Global Amaranth Market Overview

- The Global Amaranth Market is valued at USD 9.3 billion, based on a five?year historical analysis. This growth is primarily driven by the increasing demand for gluten-free and nutritious food options, as well as the rising awareness of the health benefits associated with amaranth, such as its high protein and fiber content. The market is also supported by the growing trend of plant-based diets and the incorporation of superfoods into everyday meals, with consumers increasingly seeking sustainable and health-promoting ingredients in their food choices .

- Countries like the United States, India, and China dominate the Global Amaranth Market due to their large agricultural sectors and increasing consumer interest in health and wellness products. The U.S. is a significant player due to its advanced food processing industry, while India and China benefit from traditional uses of amaranth in local cuisines, contributing to its popularity and market growth. North America, led by the U.S., currently holds the largest market share, followed by Asia Pacific and Europe .

- In 2023, the U.S. government introduced the Sustainable Crop Incentive Program, which provides grants and subsidies to farmers adopting amaranth cultivation. This initiative is designed to promote sustainable agriculture, enhance food security, and support the growth of alternative crops that are resilient to climate change and require fewer inputs such as water and pesticides .

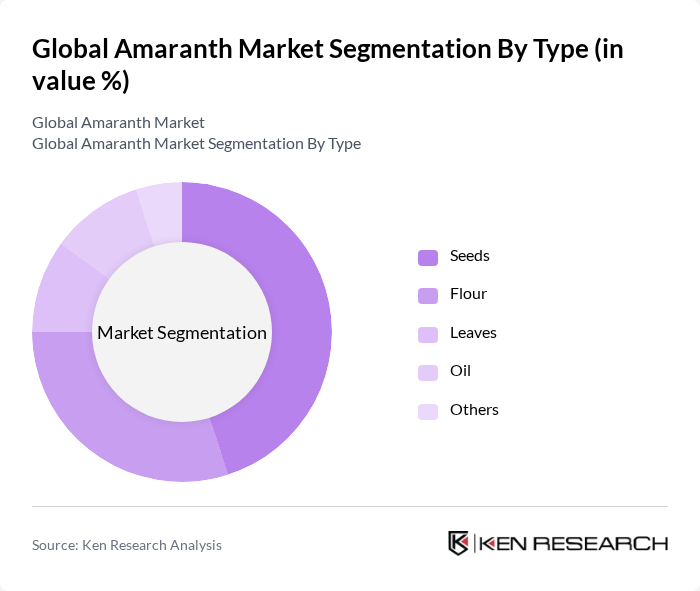

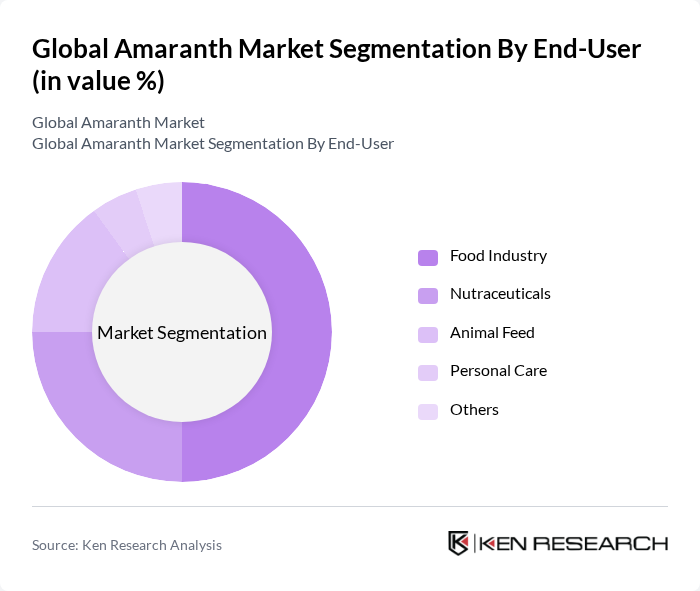

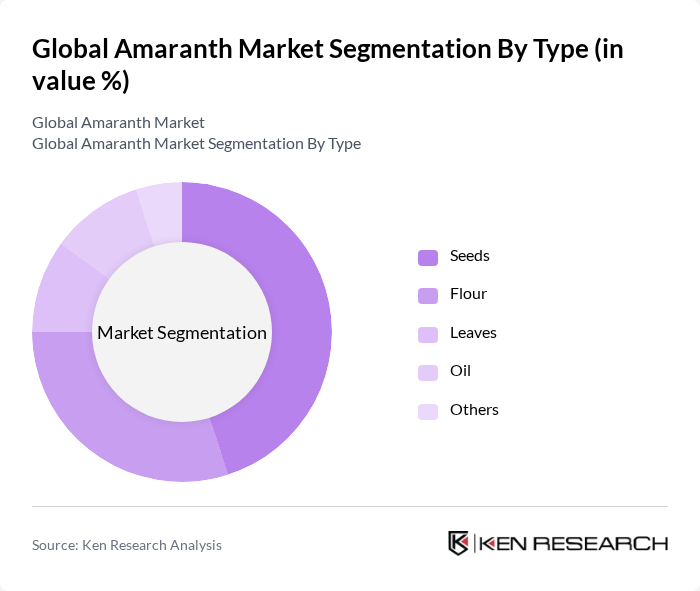

Global Amaranth Market Segmentation

By Type:The market is segmented into various types, including seeds, flour, leaves, oil, and others. Among these, seeds are the most dominant sub-segment due to their versatility and high nutritional value, making them a preferred choice for health-conscious consumers. Flour is also gaining traction as a gluten-free alternative in baking and cooking, while leaves and oil are utilized in niche markets. The demand for these products is driven by the increasing trend of healthy eating and the incorporation of superfoods into diets.

By End-User:The end-user segmentation includes the food industry, nutraceuticals, animal feed, personal care, and others. The food industry is the leading segment, driven by the rising demand for healthy and organic food products. Nutraceuticals are also gaining popularity as consumers seek supplements that offer health benefits. The increasing use of amaranth in animal feed reflects the growing trend of sustainable farming practices, while personal care products are incorporating amaranth oil for its beneficial properties.

Global Amaranth Market Competitive Landscape

The Global Amaranth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amaranth Foods, Ancient Harvest, Bob's Red Mill, NutraBio Labs, Quinoa Corporation, The Amaranth Company, Arrowhead Mills, Terrasoul Superfoods, Health Warrior, Nature's Path, Sunfood Superfoods, Organic India, Eden Foods, True Leaf Market, Food to Live, Amaranth Farms International, Amaranth & Co., Amaranth Foods Ltd., Amaranth Naturals, Amaranth Organics contribute to innovation, geographic expansion, and service delivery in this space.

