Region:Global

Author(s):Geetanshi

Product Code:KRAA2800

Pages:100

Published On:August 2025

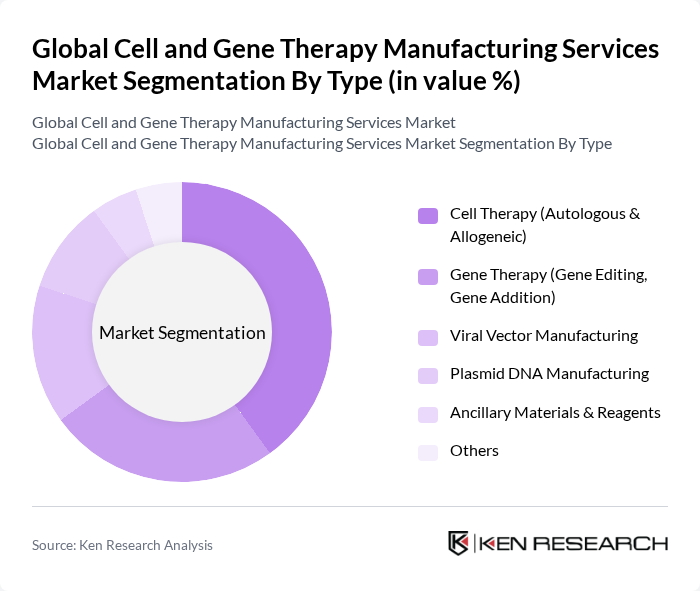

By Type:The market is segmented into various types, including Cell Therapy (Autologous & Allogeneic), Gene Therapy (Gene Editing, Gene Addition), Viral Vector Manufacturing, Plasmid DNA Manufacturing, Ancillary Materials & Reagents, and Others. Among these, Cell Therapy is currently the leading sub-segment due to its extensive application in treating various diseases, particularly cancers and genetic disorders. The increasing number of clinical trials and approvals for autologous and allogeneic therapies has significantly contributed to its dominance .

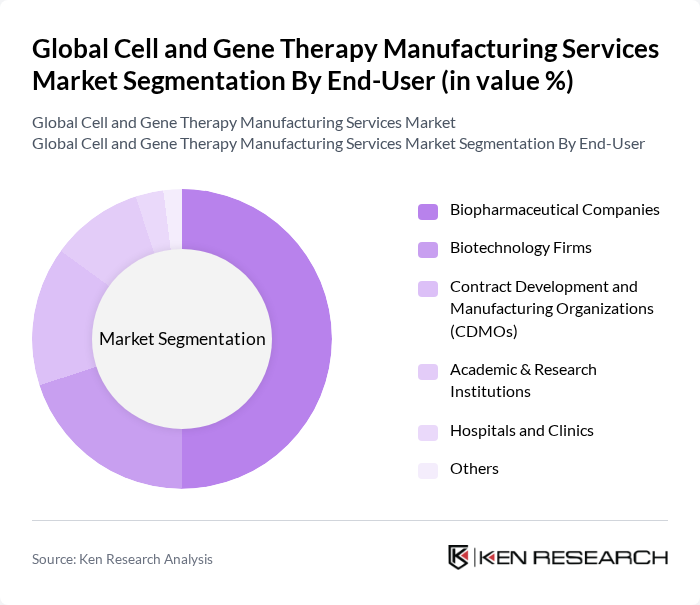

By End-User:The end-user segmentation includes Biopharmaceutical Companies, Biotechnology Firms, Contract Development and Manufacturing Organizations (CDMOs), Academic & Research Institutions, Hospitals and Clinics, and Others. Biopharmaceutical companies are the dominant end-user segment, driven by their extensive resources and capabilities to develop and commercialize advanced therapies. The increasing collaboration between biopharmaceutical firms and research institutions is also enhancing the development of innovative therapies, and CDMOs are playing a growing role in supporting commercial manufacturing needs .

The Global Cell and Gene Therapy Manufacturing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Catalent, Inc., Lonza Group AG, Thermo Fisher Scientific Inc., Charles River Laboratories International, Inc., WuXi Advanced Therapies (WuXi AppTec), Merck KGaA (MilliporeSigma), Miltenyi Biotec GmbH, Bluebird Bio, Inc., Novartis AG, Gilead Sciences, Inc. (Kite Pharma), CRISPR Therapeutics AG, Editas Medicine, Inc., Orchard Therapeutics plc, Bristol-Myers Squibb Company, Sangamo Therapeutics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of cell and gene therapy manufacturing services is poised for transformative growth, driven by technological advancements and increasing patient demand. As decentralized manufacturing models gain traction, companies are expected to adopt more flexible production strategies. Additionally, the integration of artificial intelligence in manufacturing processes will enhance efficiency and reduce costs. These trends indicate a dynamic landscape where innovation and collaboration will play pivotal roles in shaping the industry’s trajectory over the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cell Therapy (Autologous & Allogeneic) Gene Therapy (Gene Editing, Gene Addition) Viral Vector Manufacturing Plasmid DNA Manufacturing Ancillary Materials & Reagents Others |

| By End-User | Biopharmaceutical Companies Biotechnology Firms Contract Development and Manufacturing Organizations (CDMOs) Academic & Research Institutions Hospitals and Clinics Others |

| By Application | Oncology Genetic Disorders Cardiovascular Diseases Infectious Diseases Rare Diseases Others |

| By Manufacturing Process | Cell Culture & Expansion Harvesting Purification Formulation & Fill-Finish Quality Control & Release Testing Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cell Therapy Manufacturing | 60 | Manufacturing Directors, Process Engineers |

| Gene Therapy Development | 50 | Clinical Research Coordinators, Regulatory Affairs Specialists |

| Biomanufacturing Facilities | 40 | Quality Control Managers, Production Supervisors |

| Contract Manufacturing Organizations (CMOs) | 55 | Business Development Managers, Operations Directors |

| Regulatory Compliance in Gene Therapy | 45 | Compliance Officers, Legal Advisors |

The Global Cell and Gene Therapy Manufacturing Services Market is valued at approximately USD 11.6 billion, driven by advancements in biotechnology and increasing demand for innovative treatment options for chronic diseases, including cancer and genetic disorders.