Region:Global

Author(s):Geetanshi

Product Code:KRAA2752

Pages:81

Published On:August 2025

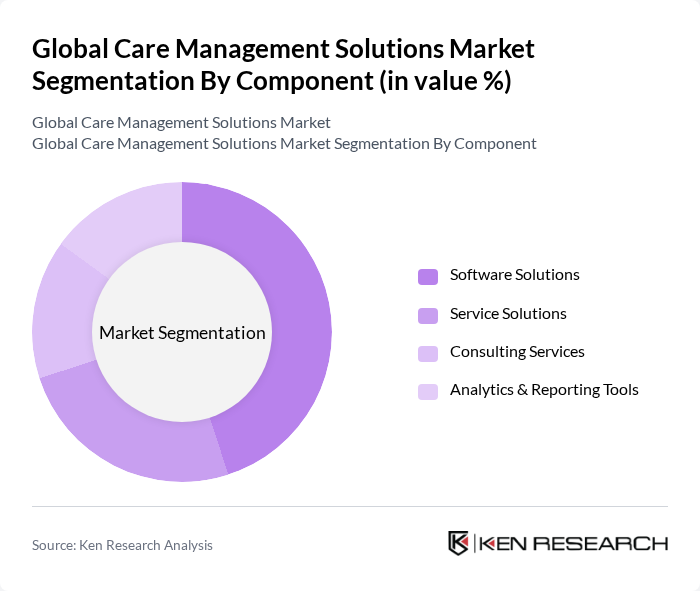

By Component:The components of care management solutions include software solutions, service solutions, consulting services, and analytics & reporting tools. Among these, software solutions are leading the market due to their ability to streamline operations, enhance patient engagement, and provide real-time data analytics. The increasing adoption of electronic health records (EHRs), telehealth services, and remote patient monitoring has further propelled the demand for software solutions, making them a critical component in the healthcare ecosystem.

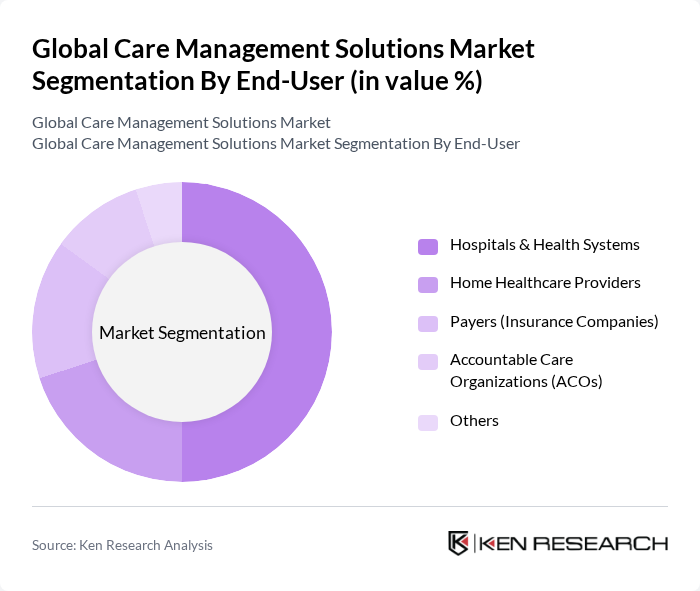

By End-User:The end-users of care management solutions include hospitals & health systems, home healthcare providers, payers (insurance companies), accountable care organizations (ACOs), and others. Hospitals & health systems dominate this segment as they require comprehensive solutions to manage patient care, streamline operations, and comply with regulatory requirements. The increasing focus on patient-centered care, integrated care models, and the need for efficient management of chronic diseases are driving hospitals to adopt advanced care management solutions.

The Global Care Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation (now Oracle Health), Allscripts Healthcare Solutions, Inc. (now Veradigm Inc.), McKesson Corporation, Optum, Inc. (UnitedHealth Group), Epic Systems Corporation, Koninklijke Philips N.V. (Philips Healthcare), IBM Watson Health (now Merative), Medtronic plc, NextGen Healthcare, Inc., athenahealth, Inc., eClinicalWorks, CareCloud, Inc., Greenway Health, LLC, Health Catalyst, Inc., Salesforce, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of care management solutions is poised for significant transformation, driven by technological advancements and evolving patient needs. As healthcare systems increasingly adopt value-based care models, the focus will shift towards enhancing patient outcomes and reducing costs. Innovations in artificial intelligence and machine learning will further streamline care processes, enabling personalized treatment plans. Additionally, the integration of telehealth services will expand access to care, particularly in underserved regions, fostering a more inclusive healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Solutions Service Solutions Consulting Services Analytics & Reporting Tools |

| By End-User | Hospitals & Health Systems Home Healthcare Providers Payers (Insurance Companies) Accountable Care Organizations (ACOs) Others |

| By Application | Care Coordination Patient Engagement Population Health Management Chronic Disease Management Utilization Management Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Care Management Solutions | 120 | Healthcare Administrators, Care Managers |

| Home Health Care Services | 60 | Home Care Coordinators, Patient Care Directors |

| Telehealth Integration | 50 | Telehealth Program Managers, IT Directors |

| Chronic Disease Management Programs | 40 | Clinical Coordinators, Health Coaches |

| Patient Engagement Solutions | 70 | Patient Experience Officers, Marketing Managers |

The Global Care Management Solutions Market is valued at approximately USD 15 billion, driven by the increasing demand for efficient healthcare management systems, the rise in chronic diseases, and the need for improved patient engagement and care coordination.