Region:Europe

Author(s):Dev

Product Code:KRAA0405

Pages:82

Published On:August 2025

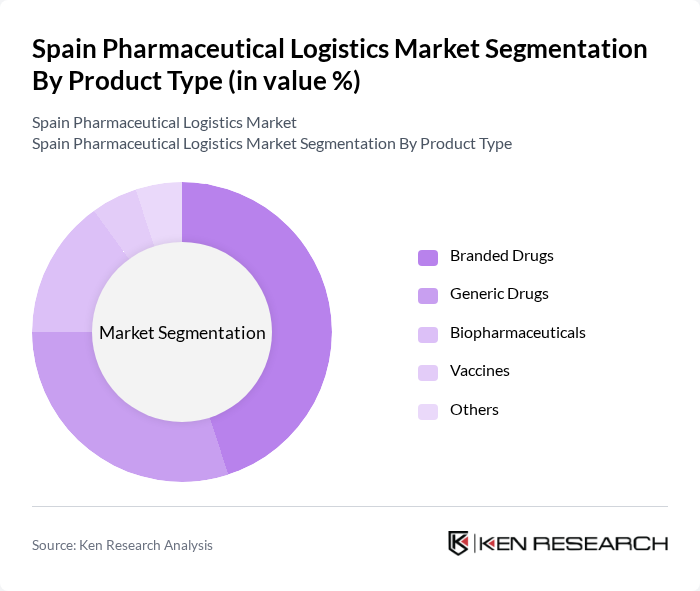

By Product Type:The product type segmentation includes branded drugs, generic drugs, biopharmaceuticals, vaccines, and others. Branded drugs maintain a leading position in the market, supported by high demand, ongoing innovations, and extensive marketing efforts. Generic drugs are increasingly adopted as cost-effective alternatives, particularly as more patents expire and healthcare systems emphasize affordability. Biopharmaceuticals are gaining importance due to their complex handling requirements and the growing interest in personalized medicine, while vaccines and other specialized products require robust cold chain solutions .

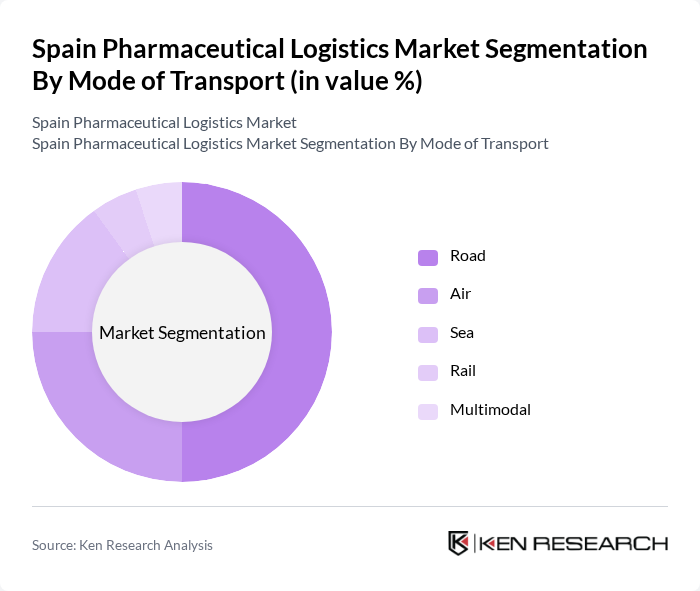

By Mode of Transport:The mode of transport segmentation includes road, air, sea, rail, and multimodal options. Road transport is the dominant method, favored for its flexibility, last-mile reach, and suitability for both ambient and temperature-controlled shipments. Air transport is essential for high-value, time-sensitive, and temperature-sensitive pharmaceuticals, while sea transport is used for bulk and international shipments. Rail is gaining attention for its cost-effectiveness and environmental benefits, and multimodal solutions are increasingly implemented to optimize efficiency and reliability in complex supply chains .

The Spain Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, UPS Healthcare, FedEx Express, XPO Logistics, Geodis, Movianto, Logista Pharma, Seur (DPDgroup), TSE Express, Transfesa Logistics, Stef Iberia, Alloga Spain, Grupo Suardiaz contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmaceutical logistics market in Spain appears promising, driven by technological advancements and evolving consumer expectations. The integration of digital solutions and automation is expected to enhance operational efficiency, while the focus on sustainability will shape logistics strategies. Additionally, the increasing prevalence of personalized medicine will necessitate tailored logistics solutions, creating opportunities for providers to innovate and expand their service offerings in response to market demands.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Branded Drugs Generic Drugs Biopharmaceuticals Vaccines Others |

| By Mode of Transport | Road Air Sea Rail Multimodal |

| By Application | Hospital & Clinic Supply Pharmacy Distribution Direct-to-Patient Delivery Clinical Trial Logistics Others |

| By Temperature Control | Cold Chain Logistics Non-Cold Chain Logistics |

| By Region | Catalonia (Barcelona) Madrid Andalusia Valencia Basque Country Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Cold Chain Management in Pharmaceuticals | 80 | Operations Managers, Quality Assurance Heads |

| Pharmaceutical Warehousing Solutions | 60 | Warehouse Managers, Inventory Control Specialists |

| Last-Mile Delivery in Pharma | 50 | Delivery Managers, Customer Service Representatives |

| Regulatory Compliance in Logistics | 40 | Compliance Officers, Regulatory Affairs Managers |

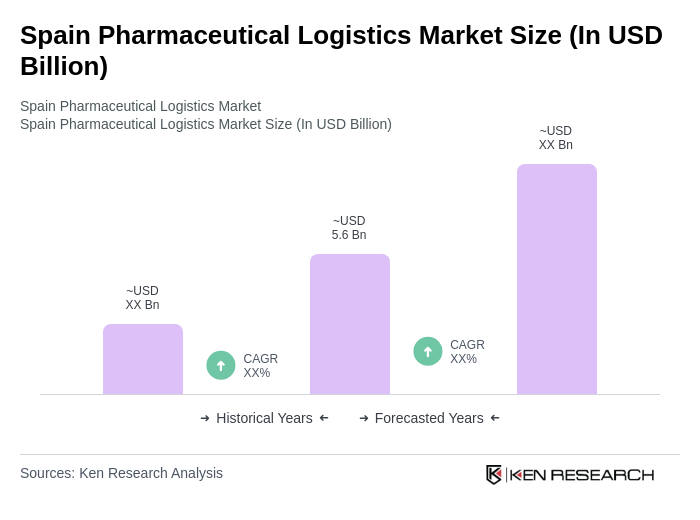

The Spain Pharmaceutical Logistics Market is valued at approximately USD 5.6 billion, reflecting a significant growth driven by increasing pharmaceutical demand, the expansion of cold chain logistics, and advancements in digital and automation technologies.