Region:Global

Author(s):Rebecca

Product Code:KRAA2390

Pages:94

Published On:August 2025

By Type:This segmentation includes various consulting services that cater to different business needs. The primary subsegments are Management Consulting, IT Consulting, Human Resources Consulting, Financial Advisory, Marketing Consulting, Operations Consulting, Strategy Consulting, Innovation Consulting, and Others. Each of these subsegments plays a crucial role in addressing specific challenges faced by organizations. Management Consulting and IT Consulting remain the largest segments, driven by digital transformation, operational efficiency initiatives, and the integration of advanced technologies such as artificial intelligence and analytics. Human Resources and Financial Advisory services are also growing, reflecting the need for talent management and complex financial structuring in a rapidly evolving business environment .

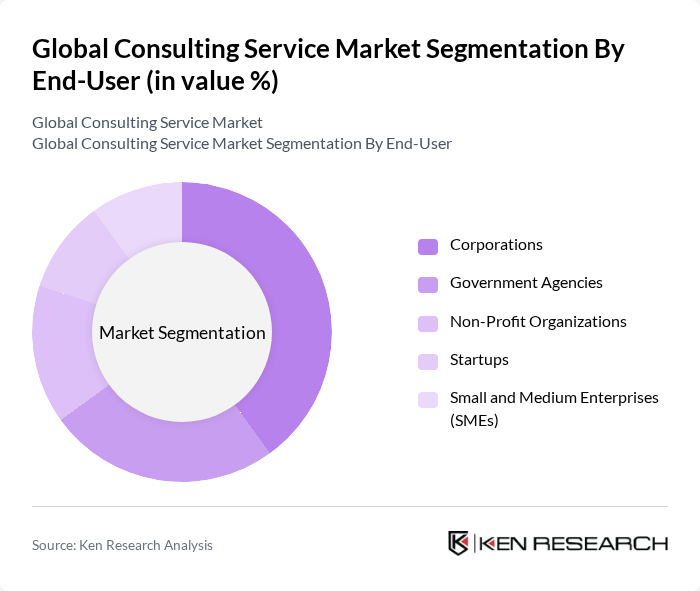

By End-User:This segmentation focuses on the various types of clients that utilize consulting services. The primary subsegments include Corporations, Government Agencies, Non-Profit Organizations, Startups, and Small and Medium Enterprises (SMEs). Each end-user category has distinct needs and requirements that consulting firms must address to provide effective solutions. Corporations and government agencies represent the largest end-user segments, driven by their scale, regulatory complexity, and ongoing transformation initiatives. SMEs and startups increasingly seek consulting support for digital adoption and market entry strategies, while non-profits require expertise in impact measurement and operational optimization .

The Global Consulting Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group, Bain & Company, Deloitte Consulting, Accenture, PwC Advisory Services, Ernst & Young Advisory (EY Advisory), KPMG Advisory, Oliver Wyman, Roland Berger, Capgemini Invent, Kearney, Navigant Consulting (now part of Guidehouse), Protiviti, FTI Consulting, Mercer, Willis Towers Watson, Alvarez & Marsal, L.E.K. Consulting, and Guidehouse contribute to innovation, geographic expansion, and service delivery in this space.

The consulting industry is poised for transformative growth, driven by the increasing integration of technology and the demand for specialized services. As businesses navigate complex operational landscapes, consulting firms that leverage data analytics and AI will gain a competitive edge. Additionally, the shift towards remote consulting services is expected to reshape client engagement strategies, allowing firms to expand their reach. The focus on sustainability and ethical practices will also drive new consulting opportunities, aligning with global trends towards responsible business practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Management Consulting IT Consulting Human Resources Consulting Financial Advisory Marketing Consulting Operations Consulting Strategy Consulting Innovation Consulting Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Startups Small and Medium Enterprises (SMEs) |

| By Service Delivery Model | On-Site Consulting Remote Consulting Hybrid Consulting |

| By Industry | Healthcare Financial Services (BFSI) Technology & Telecommunications Manufacturing Retail & Consumer Goods Energy & Utilities Government & Public Sector Others |

| By Geographic Focus | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Fixed Fee Hourly Rate Retainer Performance-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Management Consulting Services | 120 | Senior Consultants, Project Managers |

| IT Consulting Services | 90 | IT Directors, Technology Consultants |

| Human Resources Consulting | 60 | HR Managers, Talent Acquisition Specialists |

| Financial Advisory Services | 50 | Financial Analysts, CFOs |

| Operations Consulting | 70 | Operations Managers, Supply Chain Analysts |

The Global Consulting Service Market is valued at approximately USD 250 billion, reflecting a significant growth driven by the increasing complexity of business operations and the demand for specialized expertise across various sectors.