Region:Global

Author(s):Rebecca

Product Code:KRAD0213

Pages:86

Published On:August 2025

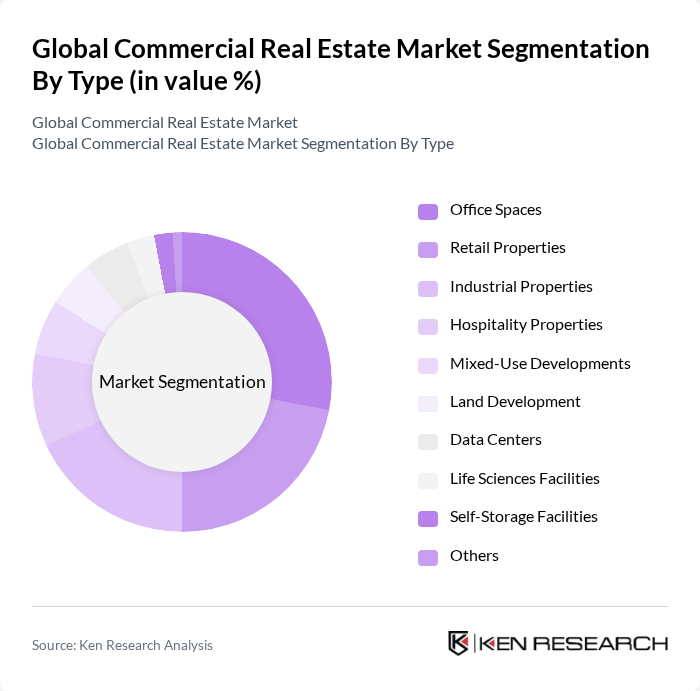

By Type:The commercial real estate market is segmented into several key property types: office spaces, retail properties, industrial properties (including logistics and warehousing), hospitality properties (such as hotels and resorts), mixed-use developments, land development, data centers, life sciences facilities, self-storage facilities, and others. Each sub-segment serves distinct business and consumer needs. In recent years, industrial properties and data centers have seen accelerated growth due to e-commerce expansion and digital transformation, while office and retail properties have experienced varying demand due to hybrid work trends and shifting consumer behavior ; .

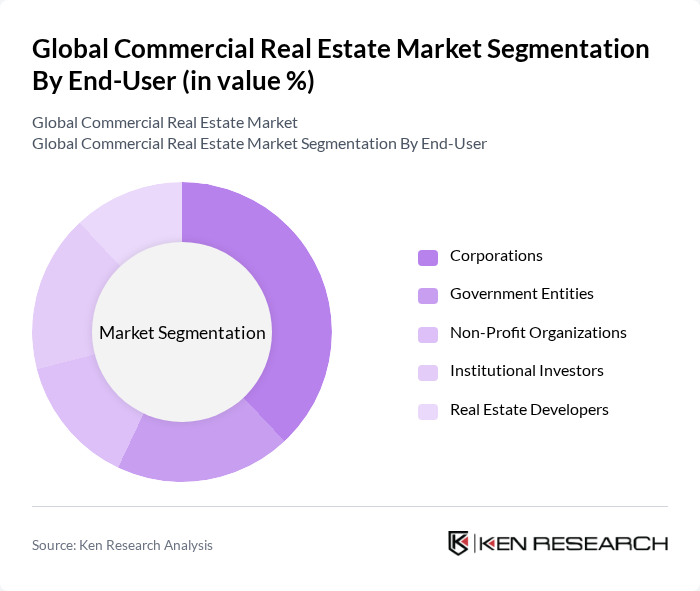

By End-User:The end-user segmentation encompasses corporations, government entities, non-profit organizations, institutional investors, and real estate developers. Corporations and institutional investors remain the leading end-users, driven by the need for business operations, portfolio diversification, and investment yield. Government entities are significant participants, particularly in infrastructure and public facility development. Non-profit organizations and developers play specialized roles in community and project-based initiatives .

The Global Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle Incorporated), Cushman & Wakefield plc, Colliers International Group Inc., Savills plc, Knight Frank LLP, Hines Interests Limited Partnership, Brookfield Asset Management Ltd., Prologis, Inc., Blackstone Inc., Starwood Capital Group, Tishman Speyer, AvalonBay Communities, Inc., Related Companies, Vornado Realty Trust, Dalian Wanda Group, SEGRO plc, Link Asset Management Ltd., DLF Ltd., WeWork Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial real estate market appears promising, driven by ongoing urbanization and technological advancements. As cities expand, the demand for diverse commercial spaces will continue to rise, particularly in emerging markets. Additionally, the integration of smart technologies in property management is expected to enhance operational efficiency and tenant satisfaction. However, stakeholders must remain vigilant regarding economic fluctuations and regulatory changes that could impact investment strategies and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Spaces Retail Properties Industrial Properties Hospitality Properties Mixed-Use Developments Land Development Data Centers Life Sciences Facilities Self-Storage Facilities Others |

| By End-User | Corporations Government Entities Non-Profit Organizations Institutional Investors Real Estate Developers |

| By Investment Type | Direct Investment Real Estate Investment Trusts (REITs) Private Equity Funds Crowdfunding Platforms Pension Funds |

| By Property Management Type | In-House Management Third-Party Management |

| By Financing Source | Bank Loans Private Equity Public Funding Joint Ventures Institutional Lending |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Emerging Markets |

| By Policy Support | Tax Incentives Subsidies for Development Grants for Sustainable Practices Green Building Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Leasing | 120 | Property Managers, Corporate Real Estate Executives |

| Retail Property Investment | 90 | Investment Analysts, Retail Property Developers |

| Industrial Real Estate Trends | 60 | Logistics Managers, Industrial Property Owners |

| Commercial Real Estate Financing | 50 | Banking Executives, Real Estate Financial Analysts |

| Emerging Market Opportunities | 70 | Market Researchers, Economic Development Officers |

The Global Commercial Real Estate Market is valued at approximately USD 1.1 trillion, reflecting the total value of commercial real estate transactions and assets worldwide, despite recent declines in transaction volumes.