Region:Africa

Author(s):Shubham

Product Code:KRAA0928

Pages:90

Published On:August 2025

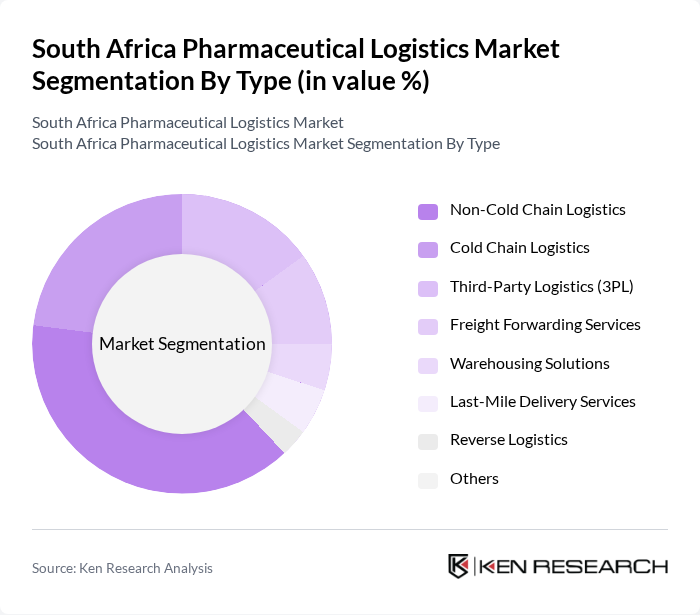

By Type:The pharmaceutical logistics market can be segmented into Non-Cold Chain Logistics, Cold Chain Logistics, Third-Party Logistics (3PL), Freight Forwarding Services, Warehousing Solutions, Last-Mile Delivery Services, Reverse Logistics, and Others. Among these, Cold Chain Logistics is particularly significant due to the increasing need for temperature-sensitive pharmaceuticals such as vaccines, biologics, and specialty medicines, which require strict temperature control during transportation and storage. The rising demand for biologics, vaccines, and high-value specialty drugs has further propelled the growth of this segment, making it a critical focus area for logistics providers .

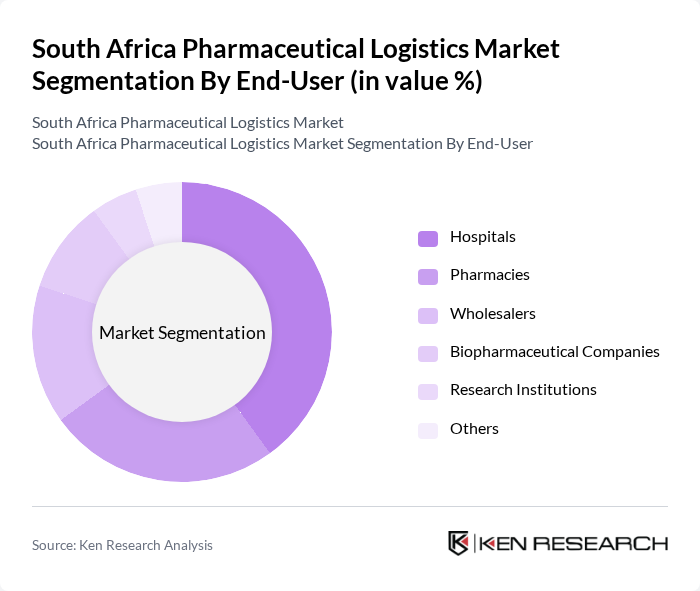

By End-User:The end-user segmentation includes Hospitals, Pharmacies, Wholesalers, Biopharmaceutical Companies, Research Institutions, and Others. Hospitals are the leading end-users in the pharmaceutical logistics market, driven by the increasing number of healthcare facilities and the rising demand for medical supplies. The need for efficient logistics solutions to manage inventory and ensure timely delivery of medications is critical in hospital settings, making this segment a key focus for logistics providers .

The South Africa Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DSV South Africa, DHL Supply Chain South Africa, Kuehne + Nagel South Africa, Medlog South Africa, Transpharm, Onelogix Group, Rhenus Logistics South Africa, CEVA Logistics South Africa, Pharmed Pharmaceuticals, SkyNet Worldwide Express, UPS Supply Chain Solutions South Africa, Bolloré Logistics South Africa, RTT Group contribute to innovation, geographic expansion, and service delivery in this space.

The South African pharmaceutical logistics market is poised for significant transformation, driven by technological advancements and increased healthcare investments. As e-commerce for pharmaceuticals expands, logistics providers will need to adapt to new distribution models. Additionally, the focus on sustainability will encourage companies to adopt greener practices. The integration of AI and automation will streamline operations, enhancing efficiency and responsiveness to market demands, ultimately improving patient access to essential medications.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-Cold Chain Logistics Cold Chain Logistics Third-Party Logistics (3PL) Freight Forwarding Services Warehousing Solutions Last-Mile Delivery Services Reverse Logistics Others |

| By End-User | Hospitals Pharmacies Wholesalers Biopharmaceutical Companies Research Institutions Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Online Distribution Retail Distribution Others |

| By Service Type | Transportation Services Inventory Management Packaging Services Value-Added Services Others |

| By Temperature Control | Ambient Temperature Refrigerated Temperature Frozen Temperature Others |

| By Compliance Level | GDP Compliant Non-GDP Compliant Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 60 | Logistics Managers, Supply Chain Executives |

| Cold Chain Management in Pharmaceuticals | 50 | Operations Managers, Quality Assurance Heads |

| Pharmaceutical Warehousing Solutions | 40 | Warehouse Managers, Inventory Control Specialists |

| Last-Mile Delivery in Pharma | 40 | Delivery Coordinators, Customer Service Managers |

| Regulatory Compliance in Logistics | 40 | Compliance Officers, Regulatory Affairs Managers |

The South Africa Pharmaceutical Logistics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing pharmaceutical demand, healthcare infrastructure expansion, and the rising prevalence of diseases such as HIV/AIDS and diabetes.