Region:Global

Author(s):Dev

Product Code:KRAC0494

Pages:82

Published On:August 2025

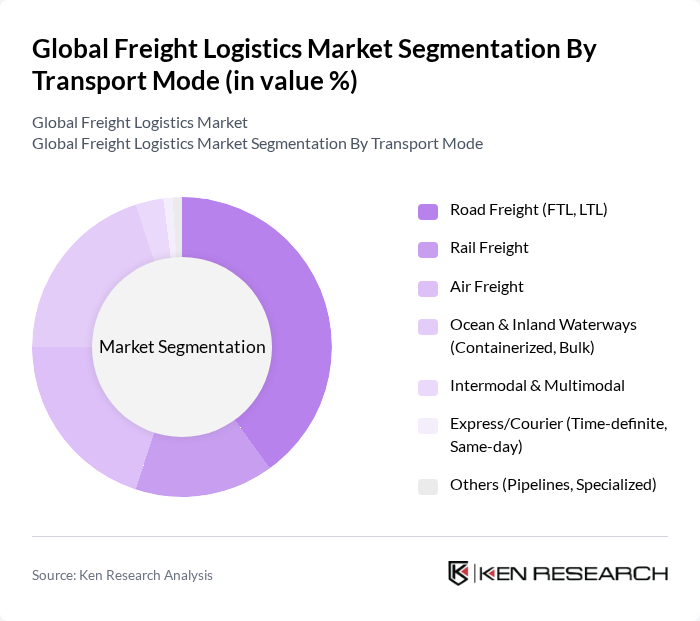

By Transport Mode:The transport mode segment encompasses various methods of freight transportation, including road, rail, air, and maritime. Each mode has its unique advantages and is chosen based on factors such as cost, speed, and cargo type. Road freight, particularly Full Truck Load (FTL) and Less Than Truck Load (LTL), is widely used for its flexibility and accessibility. Air freight is preferred for high-value and time-sensitive goods, while ocean freight is essential for bulk shipments.

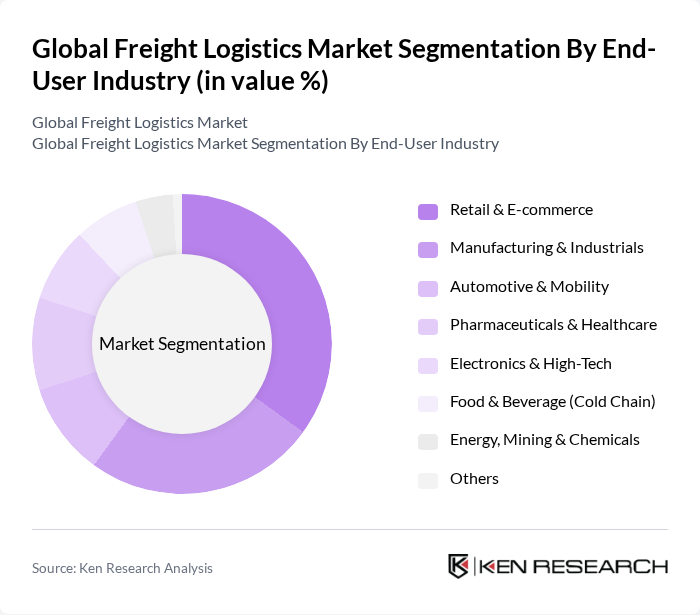

By End-User Industry:The end-user industry segment includes various sectors that rely on freight logistics for their operations. Retail and e-commerce are the largest contributors, driven by the surge in online shopping and the need for efficient last-mile delivery solutions. The manufacturing sector also plays a significant role, requiring logistics for raw materials and finished goods. Other industries, such as pharmaceuticals and automotive, have specific logistics needs that further diversify the market.

The Global Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, Kuehne+Nagel, DB Schenker, C.H. Robinson, XPO, UPS Supply Chain Solutions, FedEx Logistics, Maersk Logistics & Services (A.P. Moller - Maersk), DSV, CEVA Logistics, GEODIS, SNCF Logistics (Rail Logistics Europe), ZIM Integrated Shipping Services, Bolloré Logistics, Nippon Express Holdings (Nippon Express/NEC), Sinotrans, China COSCO Shipping Logistics, CMA CGM Air Cargo & Logistics (CEVA parent), Kerry Logistics Network, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freight logistics market is poised for transformation, driven by technological innovations and evolving consumer expectations. As companies increasingly adopt automation and AI, operational efficiencies will improve, enabling faster delivery times. Additionally, the focus on sustainability will lead to the development of greener logistics solutions, aligning with global environmental goals. The integration of IoT will enhance supply chain visibility, while collaborative logistics models will foster partnerships that optimize resource utilization, ensuring a resilient and adaptive logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Transport Mode | Road Freight (FTL, LTL) Rail Freight Air Freight Ocean & Inland Waterways (Containerized, Bulk) Intermodal & Multimodal Express/Courier (Time-definite, Same-day) Others (Pipelines, Specialized) |

| By End-User Industry | Retail & E-commerce Manufacturing & Industrials Automotive & Mobility Pharmaceuticals & Healthcare Electronics & High-Tech Food & Beverage (Cold Chain) Energy, Mining & Chemicals Others |

| By Logistics Model | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) & Lead Logistics Freight Forwarding & NVOCC Contract Logistics Others |

| By Service Type | Freight Transportation Freight Brokerage & Spot Market Freight Management & Control Towers Warehousing, Fulfillment & Distribution Customs Brokerage & Trade Compliance Last-Mile & Reverse Logistics Others |

| By Cargo Type | Dry Cargo (General, Containerized) Liquid Bulk Perishables & Cold Chain Dangerous Goods/Hazardous Materials Project & Heavy-Lift Cargo Others |

| By Pricing/Contract Model | Contracted (Long-term, Dedicated) Spot/Market-Based Pricing Dynamic/Index-Linked Pricing Subscription/Platform Fees Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Services | 100 | Air Cargo Managers, Logistics Coordinators |

| Maritime Shipping Operations | 80 | Shipping Line Executives, Port Authority Officials |

| Land Transportation Logistics | 90 | Fleet Managers, Transportation Analysts |

| Cold Chain Logistics | 70 | Supply Chain Managers, Quality Control Specialists |

| Freight Forwarding Services | 110 | Freight Forwarders, Customs Brokers |

The Global Freight Logistics Market is valued at approximately USD 6.3 trillion, reflecting the extensive scale of freight transport, forwarding, warehousing, and associated logistics services, as per recent industry analyses.