Region:Global

Author(s):Dev

Product Code:KRAA9510

Pages:90

Published On:November 2025

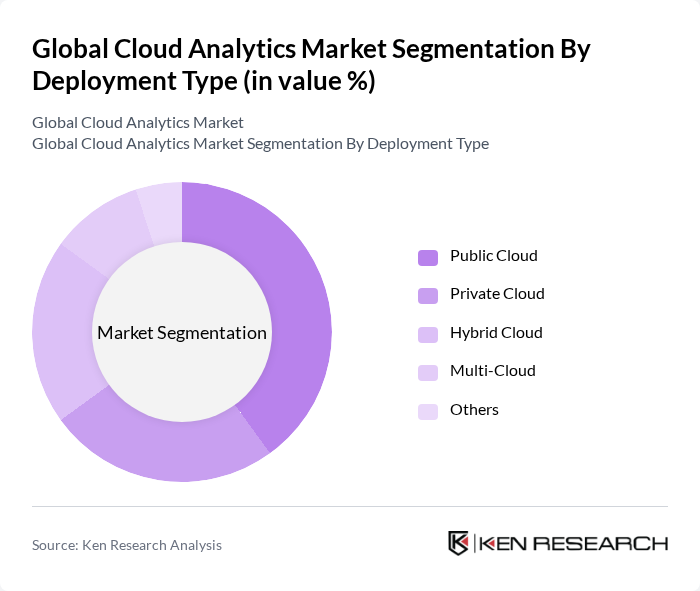

By Deployment Type:The deployment type segment includes Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, and Others. Public Cloud is gaining traction due to its cost-effectiveness, scalability, and ease of deployment, while Private Cloud is preferred by organizations with stringent data security and compliance requirements. Hybrid Cloud offers flexibility, combining both public and private solutions to optimize workload distribution, and Multi-Cloud strategies are increasingly adopted to avoid vendor lock-in, enhance resilience, and support cross-cloud interoperability.

By Organization Size:This segment is divided into Large Enterprises and Small and Medium Enterprises (SMEs). Large Enterprises dominate the market due to their substantial budgets for cloud analytics solutions, higher data volumes, and the need for advanced data processing capabilities. SMEs are increasingly adopting cloud analytics to enhance operational efficiency, access pay-as-you-go solutions, and compete effectively in the market.

The Global Cloud Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM Cloud, Oracle Cloud, SAP Cloud Platform, Salesforce, Snowflake Inc., Tableau Software (a Salesforce company), Domo, Inc., Qlik Technologies, Sisense Inc., MicroStrategy Incorporated, TIBCO Software Inc., Alteryx, Inc., SAS Institute Inc., Teradata Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud analytics market appears promising, driven by technological advancements and increasing digital transformation initiatives. As organizations continue to prioritize data-driven strategies, the integration of artificial intelligence and machine learning into cloud analytics will enhance predictive capabilities. Furthermore, the shift towards hybrid cloud solutions will facilitate greater flexibility and scalability, allowing businesses to adapt to evolving market demands while optimizing their analytics processes for improved decision-making.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) Business Process as a Service (BPaaS) Data Management Services |

| By Solution Type | Cloud Business Intelligence (BI) Tools Enterprise Information Management Governance, Risk, and Compliance Enterprise Performance Management Hosted Data Warehouse Solutions Others |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Retail and Consumer Goods Healthcare and Life Sciences Media and Entertainment Government Telecom and IT Energy and Utilities Manufacturing Education and Research Others |

| By Analytics Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Augmented Analytics Others |

| By Geographic Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cloud Analytics | 100 | Healthcare IT Managers, Data Analysts |

| Financial Services Analytics | 80 | Risk Management Officers, Financial Analysts |

| Retail Analytics Solutions | 90 | Marketing Directors, E-commerce Managers |

| Manufacturing Data Insights | 60 | Operations Managers, Supply Chain Analysts |

| Telecommunications Analytics | 50 | Network Operations Managers, Data Scientists |

The Global Cloud Analytics Market is valued at approximately USD 35 billion, driven by the increasing adoption of cloud-based solutions and the demand for real-time data processing across various industries.