Region:Global

Author(s):Shubham

Product Code:KRAA2692

Pages:95

Published On:August 2025

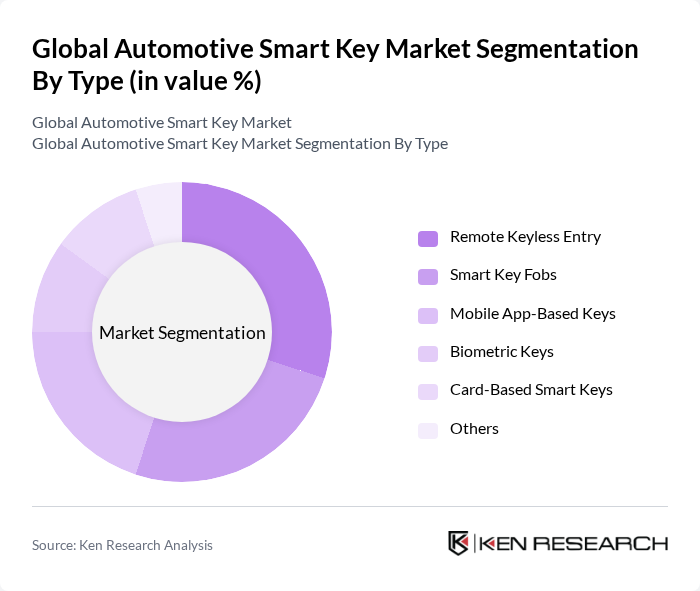

By Type:The market is segmented into various types of smart keys, including Remote Keyless Entry, Smart Key Fobs, Mobile App-Based Keys, Biometric Keys, Card-Based Smart Keys, and Others. Each type offers distinct features such as encrypted communication, rolling codes, and personalized settings, catering to evolving consumer preferences and technological advancements.

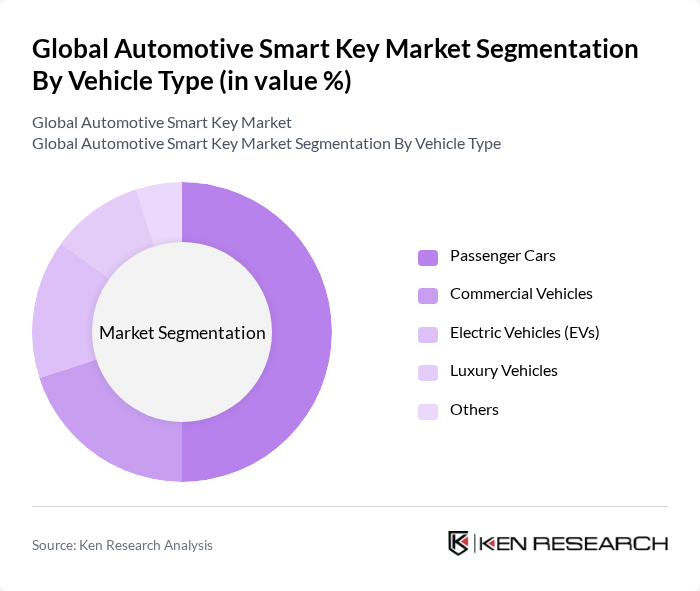

By Vehicle Type:The segmentation by vehicle type includes Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Luxury Vehicles, and Others. This classification reflects the widespread adoption of smart key technologies, with passenger cars and electric vehicles showing the highest integration rates due to consumer demand for convenience and security.

The Global Automotive Smart Key Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Valeo SA, Denso Corporation, Robert Bosch GmbH, Hella GmbH & Co. KGaA, Mitsubishi Electric Corporation, Panasonic Corporation, Hyundai Mobis Co., Ltd., ZF Friedrichshafen AG, NXP Semiconductors N.V., Tokai Rika Co., Ltd., ALPS Alpine Co., Ltd., Infineon Technologies AG, STMicroelectronics N.V., Lear Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The automotive smart key market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As electric vehicles gain traction, the integration of smart key systems with electric vehicle technology will become crucial. Additionally, the rise of connected vehicles will enhance the functionality of smart keys, allowing for seamless interaction with other smart devices. Manufacturers are likely to focus on developing more secure and user-friendly systems, ensuring that smart keys remain a vital component of modern automotive technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Keyless Entry Smart Key Fobs Mobile App-Based Keys Biometric Keys Card-Based Smart Keys Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles (EVs) Luxury Vehicles Others |

| By Component | Transmitters Receivers Batteries Microcontrollers & ICs Software Others |

| By Sales Channel | OEMs Aftermarket Online Retail Others |

| By Distribution Mode | Direct Sales Distributors Retail Outlets Others |

| By Price Range | Low-End Mid-Range High-End |

| By Application | Vehicle Security Convenience Features Fleet Management Remote Start & Access Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Smart Key Development | 60 | Product Managers, R&D Directors |

| Tier 1 Suppliers of Smart Key Components | 50 | Supply Chain Managers, Quality Assurance Leads |

| Automotive Dealerships Implementing Smart Key Systems | 40 | Service Managers, Sales Executives |

| Automotive Technology Experts | 45 | Industry Analysts, Technology Consultants |

| Consumers Using Smart Key Features | 55 | Car Owners, Automotive Enthusiasts |

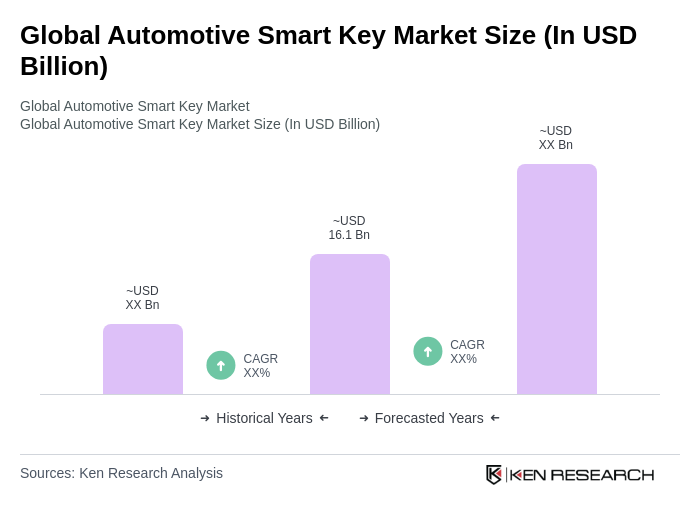

The Global Automotive Smart Key Market is valued at approximately USD 16.1 billion, reflecting significant growth driven by the demand for advanced vehicle security systems and the integration of smart keys with mobile applications and biometric authentication.