Region:Europe

Author(s):Rebecca

Product Code:KRAA0340

Pages:95

Published On:August 2025

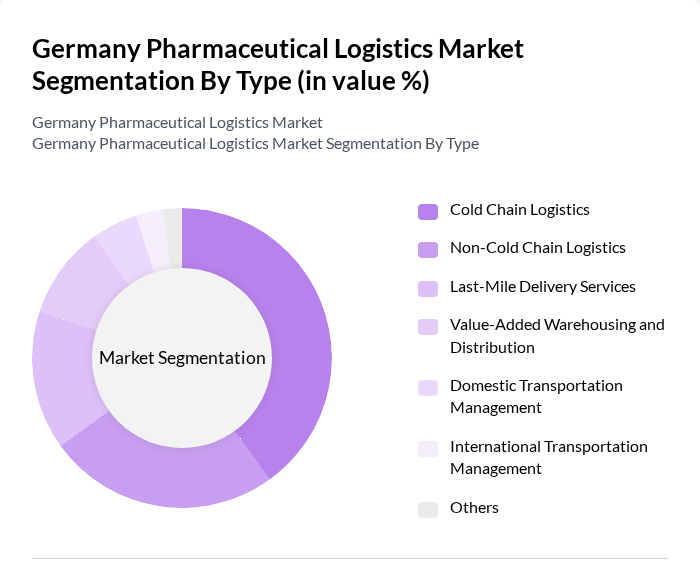

By Type:The market is segmented into various types, including Cold Chain Logistics, Non-Cold Chain Logistics, Last-Mile Delivery Services, Value-Added Warehousing and Distribution, Domestic Transportation Management, International Transportation Management, and Others. Among these, Cold Chain Logistics is the leading segment due to the increasing demand for temperature-sensitive pharmaceuticals, particularly vaccines and biologics. The rise in chronic diseases, the expansion of the biopharmaceutical sector, and the need for specialized storage and transportation solutions have further propelled this segment's growth. Cold chain logistics is critical for maintaining product efficacy and compliance with regulatory standards .

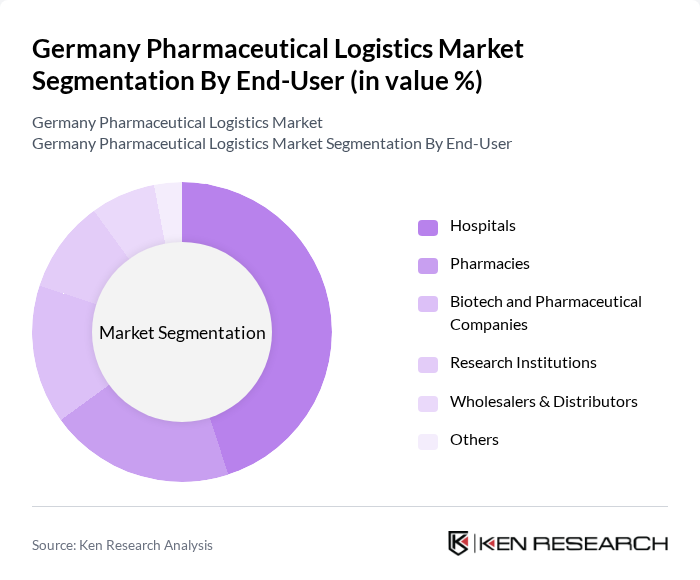

By End-User:The end-user segmentation includes Hospitals, Pharmacies, Biotech and Pharmaceutical Companies, Research Institutions, Wholesalers & Distributors, and Others. Hospitals are the dominant end-user segment, driven by the increasing need for timely and efficient delivery of medications and medical supplies. The growing number of healthcare facilities, the rising patient population, and the critical importance of uninterrupted supply chains for patient care have further contributed to the demand for pharmaceutical logistics services in this sector .

The Germany Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, GEODIS, UPS Healthcare, FedEx Express, DSV, Rhenus Logistics, Logwin AG, Hellmann Worldwide Logistics, CEVA Logistics, Fiege Logistics, Trans-o-flex Express, Pharmaserv Logistics, DACHSER contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical logistics market in Germany appears promising, driven by the increasing demand for biopharmaceuticals and the ongoing digital transformation within the industry. As companies invest in automation and AI technologies, operational efficiencies are expected to improve significantly. Furthermore, the expansion into emerging markets presents new growth avenues, allowing logistics providers to diversify their service offerings and enhance their competitive edge in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain Logistics Non-Cold Chain Logistics Last-Mile Delivery Services Value-Added Warehousing and Distribution Domestic Transportation Management International Transportation Management Others |

| By End-User | Hospitals Pharmacies Biotech and Pharmaceutical Companies Research Institutions Wholesalers & Distributors Others |

| By Service Type | Transportation Services Warehousing Services Inventory Management Packaging & Labeling Services Track & Trace Solutions Others |

| By Temperature Control | Ambient Temperature Logistics Refrigerated/Chilled Logistics Frozen Logistics Controlled Room Temperature (CRT) Others |

| By Distribution Channel | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Region | North Germany South Germany East Germany West Germany |

| By Regulatory Compliance | EU Regulations National Regulations Industry Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 60 | Logistics Managers, Supply Chain Directors |

| Cold Chain Management | 45 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Logistics | 40 | Compliance Officers, Regulatory Affairs Managers |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Customer Service Leads |

| Pharmaceutical Returns Management | 40 | Inventory Managers, Procurement Officers |

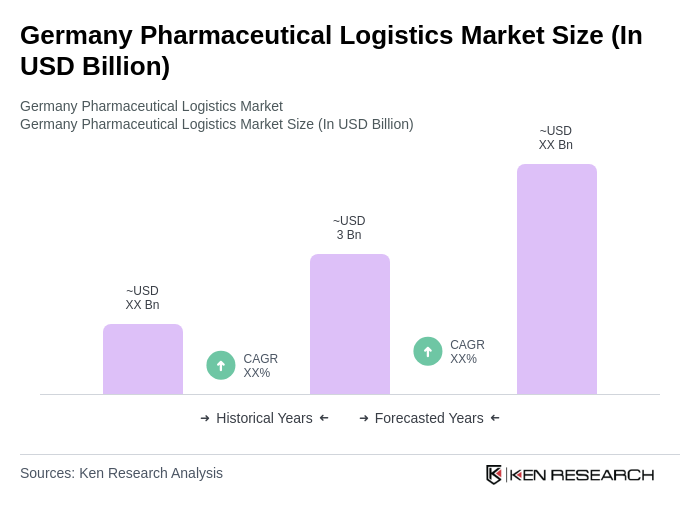

The Germany Pharmaceutical Logistics Market is valued at approximately USD 3 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient supply chain solutions and the rise of e-commerce in pharmaceuticals.