Region:Global

Author(s):Geetanshi

Product Code:KRAA2794

Pages:83

Published On:August 2025

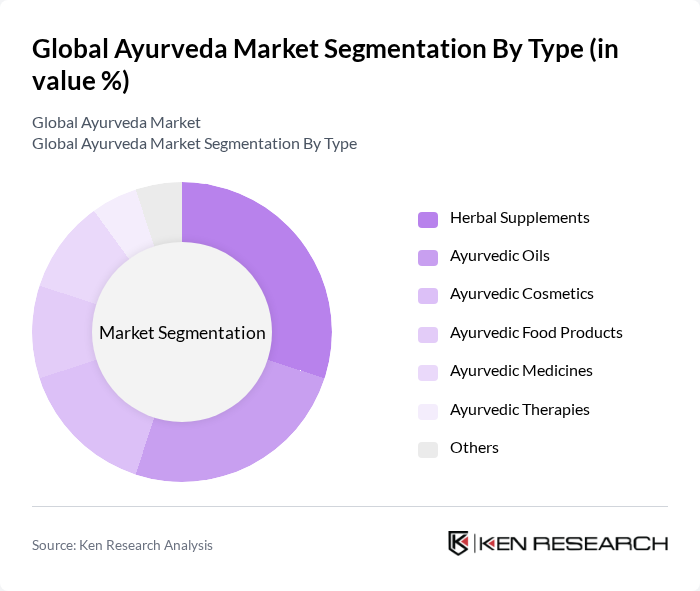

By Type:The Ayurveda market can be segmented into various types, including Herbal Supplements, Ayurvedic Oils, Ayurvedic Cosmetics, Ayurvedic Food Products, Ayurvedic Medicines, Ayurvedic Therapies, and Others. Among these, Herbal Supplements have gained significant traction due to the increasing consumer preference for natural health products. Ayurvedic Oils and Medicines also hold substantial market shares, driven by their therapeutic benefits and traditional usage. The demand for Ayurvedic Cosmetics is rising, particularly in the personal care segment, as consumers seek chemical-free alternatives for skin and hair care. Ayurvedic Food Products and Therapies are gaining attention for their role in holistic wellness and preventive health management .

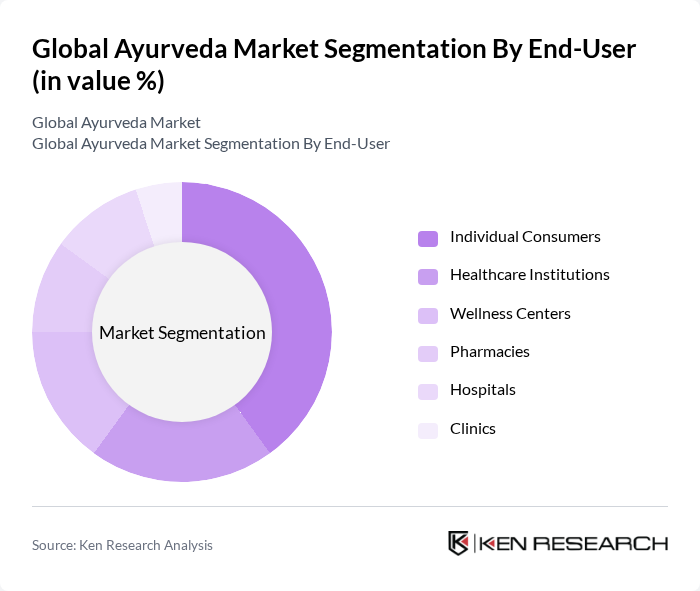

By End-User:The end-user segmentation includes Individual Consumers, Healthcare Institutions, Wellness Centers, Pharmacies, Hospitals, and Clinics. Individual Consumers dominate the market, driven by the growing trend of self-care and preventive health measures. Healthcare Institutions and Wellness Centers are also significant contributors, as they increasingly incorporate Ayurvedic practices into their treatment protocols. Pharmacies, Hospitals, and Clinics are expanding their offerings to include Ayurvedic products and therapies, reflecting the integration of Ayurveda into mainstream healthcare and retail channels .

The Global Ayurveda Market is characterized by a dynamic mix of regional and international players. Leading participants such as Himalaya Wellness Company, Dabur India Limited, Patanjali Ayurved Limited, Baidyanath Ayurved Bhawan Pvt. Ltd., Emami Limited (Zandu), Kerala Ayurveda Limited, Charak Pharma Pvt. Ltd., Maharishi Ayurveda Products Pvt. Ltd., Organic India Pvt. Ltd., Sri Sri Tattva, Amrutanjan Health Care Limited, Vicco Laboratories, Sandu Pharmaceuticals Ltd., Jiva Ayurveda, Arya Vaidya Pharmacy (Coimbatore) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Ayurveda market appears promising, driven by increasing consumer interest in holistic health solutions and the integration of Ayurvedic practices into mainstream healthcare. As digital platforms expand, more consumers will access Ayurvedic products and services, enhancing market reach. Additionally, the growing trend of personalized medicine will likely lead to tailored Ayurvedic solutions, further solidifying its position in the global health landscape. Continued government support will also play a crucial role in fostering innovation and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbal Supplements Ayurvedic Oils Ayurvedic Cosmetics Ayurvedic Food Products Ayurvedic Medicines Ayurvedic Therapies Others |

| By End-User | Individual Consumers Healthcare Institutions Wellness Centers Pharmacies Hospitals Clinics |

| By Region | Asia Pacific North America Europe Latin America Middle East & Africa |

| By Application | Preventive Healthcare Therapeutic Treatments Beauty and Personal Care Digestive Health Stress Management |

| By Distribution Channel | Online Retail Offline Retail Direct Sales E-commerce Distance Correspondence |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Product Form | Tablets and Capsules Powders Liquids Pastes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Ayurvedic Products | 120 | Health-conscious Consumers, Ayurveda Enthusiasts |

| Practitioner Insights on Ayurvedic Treatments | 60 | Ayurvedic Doctors, Wellness Coaches |

| Retail Distribution Channels for Ayurvedic Products | 50 | Retail Managers, Supply Chain Coordinators |

| Market Trends in Herbal Supplements | 70 | Product Managers, Marketing Executives |

| Consumer Awareness and Education on Ayurveda | 40 | Health Educators, Community Leaders |

The Global Ayurveda Market is valued at approximately USD 18.2 billion, reflecting significant growth driven by increasing consumer awareness of natural health solutions and a rising demand for herbal products.