Region:Global

Author(s):Rebecca

Product Code:KRAA2374

Pages:90

Published On:August 2025

By Type:The market is segmented into Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Autonomous Delivery Robots, Warehouse Robots, Service Robots, Inspection Robots, and Others. Automated Guided Vehicles (AGVs) currently hold a leading share, driven by their widespread application in manufacturing and logistics for material transport in controlled environments. However, the adoption of AMRs is rapidly increasing due to their flexibility, advanced navigation, and ability to operate in dynamic settings. The growing need for operational efficiency and automation across sectors continues to drive demand for both AGVs and AMRs .

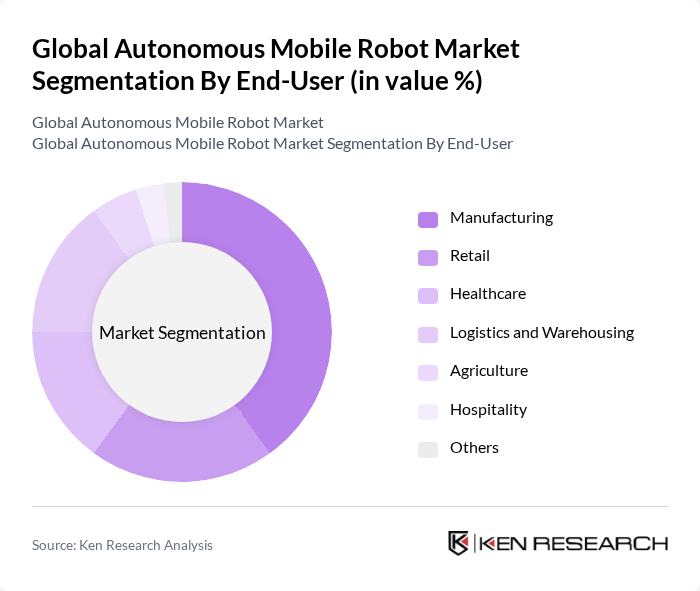

By End-User:The end-user segmentation includes Manufacturing, Retail, Healthcare, Logistics and Warehousing, Agriculture, Hospitality, and Others. The manufacturing sector remains the leading end-user of autonomous mobile robots, driven by the need for higher productivity, reduced labor costs, and improved safety. Logistics and warehousing are rapidly adopting AMRs to streamline operations, enhance inventory management, and meet the demands of e-commerce fulfillment. Healthcare and retail sectors are also increasing adoption for material transport and service delivery .

The Global Autonomous Mobile Robot Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Dynamics, KUKA AG, Fetch Robotics (now part of Zebra Technologies), Omron Adept Technologies, Clearpath Robotics, Mobile Industrial Robots (MiR), Locus Robotics, iRobot Corporation, Savioke, Yaskawa Electric Corporation, Aethon, Robotnik Automation, Seegrid Corporation, GreyOrange, Geekplus Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the autonomous mobile robot market appears promising, driven by technological advancements and increasing automation needs across industries. As companies continue to prioritize operational efficiency, the integration of IoT and AI will enhance the capabilities of AMRs, making them more versatile and efficient. Furthermore, the growing trend towards sustainability will likely push manufacturers to develop energy-efficient robots, aligning with global environmental goals and regulations, thus expanding market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Autonomous Delivery Robots Warehouse Robots Service Robots Inspection Robots Others |

| By End-User | Manufacturing Retail Healthcare Logistics and Warehousing Agriculture Hospitality Others |

| By Application | Material Handling Inventory Management Delivery Services Surveillance and Security Cleaning and Maintenance Disinfection Others |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Payload Capacity | Light Duty (up to 100 kg) Medium Duty (100 kg - 500 kg) Heavy Duty (above 500 kg) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Warehousing | 100 | Warehouse Managers, Operations Directors |

| Healthcare Facilities | 60 | Healthcare Administrators, Facility Managers |

| Manufacturing Plants | 50 | Production Managers, Automation Engineers |

| Retail Environments | 40 | Store Managers, Supply Chain Coordinators |

| Research and Development | 40 | R&D Managers, Robotics Engineers |

The Global Autonomous Mobile Robot Market is valued at approximately USD 4.9 billion, driven by advancements in robotics technology and increasing demand for automation across various industries, including logistics, manufacturing, and healthcare.