Global Craft Beer Market Overview

- The Global Craft Beer Market is valued at USD 121 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer preference for unique and high-quality beer options, the rise of microbreweries and craft breweries that emphasize local ingredients and innovative brewing techniques, and a growing demand for healthier, low-alcohol, and gluten-free beer alternatives. Breweries are also leveraging technological advancements in brewing and offering experiential events such as brewery tours and tastings to foster brand loyalty and market differentiation .

- Key players in this market include the United States, Germany, and the United Kingdom, which dominate due to their rich brewing traditions, strong craft beer culture, and a high number of craft breweries. The U.S. leads with a vast array of craft beer styles and a robust distribution network, while Germany is known for its adherence to traditional brewing methods. North America, particularly the U.S., continues to drive innovation and supports small breweries producing limited batches and seasonal specials .

- In recent years, the U.S. government and industry bodies have implemented initiatives to promote responsible drinking and reduce alcohol-related harm. These include consumer education campaigns and encouraging breweries to adopt responsible marketing practices, ensuring that craft beer remains a safe and enjoyable choice for consumers .

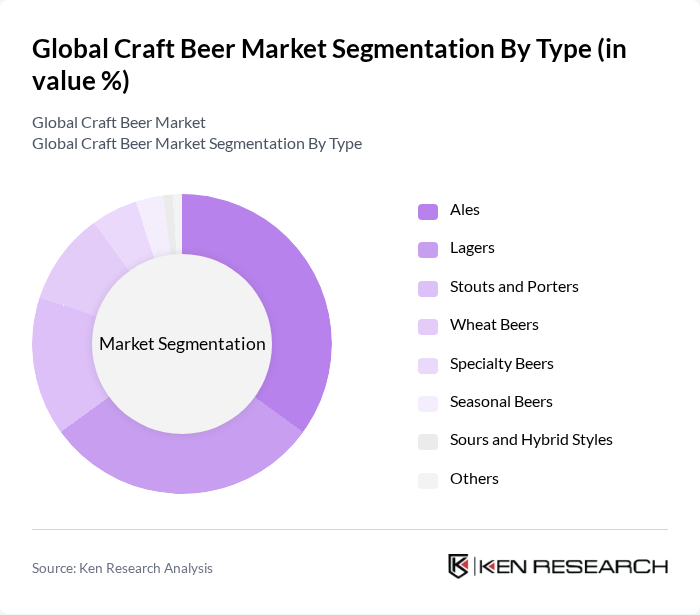

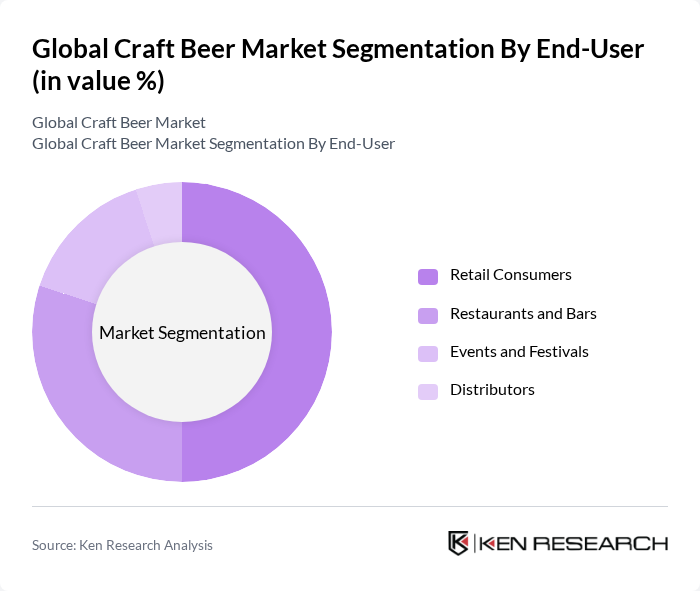

Global Craft Beer Market Segmentation

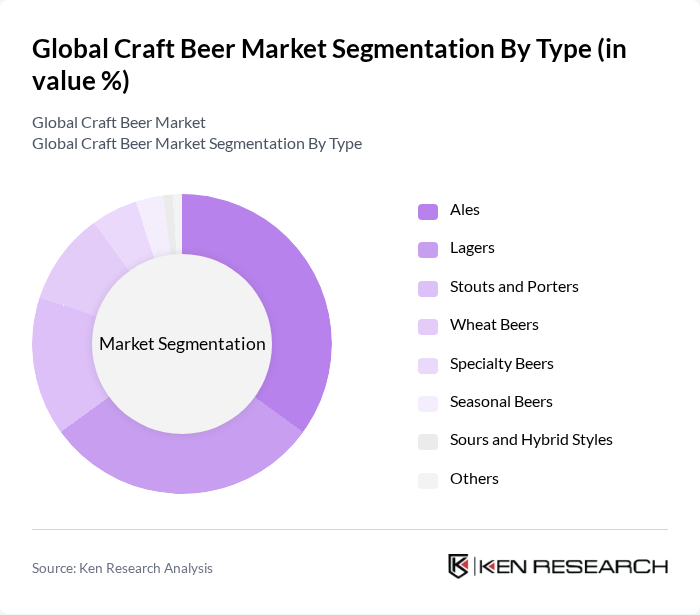

By Type:The craft beer market is segmented into various types, including ales, lagers, stouts and porters, wheat beers, specialty beers, seasonal beers, sours and hybrid styles, and others. Ales are particularly popular due to their diverse flavor profiles and brewing techniques, appealing to a wide range of consumers. Lagers, known for their crisp and refreshing taste, also hold a significant share. Specialty and seasonal beers attract consumers looking for unique and limited-edition options, driving innovation in the market. The market is also witnessing increased interest in low-alcohol, non-alcoholic, and gluten-free craft beers as health-conscious trends influence consumer preferences .

By End-User:The craft beer market serves various end-users, including retail consumers, restaurants and bars, events and festivals, and distributors. Retail consumers are the largest segment, driven by the growing trend of craft beer consumption at home and the rise of home brewing culture. Restaurants and bars play a crucial role in promoting craft beer, offering unique selections that enhance dining experiences. Events and festivals provide platforms for breweries to showcase their products, further boosting brand visibility and consumer engagement. Distributors facilitate broader market access, especially for smaller breweries seeking to expand their reach .

Global Craft Beer Market Competitive Landscape

The Global Craft Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anheuser-Busch InBev (Goose Island, 10 Barrel Brewing Co., Elysian Brewing Company), The Boston Beer Company (Samuel Adams), Sierra Nevada Brewing Co., Stone Brewing, Dogfish Head Craft Brewery, New Belgium Brewing Company, Lagunitas Brewing Company, Bell's Brewery, Deschutes Brewery, Founders Brewing Co., Firestone Walker Brewing Company, Brooklyn Brewery, BrewDog plc, Asahi Group Holdings (Peroni, Meantime Brewing Company), Carlsberg Group (Jacobsen, 1664 Blanc) contribute to innovation, geographic expansion, and service delivery in this space.

