Region:Global

Author(s):Geetanshi

Product Code:KRAD7121

Pages:94

Published On:December 2025

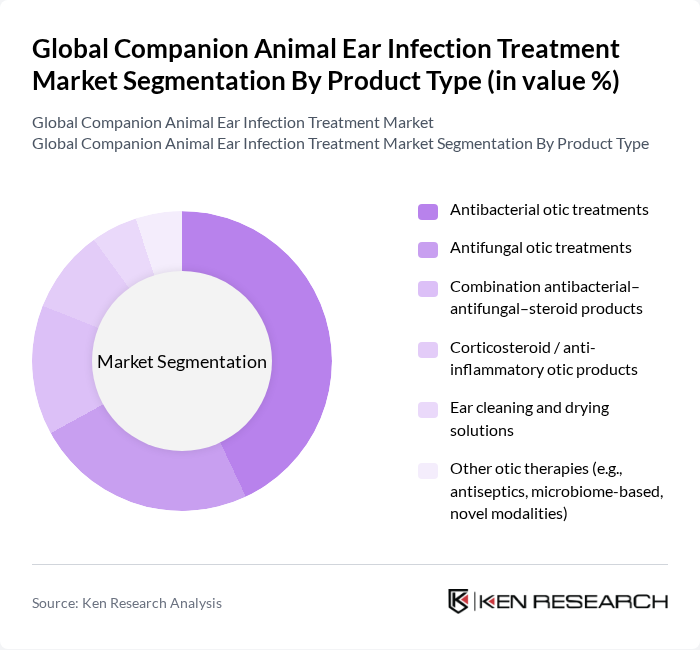

By Product Type:The product type segmentation includes various treatments designed to address ear infections in companion animals. The market is characterized by a diverse range of products, including antibacterial and antifungal treatments, combination therapies, and ear cleaning solutions. Antibacterial otic treatments are particularly dominant due to their effectiveness in treating bacterial otitis externa, which accounts for a large proportion of clinical ear infection cases in small animals.

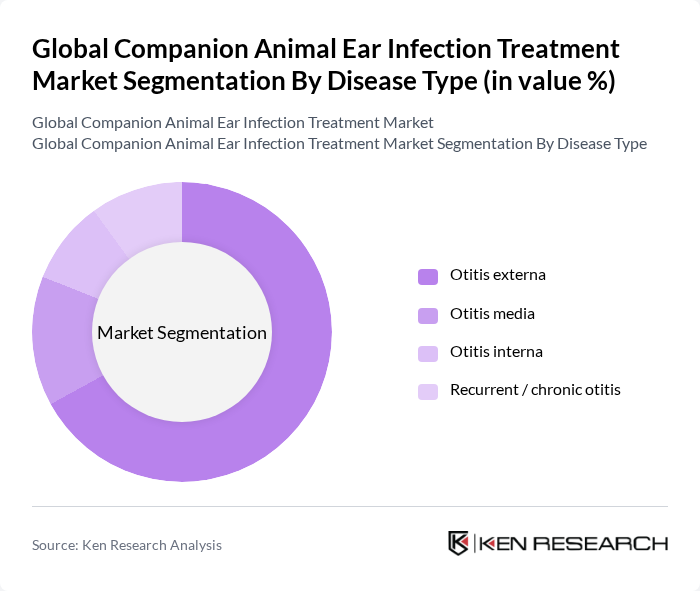

By Disease Type:The disease type segmentation focuses on the specific ear conditions affecting companion animals. Otitis externa is the most prevalent condition in clinical practice and represents the largest share of otic therapy use, leading to a higher demand for effective topical antibacterial and anti-inflammatory treatments. The market also addresses otitis media and interna, which require more advanced or systemic therapies, and a growing number of chronic and recurrent otitis cases associated with allergies, breed predisposition, and antimicrobial resistance, driving the need for long-term management and precision treatment solutions.

The Global Companion Animal Ear Infection Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health Incorporated, Boehringer Ingelheim Animal Health GmbH, Dechra Pharmaceuticals PLC, Vetoquinol S.A., Ceva Santé Animale, Virbac, Bayer AG (legacy Bayer Animal Health otic portfolio), PetIQ, Inc., PetMed Express, Inc. (1-800-PetMeds), Covetrus, Inc., Neogen Corporation, Animal Health International, Inc. (a Patterson Company), Vet’s Best (a brand of The Bramton Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the companion animal ear infection treatment market appears promising, driven by ongoing innovations in veterinary medicine and a growing emphasis on preventive care. As pet owners increasingly prioritize their pets' health, the demand for effective and affordable treatment options is expected to rise. Additionally, the integration of telemedicine in veterinary practices will enhance access to specialized care, allowing for timely diagnosis and treatment, ultimately improving health outcomes for companion animals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Antibacterial otic treatments Antifungal otic treatments Combination antibacterial–antifungal–steroid products Corticosteroid / anti-inflammatory otic products Ear cleaning and drying solutions Other otic therapies (e.g., antiseptics, microbiome-based, novel modalities) |

| By Disease Type | Otitis externa Otitis media Otitis interna Recurrent / chronic otitis |

| By Animal Type | Dogs Cats Other companion animals (e.g., rabbits, small mammals) |

| By Mode of Administration | Topical ear drops and suspensions Otic gels and ointments Systemic therapies (oral/parenteral) In-clinic otic procedures and treatments |

| By Distribution Channel | Veterinary clinics and hospitals Retail pharmacies Online pharmacies and e-commerce platforms Pet specialty stores Other channels |

| By End-User | Veterinarians / veterinary practices Pet hospitals and multi-clinic chains Home-care by pet owners Animal shelters and rescue organizations Pet grooming and boarding facilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Pet Owners | 140 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Pharmacies | 100 | Pharmacists, Store Managers |

| Pet Care Professionals | 80 | Groomers, Pet Trainers |

| Animal Health Product Manufacturers | 70 | Product Managers, Marketing Directors |

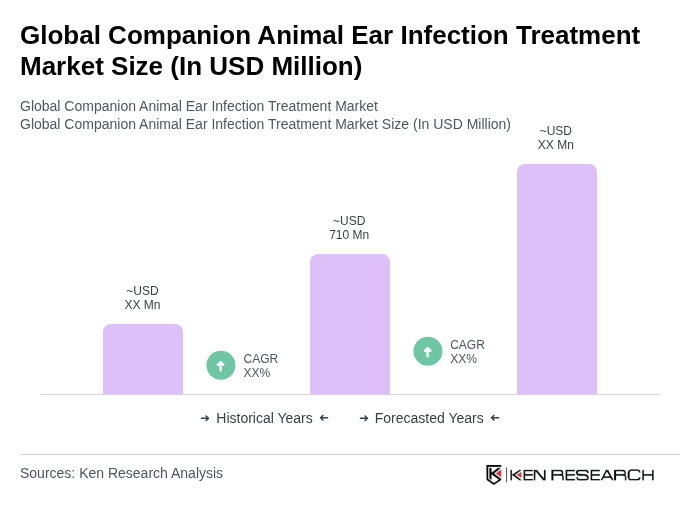

The Global Companion Animal Ear Infection Treatment Market is valued at approximately USD 710 million, driven by the rising prevalence of ear infections in pets, increased pet ownership, and advancements in veterinary medicine.