Region:Europe

Author(s):Dev

Product Code:KRAA1560

Pages:82

Published On:August 2025

By Mode:The freight logistics market in Sweden is segmented by mode into various categories, including road freight, rail freight, air freight, sea/maritime freight, intermodal/multimodal freight, courier, express & parcel (CEP), and pipeline freight. Each mode serves distinct logistical needs, with road freight being the most utilized due to its flexibility and extensive network. Rail freight is also significant, particularly for bulk goods, while air freight caters to time-sensitive deliveries. The sea/maritime segment is crucial for international trade, and intermodal solutions are increasingly popular for their efficiency. The CEP segment has seen rapid growth due to the e-commerce boom, while pipeline freight is essential for transporting liquids and gases.

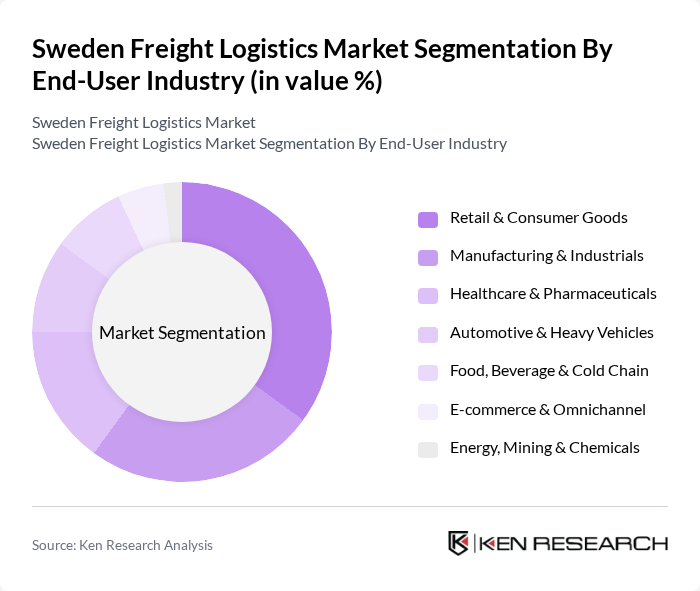

By End-User Industry:The end-user industry segmentation of the freight logistics market includes retail & consumer goods, manufacturing & industrials, healthcare & pharmaceuticals, automotive & heavy vehicles, food, beverage & cold chain, e-commerce & omnichannel, and energy, mining & chemicals. The retail and e-commerce sectors are the largest consumers of logistics services, driven by the increasing demand for fast and reliable delivery options. The manufacturing sector also plays a significant role, requiring efficient logistics for raw materials and finished goods. The healthcare industry demands specialized logistics for pharmaceuticals, while the food and beverage sector relies on cold chain logistics to maintain product quality.

The Sweden Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as PostNord AB, DHL (Deutsche Post DHL Group), DB Schenker (Schenker AB), DSV A/S (DSV Road AB; DSV Air & Sea AB), Kuehne+Nagel AB, GEODIS, FedEx Express/TNT Sweden AB, UPS Scandinavia, A.P. Moller – Maersk (Maersk Logistics & Services), Stena Line Freight, Green Cargo AB, Bring (Posten Bring Sverige), CMA CGM Scandinavia, DFDS Logistics, C.H. Robinson Europe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden freight logistics market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to enhance their last-mile delivery capabilities. Additionally, the focus on sustainability will push companies to adopt greener practices, aligning with government emission reduction targets. These trends indicate a dynamic market landscape, where innovation and efficiency will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode | Road Freight Rail Freight Air Freight Sea/Maritime Freight Intermodal/Multimodal Freight Courier, Express & Parcel (CEP) Pipeline Freight |

| By End-User Industry | Retail & Consumer Goods Manufacturing & Industrials Healthcare & Pharmaceuticals Automotive & Heavy Vehicles Food, Beverage & Cold Chain E-commerce & Omnichannel Energy, Mining & Chemicals |

| By Service Type | Freight Forwarding Warehousing & Storage Customs Brokerage Supply Chain Management & 3PL/4PL Last-Mile & Fulfilment Services Value-Added Services (kitting, packaging, returns) |

| By Region | Stockholm–Mälardalen (Eastern) Västra Götaland & Gothenburg (Western) Skåne & Malmö/Öresund (Southern) Norrland (Northern) Central Sweden (Svealand) Gotland & Other Regions |

| By Delivery Speed (CEP and B2B) | Same-Day Next-Day Two-Day/Express Standard/Economy Scheduled/Time-Definite |

| By Packaging/Load Type | Bulk & Liquid Bulk Palletized & Unitized Loads Parcels & Small Packs Specialized & Reefer (temperature-controlled) Oversized/Project Cargo |

| By Pricing Model | Contract Logistics (long-term) Spot/Variable Pricing Tariff & Fuel-Surcharge Based Subscription/Platform Fees |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Coordinators, Fleet Managers |

| Rail Freight Services | 90 | Operations Directors, Rail Network Planners |

| Maritime Freight Logistics | 80 | Port Managers, Shipping Line Executives |

| Air Cargo Management | 70 | Air Freight Managers, Customs Compliance Officers |

| Cold Chain Logistics | 60 | Supply Chain Managers, Quality Assurance Leads |

The Sweden Freight Logistics Market is valued at approximately USD 42 billion, reflecting a robust growth trajectory driven by increasing demand for efficient supply chain solutions, technological advancements, and the rise of e-commerce in the country.