Region:Global

Author(s):Shubham

Product Code:KRAD5501

Pages:99

Published On:December 2025

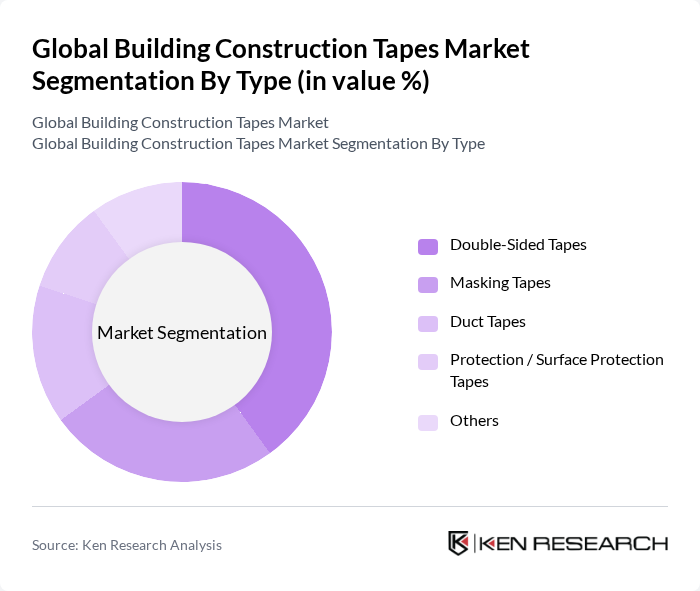

By Type:The market is segmented into various types of tapes, including Double-Sided Tapes, Masking Tapes, Duct Tapes, Protection / Surface Protection Tapes, and Others. Among these, Double-Sided Tapes are leading the market due to their versatility and strong bonding capabilities, making them ideal for various applications in construction and renovation projects. The increasing trend of interior design and home improvement projects has further fueled the demand for these tapes.

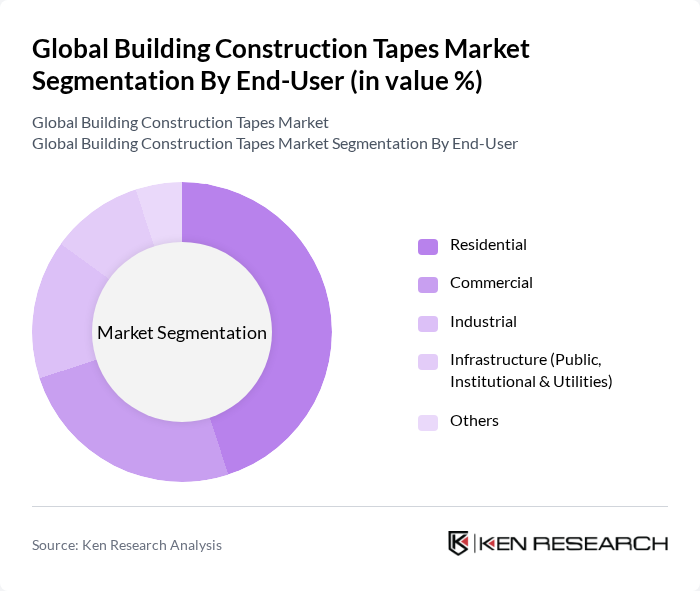

By End-User:The market is categorized into Residential, Commercial, Industrial, Infrastructure (Public, Institutional & Utilities), and Others. The Residential segment is currently the dominant end-user category, driven by the growing trend of home renovations and DIY projects. Increased consumer spending on home improvement and the rising number of residential construction projects have significantly contributed to the demand for building construction tapes in this segment.

The Global Building Construction Tapes Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Henkel AG & Co. KGaA, Avery Dennison Corporation, tesa SE, Nitto Denko Corporation, Intertape Polymer Group Inc., Shurtape Technologies, LLC, Compagnie de Saint-Gobain S.A., Sika AG, Scapa Group Ltd, Bostik SA (Arkema Group), RPM International Inc., The Dow Chemical Company, Achem Technology Corporation, Ahlstrom Oyj contribute to innovation, geographic expansion, and service delivery in this space.

The future of the building construction tapes market appears promising, driven by the increasing emphasis on sustainability and technological advancements. As governments worldwide implement stricter environmental regulations, the demand for eco-friendly tapes is expected to rise significantly. Additionally, the integration of smart building technologies will create new opportunities for innovative tape solutions. Companies that invest in R&D and collaborate with construction firms will likely gain a competitive edge, positioning themselves favorably in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Double-Sided Tapes Masking Tapes Duct Tapes Protection / Surface Protection Tapes Others |

| By End-User | Residential Commercial Industrial Infrastructure (Public, Institutional & Utilities) Others |

| By Application | Flooring Walls & Ceilings Windows & Doors Roofing Building Envelope & Vapor Barriers HVAC & Plumbing Electrical & Cable Management Others |

| By Adhesive Type | Rubber-Based Adhesives Acrylic-Based Adhesives Silicone-Based Adhesives Hot-Melt Adhesives Water-Based Adhesives Others |

| By Backing / Carrier Material | Polypropylene (PP) Films PVC Films Foam (PE, PU, Others) Foil (Aluminum & Other Metal Foils) Paper & Tissue Others |

| By Function | Bonding & Joining Protection & Masking Insulation (Thermal & Acoustic) Glazing Sound & Waterproofing / Air & Moisture Sealing Others |

| By Distribution Channel | Direct Sales to OEMs & Contractors Industrial / Construction Distributors Online (E-commerce & E-procurement Portals) Retail & DIY Stores Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 150 | Project Managers, Site Supervisors |

| Commercial Building Developments | 120 | Construction Managers, Architects |

| Industrial Facility Upgrades | 90 | Facility Managers, Procurement Officers |

| Retail Construction and Renovation | 70 | Store Managers, Construction Coordinators |

| Government Infrastructure Projects | 60 | Public Works Directors, Contract Managers |

The Global Building Construction Tapes Market is valued at approximately USD 4.8 billion, driven by increasing construction activities and the demand for durable adhesive solutions, particularly in emerging economies.