Region:Asia

Author(s):Dev

Product Code:KRAC4734

Pages:87

Published On:October 2025

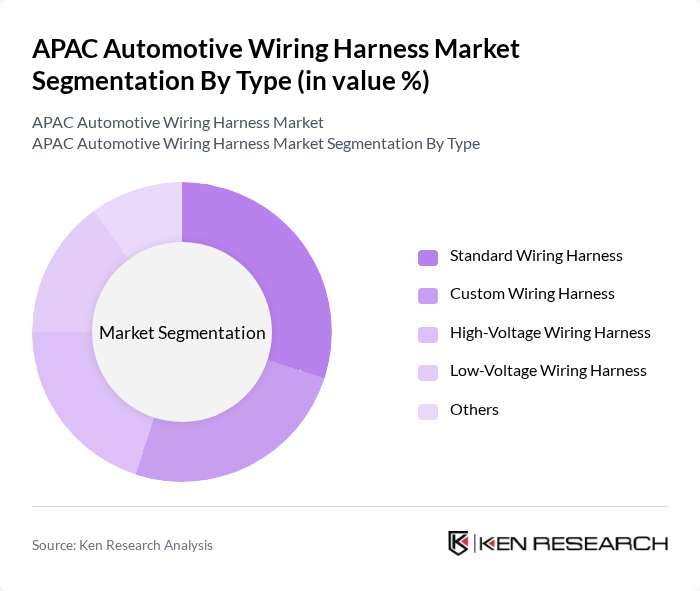

By Type:The market is segmented into various types of wiring harnesses, including Standard Wiring Harness, Custom Wiring Harness, High-Voltage Wiring Harness, Low-Voltage Wiring Harness, and Others. Each type serves different applications and industries, catering to the diverse needs of automotive manufacturers. Standard wiring harnesses are widely used in conventional vehicles, while high-voltage harnesses are increasingly critical for electric and hybrid vehicles due to their role in power distribution and safety .

The Standard Wiring Harness segment is currently dominating the market due to its widespread application in various vehicle types, including passenger cars and commercial vehicles. This segment is favored for its cost-effectiveness and reliability, making it a preferred choice among manufacturers. The increasing production of conventional vehicles continues to drive demand for standard wiring harnesses, while the growing trend towards customization is also contributing to the growth of the Custom Wiring Harness segment. High-voltage wiring harnesses are gaining traction with the rising penetration of electric vehicles, as they are essential for managing high-power transmission safely and efficiently .

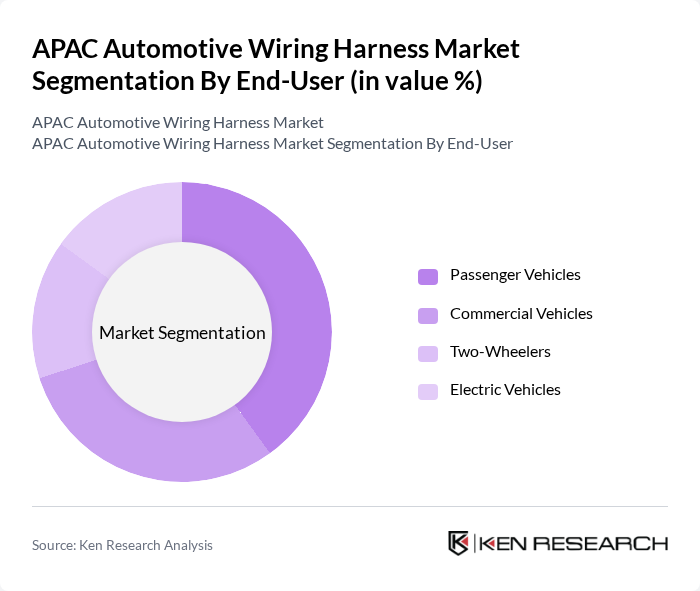

By End-User:The market is segmented based on end-users, including Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and Electric Vehicles. Each segment reflects the specific requirements and trends within the automotive industry, influencing the demand for wiring harnesses. Passenger vehicles dominate due to high production volumes, while the electric vehicle segment is expanding rapidly as automakers invest in electrification and advanced safety features .

The Passenger Vehicles segment holds the largest market share, driven by the high demand for personal transportation and the increasing production of cars in the region. The growth of the commercial vehicle segment is also significant, fueled by the expansion of logistics and transportation services. Additionally, the rising popularity of electric vehicles is creating new opportunities for wiring harness manufacturers, particularly in the high-voltage wiring harness category. The two-wheeler segment benefits from the surge in affordable mobility solutions, especially in emerging markets .

The APAC Automotive Wiring Harness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yazaki Corporation, Sumitomo Electric Industries, Ltd., Aptiv PLC, Leoni AG, Furukawa Electric Co., Ltd., Lear Corporation, Kromberg & Schubert GmbH & Co. KG, Nexans Autoelectric GmbH, Amphenol Corporation, TE Connectivity Ltd., PKC Group, Samvardhana Motherson International Ltd., Hitachi Astemo, Ltd., THB Group, Yura Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The APAC automotive wiring harness market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As the region embraces electric vehicles and smart technologies, manufacturers will need to innovate continuously to meet the demands for lightweight and efficient wiring solutions. Additionally, the focus on sustainability will push companies to adopt eco-friendly materials and practices. Collaborations with automotive OEMs will be crucial in navigating regulatory landscapes and enhancing product offerings, ensuring competitiveness in a rapidly changing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Wiring Harness Custom Wiring Harness High-Voltage Wiring Harness Low-Voltage Wiring Harness Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Electric Vehicles |

| By Component | Electric Wires Connectors Terminals Insulation Materials Convoluted Tubes, Sheaths, Clamps, Protectors, Grommets |

| By Application | Engine Wiring Body Wiring Chassis Wiring Dashboard & Cabin Wiring Body & Lighting HVAC Wiring |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Economy Mid-Range Premium |

| By Material | Copper Aluminum Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Wiring Harness Procurement | 60 | Procurement Managers, Supply Chain Directors |

| Tier 1 Supplier Manufacturing Insights | 50 | Production Managers, Quality Assurance Leads |

| Electric Vehicle Wiring Solutions | 40 | R&D Engineers, Product Development Managers |

| Automotive Aftermarket Wiring Needs | 40 | Aftermarket Managers, Sales Directors |

| Regulatory Compliance in Wiring Harnesses | 40 | Compliance Officers, Regulatory Affairs Managers |

The APAC Automotive Wiring Harness Market is valued at approximately USD 23 billion, driven by the increasing demand for advanced automotive technologies, including electric and hybrid vehicles, and the rise in vehicle production in the region.