Region:Global

Author(s):Rebecca

Product Code:KRAD0231

Pages:100

Published On:August 2025

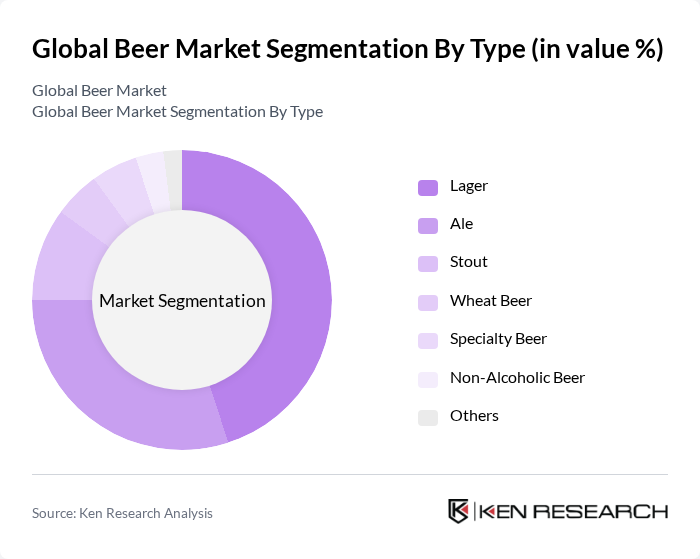

By Type:The beer market is segmented into various types, including Lager, Ale, Stout, Wheat Beer, Specialty Beer, Non-Alcoholic Beer, and Others. Among these, Lager is the most dominant segment, favored for its refreshing taste, clean profile, and versatility, making it a staple in both traditional and emerging beer markets. Ale follows, appealing to consumers seeking diverse flavors and craft options, particularly in regions with strong microbrewery cultures. The rise of craft breweries has also led to increased interest in Specialty Beers, which cater to niche markets and experimental tastes .

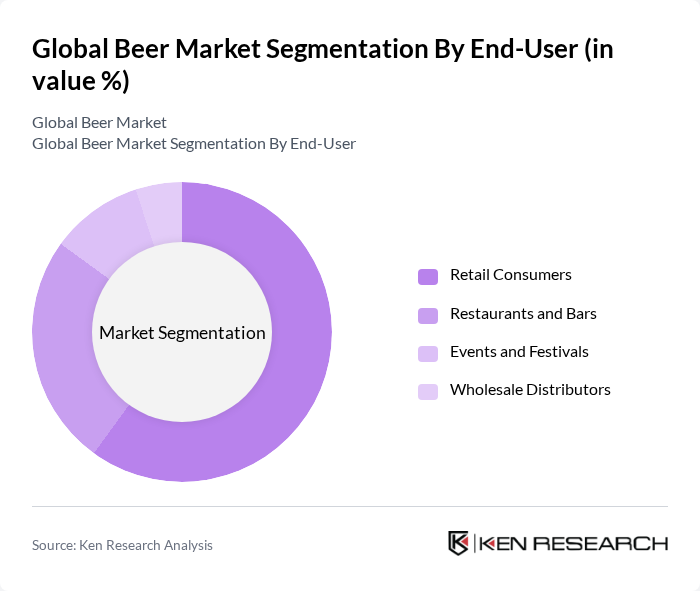

By End-User:The beer market is segmented by end-users, including Retail Consumers, Restaurants and Bars, Events and Festivals, and Wholesale Distributors. Retail Consumers represent the largest segment, driven by the increasing popularity of beer among younger demographics and the convenience of purchasing from supermarkets, hypermarkets, and online platforms. Restaurants and Bars play a significant role by offering a social environment for beer consumption, while Events and Festivals contribute to seasonal spikes in demand .

The Global Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Molson Coors Beverage Company, Diageo plc, Asahi Group Holdings, Ltd., Constellation Brands, Inc., Kirin Holdings Company, Limited, The Boston Beer Company, Inc., BrewDog plc, Sapporo Holdings Limited, Grupo Modelo, S.A. de C.V., Tsingtao Brewery Group Co., Ltd., New Belgium Brewing Company, and Dogfish Head Craft Brewery, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the beer market appears promising, driven by evolving consumer preferences and innovative brewing practices. The rise of non-alcoholic and low-alcohol beers is expected to gain traction, appealing to health-conscious consumers. Additionally, sustainability initiatives in brewing processes are likely to attract environmentally aware customers, fostering brand loyalty. As breweries adapt to these trends, the market is poised for dynamic growth, with opportunities for expansion in both established and emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout Wheat Beer Specialty Beer Non-Alcoholic Beer Others |

| By End-User | Retail Consumers Restaurants and Bars Events and Festivals Wholesale Distributors |

| By Sales Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty/Liquor Stores On-Trade (Bars, Pubs, Restaurants) Off-Trade (Retail, Take-Home) |

| By Packaging Type | Bottles (Glass, PET) Cans (Aluminum, Steel) Kegs Others (Growlers, Mini-Kegs) |

| By Alcohol Content | Low Alcohol (<3.5% ABV) Regular Alcohol (3.5–6% ABV) High Alcohol (>6% ABV) |

| By Flavor Profile | Hoppy Malty Fruity Spicy Sour |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Geography | North America (United States, Canada, Mexico, Rest of North America) Europe (United Kingdom, Germany, France, Spain, Italy, Russia, Rest of Europe) Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific) South America (Brazil, Argentina, Rest of South America) Middle East and Africa (UAE, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Beer Market Insights | 100 | Brewers, Craft Beer Enthusiasts |

| Retail Distribution Channels | 80 | Retail Managers, Beverage Distributors |

| Consumer Preferences in Beer Types | 120 | General Consumers, Beer Connoisseurs |

| Impact of Marketing Strategies | 60 | Marketing Managers, Brand Strategists |

| Trends in Beer Consumption | 90 | Market Analysts, Industry Experts |

The global beer market is valued at approximately USD 860 billion, reflecting a significant growth trend driven by consumer demand for craft, low-alcohol, and non-alcoholic beer variants, as well as the rise of premium products and expanded distribution channels.