Region:Global

Author(s):Rebecca

Product Code:KRAA2922

Pages:81

Published On:August 2025

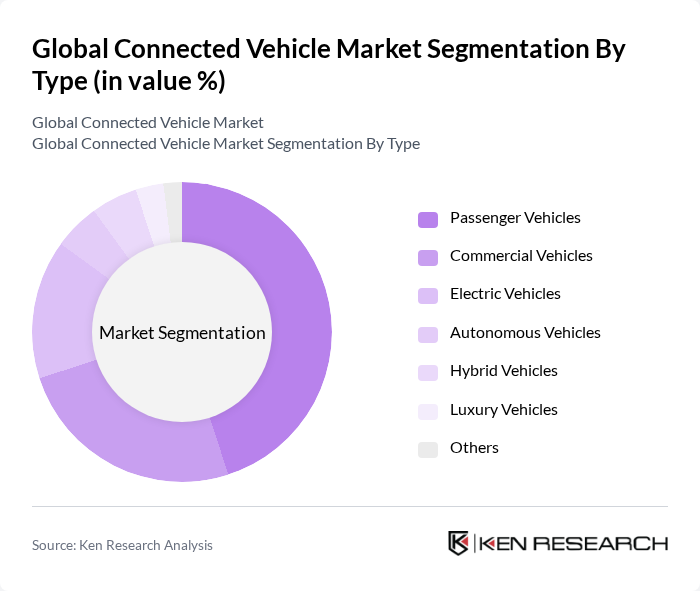

By Type:The market is segmented into various types, including Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Autonomous Vehicles, Hybrid Vehicles, Luxury Vehicles, and Others. Among these, Passenger Vehicles dominate the market due to their widespread adoption and the increasing consumer preference for connected features that enhance driving experience and safety. The rise in urbanization and the demand for smart mobility solutions further bolster the growth of this segment. Electric and autonomous vehicles are gaining traction, driven by regulatory mandates and the push for sustainable transportation .

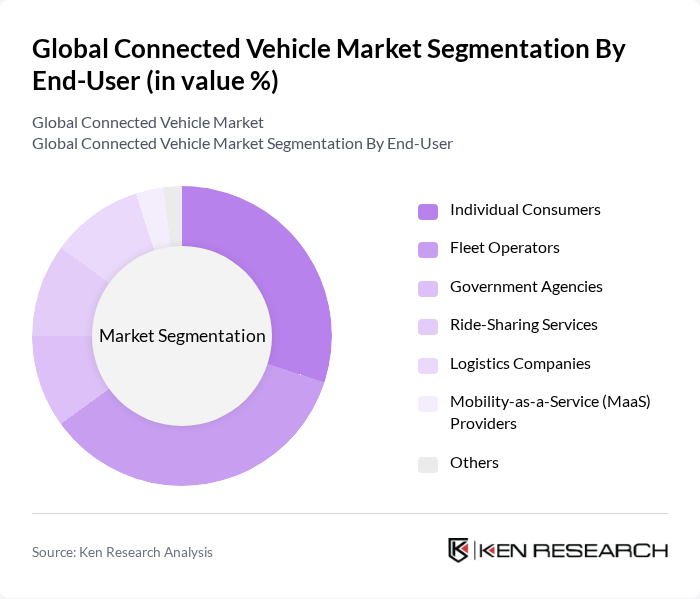

By End-User:The end-user segmentation includes Individual Consumers, Fleet Operators, Government Agencies, Ride-Sharing Services, Logistics Companies, Mobility-as-a-Service (MaaS) Providers, and Others. Fleet Operators are currently the leading segment, driven by the need for efficient fleet management and telematics solutions that enhance operational efficiency and reduce costs. The growing trend of digitalization in logistics and transportation further supports this segment's growth. Individual consumers are increasingly adopting connected vehicles for convenience and safety, while government agencies and MaaS providers are leveraging connectivity for smart mobility initiatives .

The Global Connected Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Ford Motor Company, General Motors Company, BMW AG, Audi AG, Toyota Motor Corporation, Honda Motor Co., Ltd., Volkswagen AG, Mercedes-Benz Group AG, Hyundai Motor Company, Nissan Motor Co., Ltd., Cisco Systems, Inc., Qualcomm Technologies, Inc., Ericsson AB, Intel Corporation, TomTom N.V., Harman International Industries, Inc., Continental AG, Robert Bosch GmbH, Denso Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the connected vehicle market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As the integration of artificial intelligence and machine learning enhances user experiences, the demand for smart features will likely increase. Furthermore, the collaboration between automotive manufacturers and technology firms is expected to foster innovation, leading to the development of more sophisticated connected vehicle solutions that prioritize safety, efficiency, and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Vehicles Commercial Vehicles Electric Vehicles Autonomous Vehicles Hybrid Vehicles Luxury Vehicles Others |

| By End-User | Individual Consumers Fleet Operators Government Agencies Ride-Sharing Services Logistics Companies Mobility-as-a-Service (MaaS) Providers Others |

| By Application | Navigation & Real-Time Traffic Services Remote Vehicle Diagnostics & Prognostics Safety and Security (eCall, Emergency Response, Anti-Theft) In-Vehicle Infotainment & Entertainment Services Fleet Management & Telematics Over-the-Air (OTA) Updates Vehicle-to-Everything (V2X) Communication Others |

| By Component | Hardware (ECUs, Telematics Control Units, Displays) Software (Operating Systems, Middleware, Applications) Connectivity Modules (4G/5G, Wi-Fi, Bluetooth) Sensors & Cameras Cloud Services & Platforms Others |

| By Sales Channel | OEM Sales Aftermarket Sales Online Sales Dealerships Distributors Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution E-commerce Distribution Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 60 | Product Development Managers, Technology Officers |

| Telematics Service Providers | 50 | Business Development Managers, Technical Leads |

| Fleet Management Companies | 40 | Operations Managers, Fleet Directors |

| Consumer Insights on Connected Vehicles | 70 | End-users, Automotive Enthusiasts |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

The Global Connected Vehicle Market is valued at approximately USD 95 billion, reflecting significant growth driven by advancements in telematics, safety features, and smart city initiatives, alongside increasing consumer demand for connectivity in vehicles.