Region:Asia

Author(s):Shubham

Product Code:KRAA0903

Pages:88

Published On:August 2025

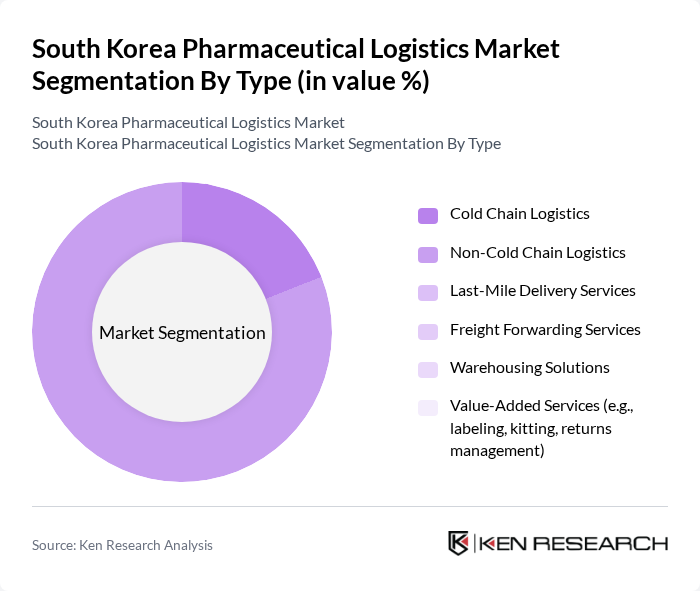

By Type:The market is segmented into various types of logistics services, including Cold Chain Logistics, Non-Cold Chain Logistics, Last-Mile Delivery Services, Freight Forwarding Services, Warehousing Solutions, and Value-Added Services. Cold chain logistics are increasingly critical due to the growing share of temperature-sensitive biopharmaceuticals and vaccines, while non-cold chain logistics continue to serve the bulk of conventional pharmaceuticals. Last-mile delivery and value-added services such as labeling, kitting, and returns management are gaining importance with the rise of e-commerce and direct-to-patient distribution models .

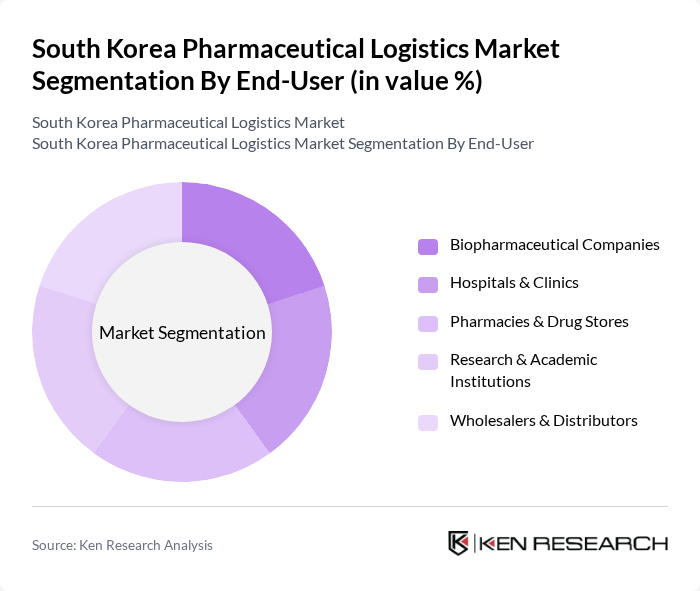

By End-User:The end-user segmentation includes Biopharmaceutical Companies, Hospitals & Clinics, Pharmacies & Drug Stores, Research & Academic Institutions, and Wholesalers & Distributors. Biopharmaceutical companies and hospitals are the largest end-users, driven by high-value, temperature-sensitive products and the need for stringent compliance. Pharmacies, research institutions, and wholesalers also contribute significantly, each with distinct logistics requirements .

The South Korea Pharmaceutical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hanjin Transportation, Logen, Lotte Global Logistics, DB Schenker Korea, DHL Supply Chain Korea, Kuehne + Nagel Korea, Samsung SDS, SK Networks, Pantos Logistics (LG CNS), Yusen Logistics Korea, Nippon Express Korea, SF Express Korea, FedEx Korea, UPS Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean pharmaceutical logistics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. The integration of IoT and AI technologies is expected to enhance supply chain efficiency, enabling real-time tracking and predictive analytics. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly logistics practices. As the market adapts to these trends, stakeholders must remain agile to capitalize on emerging opportunities while navigating regulatory complexities and operational challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain Logistics Non-Cold Chain Logistics Last-Mile Delivery Services Freight Forwarding Services Warehousing Solutions Value-Added Services (e.g., labeling, kitting, returns management) |

| By End-User | Biopharmaceutical Companies Hospitals & Clinics Pharmacies & Drug Stores Research & Academic Institutions Wholesalers & Distributors |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce & Online Pharmacies Hybrid Models |

| By Service Type | Transportation Services (Road, Air, Sea) Warehousing & Storage Inventory & Order Management Packaging & Repackaging Regulatory Compliance Services |

| By Temperature Control | Ambient (15–25°C) Refrigerated (2–8°C) Frozen (below –20°C) Ultra-Cold Chain (–70°C and below) |

| By Compliance Type | Good Distribution Practice (GDP) Compliance Good Manufacturing Practice (GMP) Compliance ISO 9001/13485 Certification Other Regulatory Standards |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Contract-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 60 | Logistics Managers, Supply Chain Analysts |

| Cold Chain Management | 45 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Logistics | 40 | Compliance Officers, Regulatory Affairs Managers |

| Last-Mile Delivery Solutions | 40 | Delivery Managers, Customer Service Representatives |

| Pharmaceutical Returns Management | 45 | Returns Managers, Inventory Control Specialists |

The South Korea Pharmaceutical Logistics Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by the increasing demand for efficient logistics solutions, particularly for biopharmaceutical products and temperature-sensitive transportation.