry capable of meeting evolving consumer demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Courier, Express and Parcel (CEP) Intermodal Freight Warehousing and Storage Others |

| By End-User | Manufacturing Wholesale and Retail Trade Food and Beverage Healthcare Automotive Chemicals Construction Agriculture, Fishing and Forestry Oil and Gas IT Hardware and Telecom E-commerce Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Forwarding Contract Logistics Reverse Logistics Others |

| By Service Type | Transportation Services Warehousing Services Inventory Management Packaging and Labeling Customs Brokerage Value-Added Services Freight Brokerage Others |

| By Payload Capacity | Less than 1 Ton 5 Tons 10 Tons Above 10 Tons Others |

| By Geographic Coverage | England Wales Scotland Northern Ireland National Coverage Regional Coverage Local Coverage International Coverage Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Fleet Managers, Operations Directors |

| Rail Freight Services | 60 | Logistics Coordinators, Rail Operations Managers |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Solutions | 50 | Port Operations Managers, Shipping Line Executives |

| Last-Mile Delivery Services | 70 | Last-Mile Managers, E-commerce Logistics Heads |

The United Kingdom Freight Logistics Market is valued at approximately USD 134 billion, driven by factors such as the growth of e-commerce, consumer demand for speed, and significant investments in digital technologies and infrastructure.