Region:Global

Author(s):Dev

Product Code:KRAD3312

Pages:90

Published On:November 2025

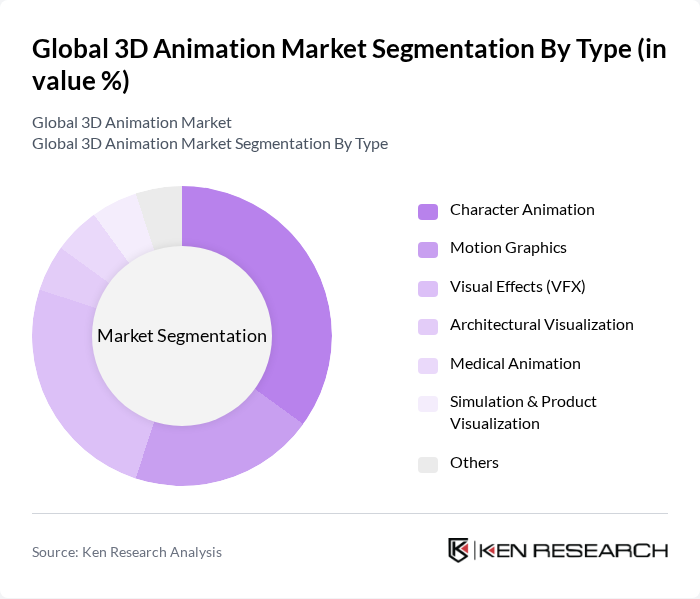

By Type:The 3D animation market is segmented into Character Animation, Motion Graphics, Visual Effects (VFX), Architectural Visualization, Medical Animation, Simulation & Product Visualization, and Others. Character Animation remains the leading sub-segment, driven by its extensive use in video games, animated films, and digital content. The growing demand for engaging, lifelike characters in storytelling and interactive media has led to a surge in character animation projects, making it a focal point for studios and creators .

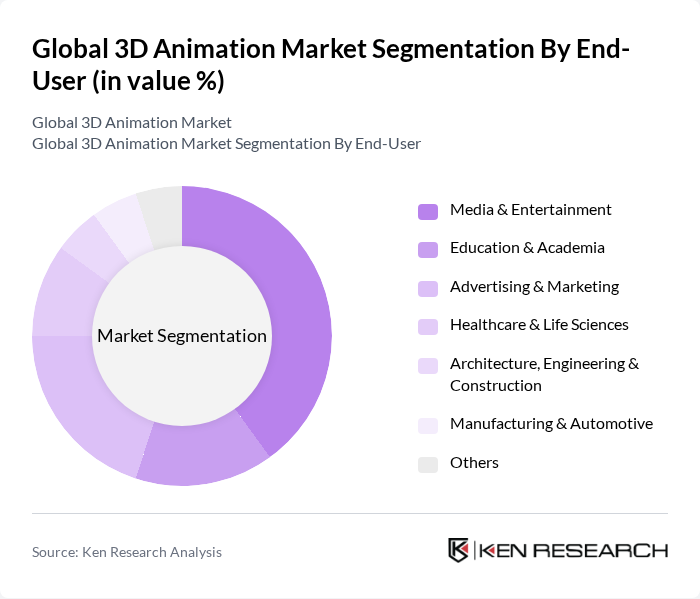

By End-User:The end-user segmentation of the 3D animation market includes Media & Entertainment, Education & Academia, Advertising & Marketing, Healthcare & Life Sciences, Architecture, Engineering & Construction, Manufacturing & Automotive, and Others. The Media & Entertainment sector is the dominant segment, encompassing applications from animated films to video games and streaming content. The expansion of digital platforms and the rising popularity of immersive content continue to drive significant demand for 3D animation services and technologies in this sector .

The Global 3D Animation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autodesk, Inc., Adobe Inc., Blender Foundation, Pixar Animation Studios, DreamWorks Animation LLC, Unity Technologies, Epic Games, Inc., SideFX (Side Effects Software Inc.), Maxon Computer GmbH, Foundry Visionmongers Ltd., Chaos Group (Chaos Software Ltd.), NVIDIA Corporation, W?t? FX (formerly Weta Digital), Framestore Ltd., Industrial Light & Magic (ILM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D animation market appears promising, driven by technological advancements and increasing demand across various sectors. As industries continue to embrace digital transformation, the integration of AI and machine learning will streamline production processes, enhancing creativity and efficiency. Furthermore, the expansion of 5G technology is expected to facilitate real-time streaming of high-quality animations, opening new avenues for interactive content. This evolution will likely lead to innovative applications in education, marketing, and entertainment, reshaping how audiences engage with animated content.

| Segment | Sub-Segments |

|---|---|

| By Type | Character Animation Motion Graphics Visual Effects (VFX) Architectural Visualization Medical Animation Simulation & Product Visualization Others |

| By End-User | Media & Entertainment Education & Academia Advertising & Marketing Healthcare & Life Sciences Architecture, Engineering & Construction Manufacturing & Automotive Others |

| By Application | Film & Television Video Games Online Content Creation Simulation & Training Virtual Reality (VR) & Augmented Reality (AR) Corporate Presentations Others |

| By Software | D Modeling Software Animation Software Rendering Software Compositing & Motion Tracking Software Simulation Software Others |

| By Distribution Channel | Direct Sales Online Platforms Value-Added Resellers & Distributors Others |

| By Region | North America (U.S., Canada) Europe (Germany, U.K., France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of LATAM) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| By Industry Vertical | Media and Entertainment Education and Training Advertising and Marketing Healthcare and Life Sciences Architecture, Engineering & Construction Manufacturing & Automotive Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Film and Television Animation | 100 | Animation Directors, Producers |

| Video Game Development | 80 | Game Designers, Art Directors |

| Advertising and Marketing Animation | 70 | Creative Directors, Marketing Managers |

| Educational Content Creation | 50 | Instructional Designers, Content Developers |

| Virtual Reality and Augmented Reality Applications | 60 | VR/AR Developers, UX Designers |

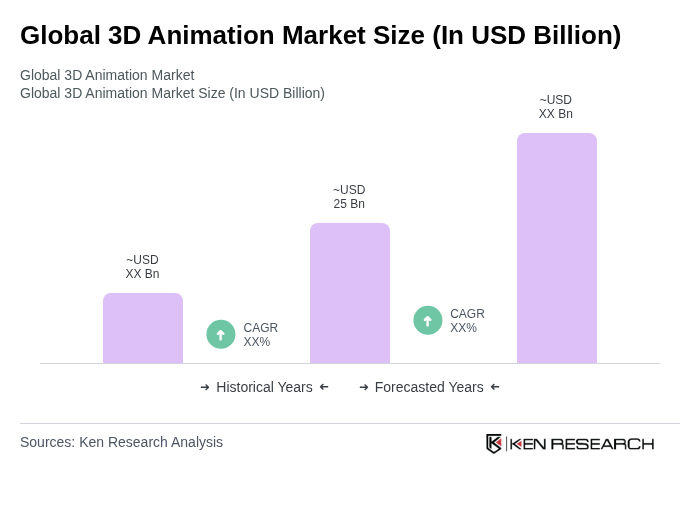

The Global 3D Animation Market is valued at approximately USD 25 billion, driven by the increasing demand for high-quality visual content across various sectors, including entertainment, advertising, gaming, and education.