Region:Global

Author(s):Rebecca

Product Code:KRAD8426

Pages:90

Published On:December 2025

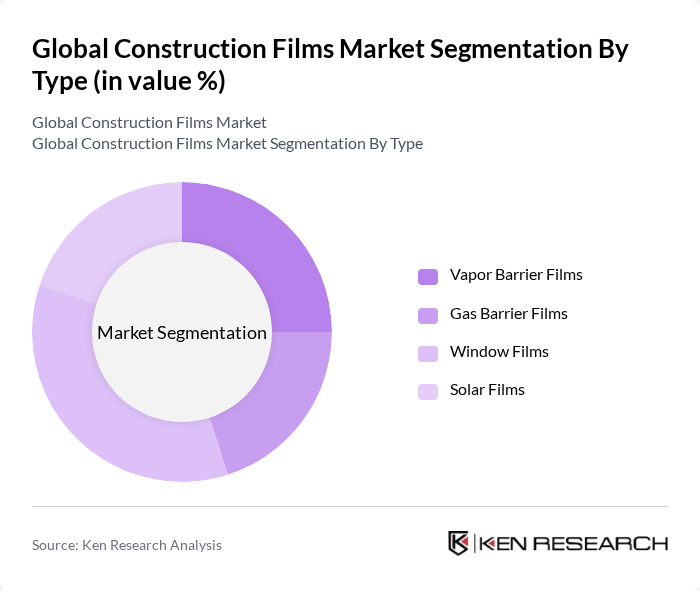

By Type:The market is segmented into various types of films, including Vapor Barrier Films, Gas Barrier Films, Window Films, and Solar Films. Each type serves specific functions in construction, such as moisture control, energy efficiency, and protection against environmental factors. Among these, Window Films are gaining traction due to their ability to enhance energy efficiency and provide UV protection, making them a preferred choice in both residential and commercial applications.

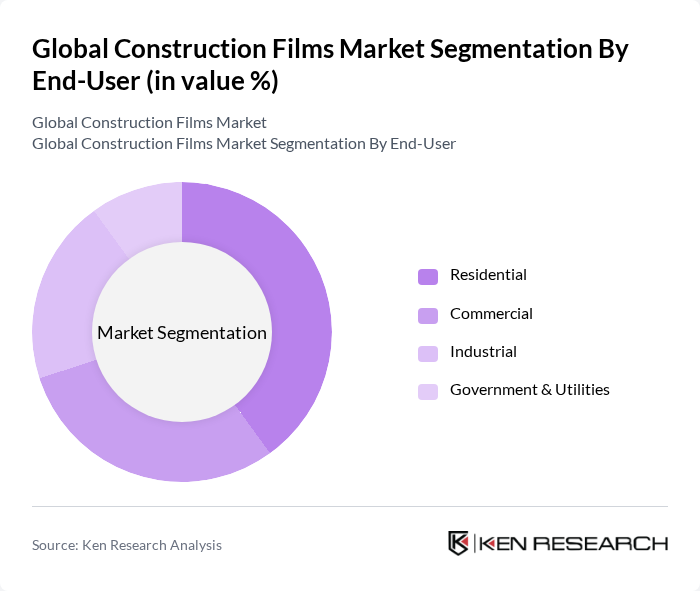

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities sectors. The Residential segment is particularly prominent, driven by increasing home renovations and new constructions focusing on energy efficiency. The Commercial sector follows closely, as businesses seek to reduce operational costs through energy-saving materials. The Industrial segment is also significant, with a growing emphasis on protective films for machinery and equipment.

The Global Construction Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont, 3M, Berry Global, Sealed Air Corporation, Amcor, Inteplast Group, Novolex, Toray Plastics, Coveris, Sigma Plastics Group, Jindal Poly Films, Polifilm, Mondi Group, Raven Industries, EP Film Industries Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction films market appears promising, driven by the ongoing transition towards sustainable building practices and technological innovations. As urbanization accelerates, the demand for high-performance, eco-friendly construction films is expected to rise. Additionally, the integration of smart technologies in construction processes will further enhance the functionality of these films. Companies that invest in research and development to create innovative products will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vapor Barrier Films Gas Barrier Films Window Films Solar Films |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Moisture Barriers Insulation Protective Coverings Others |

| By Thickness | Thin Films Medium Films Thick Films Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Resin Type | Polyolefin Films LLDPE Films PVC Films Others |

| By Distribution Channel | Direct Sales Indirect Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Supervisors |

| Commercial Building Developments | 100 | Architects, Construction Managers |

| Industrial Facility Upgrades | 80 | Procurement Officers, Facility Managers |

| Infrastructure Projects (Roads, Bridges) | 70 | Engineers, Project Directors |

| Green Building Initiatives | 60 | Sustainability Consultants, Building Inspectors |

The Global Construction Films Market is valued at approximately USD 16 billion, driven by the increasing demand for sustainable construction practices and advancements in film technology, including weather-resistant and anti-microbial properties.