Region:Global

Author(s):Rebecca

Product Code:KRAA2454

Pages:86

Published On:August 2025

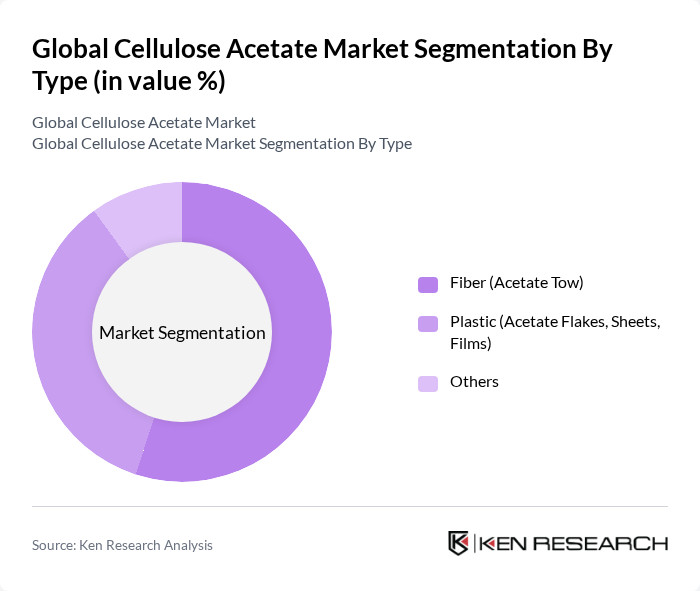

By Type:The cellulose acetate market is segmented into three main types:Fiber (Acetate Tow),Plastic (Acetate Flakes, Sheets, Films), andOthers. Fiber (Acetate Tow) is the leading subsegment, driven by its extensive use in cigarette filters, which represent a substantial share of global demand. The growing emphasis on sustainable materials has further accelerated the adoption of acetate tow, as manufacturers seek alternatives to petroleum-based plastics. Plastic-grade cellulose acetate is widely used in consumer goods such as eyewear frames, tool handles, and photographic films, while the "Others" category includes specialty applications in coatings and membranes.

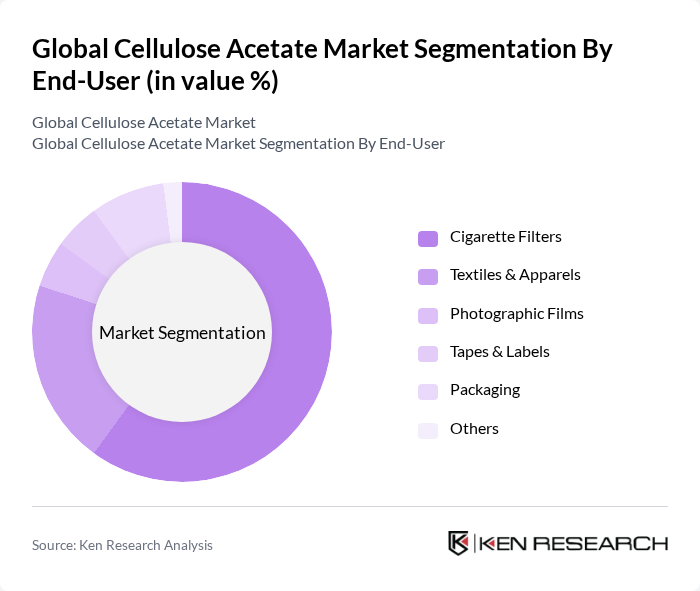

By End-User:The end-user segmentation includesCigarette Filters,Textiles & Apparels,Photographic Films,Tapes & Labels,Packaging, andOthers. Cigarette Filters remain the dominant segment, accounting for the majority of global cellulose acetate consumption due to the tobacco industry's preference for acetate tow in filter production. Textiles & Apparels represent the second-largest segment, leveraging cellulose acetate's silk-like texture and dyeability. Photographic Films, Tapes & Labels, and Packaging are important niche applications, with Packaging gaining traction as sustainability regulations drive demand for biodegradable solutions.

The Global Cellulose Acetate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eastman Chemical Company, Celanese Corporation, Mitsubishi Chemical Corporation, Solvay S.A., Sichuan Push Acetati Co., Ltd., Daicel Corporation, Rayonier Advanced Materials Inc. (RYAM), Sappi Limited, Cerdia International GmbH, Acordis Cellulosics, Hubei Xianfeng Chemical Co., Ltd., Jiangsu Shuangxing Color Plastic Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., FPC USA, Inc., Rotuba Extruders, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The cellulose acetate market is poised for significant growth, driven by increasing consumer demand for sustainable products and innovations in production techniques. As industries adapt to eco-friendly practices, the market is expected to see a rise in cellulose acetate applications across various sectors, including textiles and pharmaceuticals. Additionally, the expansion into emerging markets will provide new opportunities for growth, as these regions increasingly prioritize sustainable materials in their manufacturing processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber (Acetate Tow) Plastic (Acetate Flakes, Sheets, Films) Others |

| By End-User | Cigarette Filters Textiles & Apparels Photographic Films Tapes & Labels Packaging Others |

| By Application | Filters (Cigarette, Industrial) LCD & Display Films Coatings Adhesives Plastics & Eyewear Frames Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy) Asia-Pacific (China, Japan, India) Central & South America (Brazil, Argentina) Middle East & Africa (Saudi Arabia, South Africa) |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Granules Powders Liquids Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Textile Manufacturers, Product Development Managers |

| Packaging Sector Insights | 80 | Packaging Engineers, Supply Chain Managers |

| Film Production Insights | 60 | Film Production Managers, Quality Control Specialists |

| Research & Development Feedback | 50 | R&D Directors, Innovation Managers |

| Regulatory Compliance Insights | 40 | Compliance Officers, Environmental Managers |

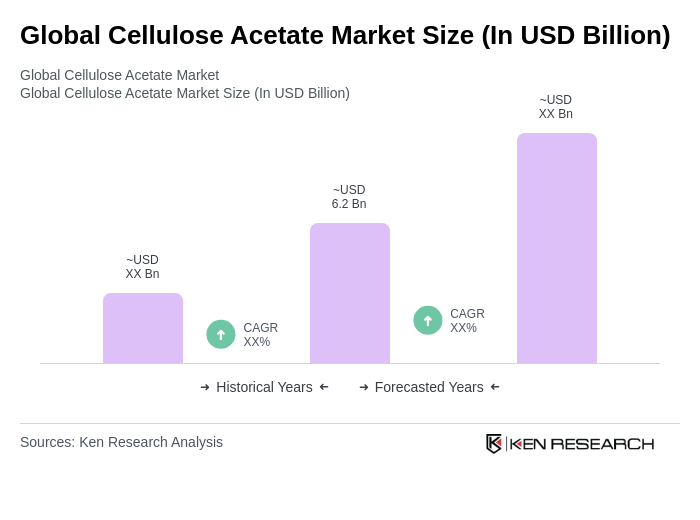

The Global Cellulose Acetate Market is valued at approximately USD 6.2 billion, reflecting a significant growth trend driven by the increasing demand for biodegradable materials across various industries, including textiles, packaging, and cigarette filters.