Global Amaranth Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The global health food market is projected to reach $1 trillion in future, driven by consumers prioritizing nutritious diets. Amaranth, rich in protein (13-15% per 100g) and essential amino acids, aligns with this trend. The World Health Organization reports that 39% of adults are actively seeking healthier food options, indicating a significant shift towards nutrient-dense grains like amaranth, which is gaining traction among health-conscious consumers.

- Rising Demand for Gluten-Free Products:The gluten-free food market is expected to surpass $7 billion in future, with amaranth emerging as a popular alternative for gluten-sensitive individuals. According to the Celiac Disease Foundation, approximately 1 in 133 Americans has celiac disease, driving the demand for gluten-free grains. Amaranth's naturally gluten-free properties make it an attractive option, contributing to its increasing popularity in gluten-free product formulations.

- Expansion of Organic Farming:The organic food market is projected to reach $620 billion in future, with a growing emphasis on sustainable agriculture. The USDA reported a 20% increase in organic farmland from 2016 to 2021, promoting crops like amaranth. This trend is supported by consumer preferences for organic products, with 76% of consumers willing to pay more for organic options, enhancing the market potential for organically grown amaranth.

Market Challenges

- Limited Awareness Among Consumers:Despite its nutritional benefits, amaranth remains relatively unknown to many consumers. A survey by the Food Marketing Institute indicated that only 15% of consumers are familiar with amaranth. This lack of awareness hampers market growth, as consumers often gravitate towards more recognized grains. Educational initiatives are essential to increase visibility and understanding of amaranth's health benefits and culinary uses.

- Price Volatility of Raw Materials:The price of amaranth can fluctuate significantly due to factors such as climate change and supply chain disruptions. The FAO reported a 30% increase in grain prices in future, impacting the cost of amaranth production. This volatility can deter potential investors and producers, making it challenging to establish stable pricing and supply chains, ultimately affecting market growth and consumer access.

Global Amaranth Market Future Outlook

The future of the amaranth market appears promising, driven by increasing consumer interest in health and wellness. As plant-based diets gain traction, amaranth's nutritional profile positions it favorably among alternative grains. Innovations in food processing and sustainable farming practices are expected to enhance production efficiency. Additionally, the rise of e-commerce platforms will facilitate broader distribution, making amaranth more accessible to consumers seeking healthy food options, thus fostering market growth.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for amaranth. With a rising middle class and increasing health awareness, these regions are likely to adopt amaranth as a staple food. The World Bank projects a 5% annual growth in these economies, creating a favorable environment for introducing amaranth-based products.

- Development of Value-Added Products:There is a growing trend towards value-added amaranth products, such as snacks and ready-to-eat meals. The global snack food market is expected to reach $600 billion in future, providing a lucrative opportunity for amaranth-based snacks. Companies can leverage this trend by innovating and creating diverse product lines that cater to health-conscious consumers, enhancing market penetration.