Region:Europe

Author(s):Geetanshi

Product Code:KRAA0298

Pages:85

Published On:August 2025

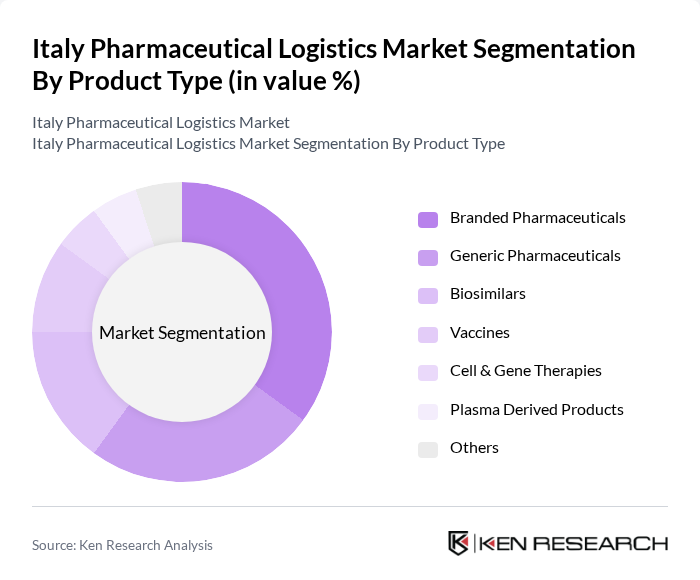

By Product Type:The product type segmentation includes Branded Pharmaceuticals, Generic Pharmaceuticals, Biosimilars, Vaccines, Cell & Gene Therapies, Plasma Derived Products, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics. Branded pharmaceuticals and biopharmaceuticals, in particular, are experiencing increased demand due to the prevalence of chronic diseases, the aging population, and the introduction of innovative therapies. Biosimilars and cell & gene therapies are also gaining traction as cost-effective and advanced treatment options .

The Branded Pharmaceuticals segment is currently dominating the market due to high demand for innovative drugs and therapies addressing complex health issues. This segment benefits from strong marketing strategies and established brand loyalty among healthcare providers and patients. The increasing prevalence of chronic diseases, an aging population, and ongoing investments in research and development are further driving demand for branded medications, reinforcing its market leadership .

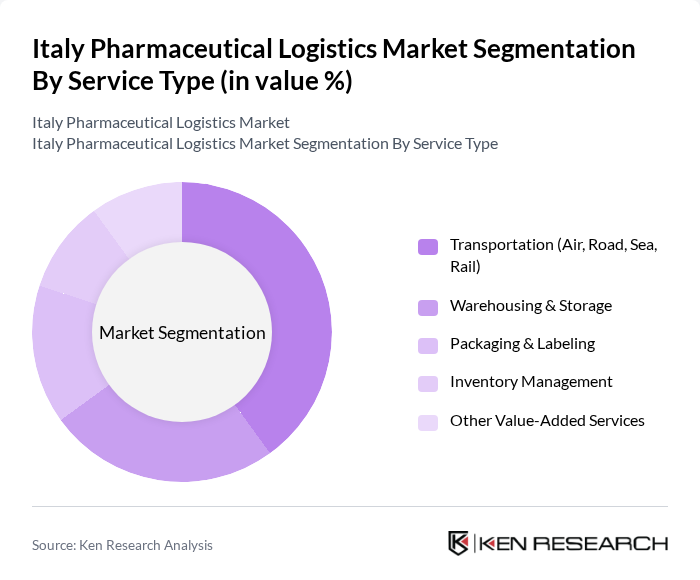

By Service Type:The service type segmentation encompasses Transportation (Air, Road, Sea, Rail), Warehousing & Storage, Packaging & Labeling, Inventory Management, and Other Value-Added Services. Each service type is essential for ensuring the efficient delivery and management of pharmaceutical products throughout the supply chain. Cold chain logistics and specialized storage solutions are increasingly important for temperature-sensitive products, while digital inventory management and real-time tracking are enhancing operational efficiency .

The Transportation segment is the leading service type, driven by the need for timely and efficient delivery of pharmaceutical products. The rise of e-commerce and the demand for rapid distribution channels have significantly increased reliance on various transportation modes. Air freight, in particular, is favored for its speed, especially for temperature-sensitive products like vaccines and biologics, making it a critical component of the logistics chain. Additionally, multimodal logistics solutions and real-time shipment monitoring are becoming standard to ensure compliance and product integrity .

The Italy Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, UPS Healthcare, FedEx Express, Geodis, XPO Logistics, Movianto, PHSE Srl, Bomi Group (A UPS Company), Stef Italia, Savino Del Bene, Logista Italia, Biocair, Fercam Logistics & Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian pharmaceutical logistics market is poised for transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt digital solutions, such as IoT and AI, operational efficiencies are expected to improve significantly. Additionally, the growing trend towards sustainability will likely influence logistics strategies, prompting firms to adopt greener practices. These developments will enhance service delivery and foster a more resilient supply chain, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Branded Pharmaceuticals Generic Pharmaceuticals Biosimilars Vaccines Cell & Gene Therapies Plasma Derived Products Others |

| By Service Type | Transportation (Air, Road, Sea, Rail) Warehousing & Storage Packaging & Labeling Inventory Management Other Value-Added Services |

| By Temperature Control | Ambient Refrigerated (2–8°C) Frozen (<–20°C) Cryogenic (<–150°C) Others |

| By End-User | Hospitals & Clinics Pharmacies Biopharmaceutical Companies Research & Academic Institutions Others |

| By Mode of Transportation | Air Freight Road Freight Sea Freight Rail Freight Others |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| By Technology Adoption | Traditional Logistics Systems Automated Logistics Solutions Digital Tracking & Monitoring Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Cold Chain Management | 60 | Operations Managers, Quality Assurance Managers |

| Regulatory Compliance in Logistics | 50 | Compliance Officers, Regulatory Affairs Managers |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Customer Service Managers |

| Pharmaceutical Returns Management | 45 | Inventory Managers, Procurement Managers |

The Italy Pharmaceutical Logistics Market is valued at approximately EUR 7.7 billion, driven by the demand for efficient supply chain solutions, e-commerce growth, and the need for temperature-controlled logistics, particularly in the biopharmaceutical sector.