Region:Middle East

Author(s):Dev

Product Code:KRAC4778

Pages:94

Published On:October 2025

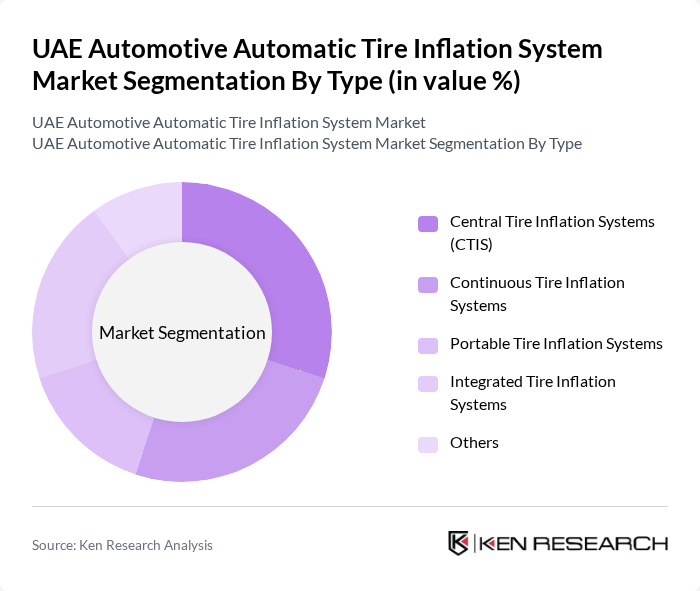

By Type:The market is segmented into various types of automatic tire inflation systems, including Central Tire Inflation Systems (CTIS), Continuous Tire Inflation Systems, Portable Tire Inflation Systems, Integrated Tire Inflation Systems, and Others. Each type serves different applications and user needs, contributing to the overall market dynamics.

The Central Tire Inflation Systems (CTIS) segment leads the market, driven by its widespread use in commercial vehicles, off-road fleets, and logistics applications. These systems enable real-time tire pressure adjustments, which enhance vehicle safety, reduce tire wear, and improve operational efficiency. The increasing adoption of fleet management solutions and the integration of CTIS with telematics platforms are further accelerating demand among logistics and transportation companies.

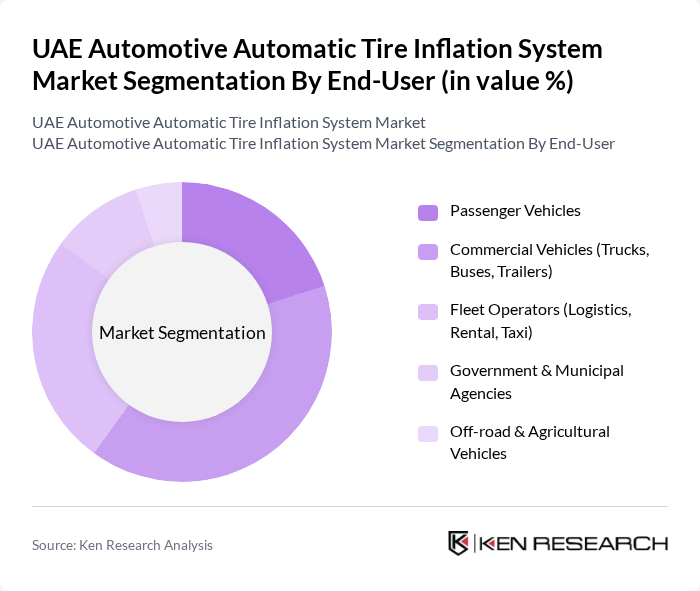

By End-User:The market is segmented based on end-users, including Passenger Vehicles, Commercial Vehicles (Trucks, Buses, Trailers), Fleet Operators (Logistics, Rental, Taxi), Government & Municipal Agencies, and Off-road & Agricultural Vehicles. Each end-user category has distinct requirements and influences the market's growth trajectory.

The Commercial Vehicles segment holds the largest market share, supported by the growing logistics and transportation sector in the UAE. Fleet operators are increasingly adopting automatic tire inflation systems to improve safety, reduce maintenance costs, and comply with new regulatory requirements. The emphasis on sustainability and operational efficiency continues to propel this segment’s growth.

The UAE Automotive Automatic Tire Inflation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dana Incorporated, WABCO Holdings Inc., Hendrickson USA, L.L.C., Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Trelleborg AB, Freudenberg Sealing Technologies, Pressure Systems International (PSI), Airgo Systems, Stemco (EnPro Industries), Haltec Corporation, Festo AG & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive automatic tire inflation system market appears promising, driven by increasing regulatory support and technological innovations. As the government implements stricter safety regulations and promotes smart vehicle technologies, the demand for automatic tire inflation systems is expected to rise. Additionally, the integration of IoT and AI in automotive applications will enhance system efficiency, making these solutions more attractive to consumers and businesses alike, thereby fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Tire Inflation Systems (CTIS) Continuous Tire Inflation Systems Portable Tire Inflation Systems Integrated Tire Inflation Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles (Trucks, Buses, Trailers) Fleet Operators (Logistics, Rental, Taxi) Government & Municipal Agencies Off-road & Agricultural Vehicles |

| By Application | On-Road Vehicles Off-Road Vehicles (Construction, Mining, Agriculture) Emergency & Defense Vehicles Racing and Performance Vehicles |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Online Retail Automotive Dealerships Service Centers |

| By Component | Pressure Sensors Electronic Control Units (ECU) Compressors & Inflation Mechanisms Valves & Tubing Monitoring & Display Systems |

| By Price Range | Budget Mid-Range Premium |

| By Technology | Pneumatic Systems Electronic Systems Mechanical Systems Hybrid Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Owners | 120 | Car Owners, Fleet Operators |

| Commercial Vehicle Fleets | 80 | Fleet Managers, Logistics Coordinators |

| Automotive Service Centers | 60 | Service Managers, Technicians |

| Automotive Retailers | 50 | Sales Representatives, Product Managers |

| Industry Experts and Analysts | 40 | Automotive Engineers, Market Analysts |

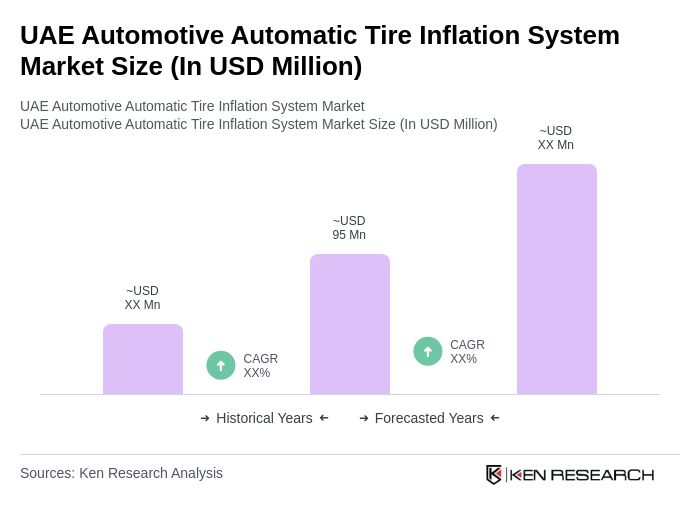

The UAE Automotive Automatic Tire Inflation System market is valued at approximately USD 95 million, driven by factors such as increasing vehicle ownership, enhanced safety standards, and advancements in tire technology.