Region:Global

Author(s):Geetanshi

Product Code:KRAA2762

Pages:88

Published On:August 2025

Market.png)

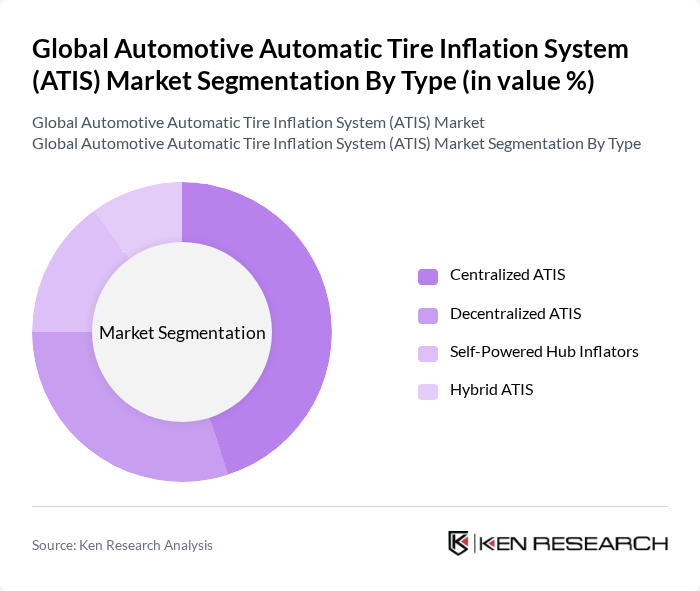

By Type:The market is segmented into four main types: Centralized ATIS, Decentralized ATIS, Self-Powered Hub Inflators, and Hybrid ATIS. Centralized ATIS leads due to its capability to maintain optimal tire pressure across multiple tires simultaneously, which is essential for commercial and heavy-duty vehicles. The rise in fleet management solutions and regulatory compliance has further increased demand for centralized systems. Decentralized ATIS is gaining traction, especially in passenger vehicles, owing to its modularity and ease of installation. Self-Powered Hub Inflators and Hybrid ATIS are emerging, targeting niche applications focused on innovation, sustainability, and specialized vehicle requirements .

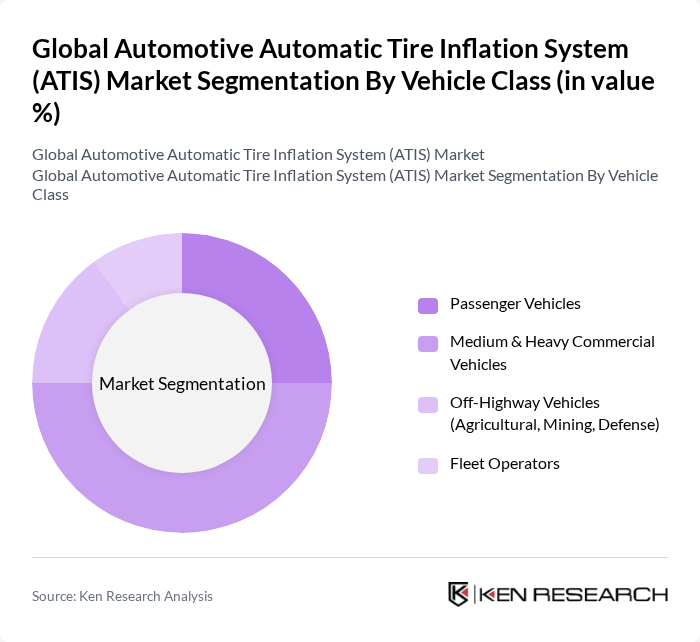

By Vehicle Class:The market is categorized into Passenger Vehicles, Medium & Heavy Commercial Vehicles, Off-Highway Vehicles (Agricultural, Mining, Defense), and Fleet Operators. Medium & Heavy Commercial Vehicles hold the largest share, driven by regulatory mandates and the need for efficient fleet operations. The focus on reducing operational costs, minimizing tire wear, and improving safety features in commercial fleets is a major growth driver. Passenger vehicles are experiencing increased adoption due to growing consumer demand for safety, convenience, and integration with connected vehicle platforms. Off-Highway Vehicles and Fleet Operators represent specialized segments, with requirements for robust tire management in challenging environments .

The Global Automotive Automatic Tire Inflation System (ATIS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Michelin, Bridgestone Corporation, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Hamaton Ltd., Schrader Electronics, Trelleborg AB, Yokohama Rubber Company, Dunlop Tires, Trelleborg Wheel Systems, Aperia Technologies Inc., Pressure Systems International (PSI), Meritor Inc., Freudenberg Sealing Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATIS market appears promising, driven by increasing safety regulations and technological advancements. As governments worldwide implement stricter safety mandates, the demand for ATIS is expected to rise. Additionally, the integration of IoT technologies in tire management will enhance system efficiency and user experience. The automotive industry's shift towards electric vehicles will further accelerate ATIS adoption, as these vehicles require advanced tire management solutions to optimize performance and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized ATIS Decentralized ATIS Self-Powered Hub Inflators Hybrid ATIS |

| By Vehicle Class | Passenger Vehicles Medium & Heavy Commercial Vehicles Off-Highway Vehicles (Agricultural, Mining, Defense) Fleet Operators |

| By Application | On-Road Vehicles Off-Road Vehicles Emergency Vehicles |

| By Component | Sensors Control Units Inflation Mechanisms Sealing Solutions |

| By Sales Channel | OEM Sales Aftermarket Sales Distributors Online Retail |

| By Distribution Mode | B2B Distribution B2C Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Engineers, R&D Managers |

| Commercial Fleet Operators | 80 | Fleet Managers, Maintenance Supervisors |

| Tire Manufacturers | 60 | Product Managers, Technical Directors |

| Automotive Safety Regulators | 40 | Policy Makers, Compliance Officers |

| Automotive Aftermarket Service Providers | 50 | Service Managers, Business Development Executives |

The Global Automotive Automatic Tire Inflation System (ATIS) Market is valued at approximately USD 730 million, driven by safety regulations, advancements in tire technology, and increased consumer awareness regarding vehicle maintenance and fuel efficiency.