Region:North America

Author(s):Shubham

Product Code:KRAA3121

Pages:85

Published On:August 2025

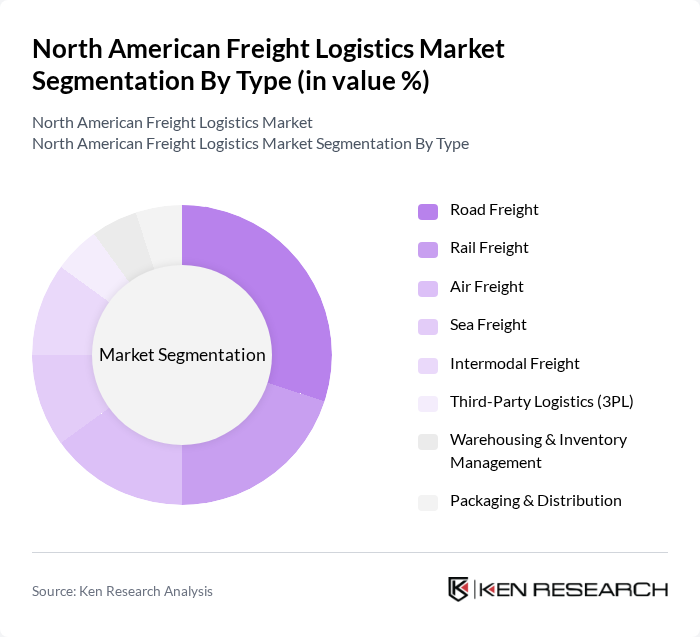

By Type:The freight logistics market can be segmented into various types, including road freight, rail freight, air freight, sea freight, intermodal freight, third-party logistics (3PL), warehousing & inventory management, and packaging & distribution. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and customer requirements .

The road freight segment is the largest in the market, driven by the increasing demand for last-mile delivery services and the flexibility it offers in transporting goods. The surge in e-commerce has significantly boosted the need for efficient road logistics, as businesses seek to meet consumer expectations for quick and reliable deliveries. Additionally, advancements in technology, such as route optimization, real-time tracking, and the adoption of electric and autonomous vehicles, have further enhanced the efficiency and sustainability of road freight operations .

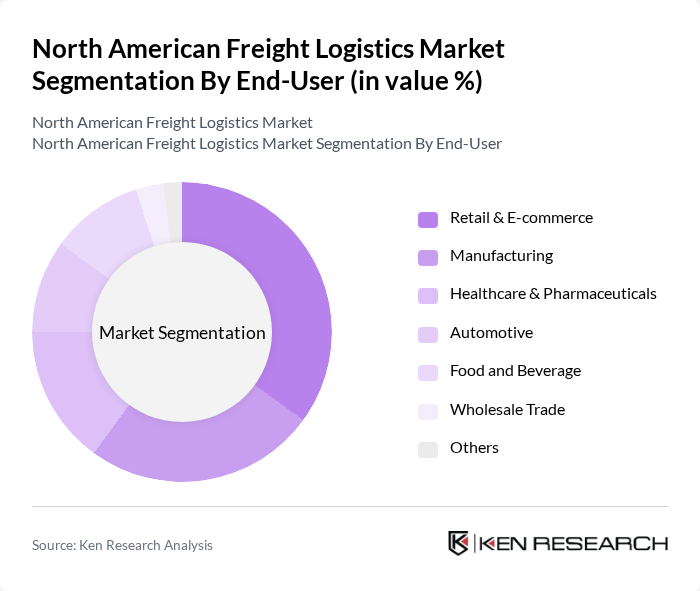

By End-User:The freight logistics market serves various end-user industries, including retail & e-commerce, manufacturing, healthcare & pharmaceuticals, automotive, food and beverage, wholesale trade, and others. Each sector has unique logistics requirements, influencing the demand for specific freight services .

The retail & e-commerce segment is the leading end-user in the freight logistics market, driven by the rapid growth of online shopping and the demand for fast delivery services. The shift in consumer behavior towards online purchasing has necessitated efficient logistics solutions to ensure timely deliveries. Additionally, the increasing number of fulfillment centers, the adoption of automation in warehouses, and advancements in digital tracking technologies have further supported the growth of this segment .

The North American Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, United Parcel Service, Inc. (UPS), XPO Logistics, Inc., J.B. Hunt Transport Services, Inc., C.H. Robinson Worldwide, Inc., Schneider National, Inc., Old Dominion Freight Line, Inc., TFI International Inc., ArcBest Corporation, Saia, Inc., Landstar System, Inc., Estes Express Lines, Inc., R+L Carriers, Inc., Knight-Swift Transportation Holdings Inc., Penske Logistics, Ryder System, Inc., Canadian National Railway Company (CN), BNSF Railway Company, Union Pacific Corporation, and Purolator Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American freight logistics market is poised for transformative growth driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly adopt automation and data analytics to enhance efficiency. Additionally, sustainability initiatives will shape operational strategies, with companies investing in green logistics solutions. The focus on intermodal transportation will also gain traction, facilitating seamless movement across various transport modes, ultimately improving service delivery and reducing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Third-Party Logistics (3PL) Warehousing & Inventory Management Packaging & Distribution |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Wholesale Trade Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Drop Shipping Cross-Docking Others |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing Transportation Management Inventory Management Packaging Others |

| By Cargo Type | Dry Cargo Liquid Cargo Perishable Goods Hazardous Materials Temperature-Sensitive Goods Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Truck Freight Operations | 120 | Fleet Managers, Operations Directors |

| Rail Freight Logistics | 60 | Logistics Coordinators, Rail Operations Managers |

| Air Cargo Services | 40 | Air Freight Managers, Supply Chain Analysts |

| Maritime Shipping Logistics | 50 | Port Operations Managers, Shipping Coordinators |

| Last-Mile Delivery Solutions | 55 | Last-Mile Managers, E-commerce Logistics Directors |

The North American Freight Logistics Market is valued at approximately USD 1.48 trillion, reflecting significant growth driven by increased demand for efficient supply chain solutions, e-commerce expansion, and technological advancements in logistics management.