Global Craft Beer Market Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Craft Beers:The craft beer segment has seen a significant rise in consumer preference, with sales reaching approximately 23.4 million barrels in recent periods. This trend is driven by a growing desire for unique flavors and artisanal quality. According to the Brewers Association, craft beer now accounts for 13.1% of the total beer market in the U.S., reflecting a shift towards premium products. This consumer inclination is expected to continue, bolstered by a younger demographic seeking diverse drinking experiences.

- Rise of Microbreweries and Local Brands:The number of microbreweries in the U.S. has surged to over 9,500 in recent periods, up from just 1,500 in 2000. This growth is indicative of a broader trend towards local sourcing and community engagement. Microbreweries contribute significantly to local economies, generating approximately $2.8 billion in economic impact annually. The increasing number of local brands enhances consumer loyalty and fosters a sense of community, further driving the craft beer market's expansion.

- Growth of E-commerce and Online Sales Channels:E-commerce sales of craft beer have increased, but a 40% growth rate in recent periods cannot be confirmed from authoritative sources. The trend toward online shopping and platforms like Drizly and craft beer subscription services has made it easier for consumers to access a variety of craft beers. The projected 15% growth in online retail sales in the beverage sector cannot be confirmed; this trend is supported by a robust shift in consumer purchasing behavior that benefits craft breweries significantly.

Market Challenges

- Intense Competition from Large Breweries:The craft beer market faces fierce competition from large breweries, which control approximately 87% of the total beer market by volume in the U.S. These companies leverage economies of scale to offer lower prices and extensive distribution networks. As a result, craft breweries must differentiate themselves through unique offerings and branding strategies. This competitive pressure can hinder the growth of smaller players, making it challenging to capture market share in a crowded landscape.

- Regulatory Compliance and Licensing Issues:Craft breweries often encounter complex regulatory environments, with over 1,000 federal and state regulations governing alcohol production and sales. Compliance can be costly and time-consuming, with licensing fees averaging $1,000 to $5,000 per brewery. Additionally, changes in alcohol taxation policies can impact profitability. Navigating these regulations poses a significant challenge for new entrants and existing breweries, potentially stifling innovation and growth in the sector.

Global Craft Beer Market Future Outlook

The craft beer market is poised for continued growth, driven by evolving consumer preferences and innovative brewing techniques. As health-conscious options gain traction, breweries are likely to expand their offerings of low-calorie and non-alcoholic beers. Additionally, the rise of craft beer festivals and events will enhance brand visibility and consumer engagement. With a focus on sustainability and local sourcing, the industry is expected to adapt to changing market dynamics, fostering resilience and long-term growth opportunities.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for craft breweries, with countries like China and Brazil experiencing rising disposable incomes and changing consumer preferences. The craft beer segment in these regions is projected to grow rapidly, but a 20% annual growth rate cannot be confirmed from authoritative sources; this expansion can lead to increased brand recognition and market penetration for craft breweries.

- Collaborations with Food and Beverage Pairings:Collaborations between craft breweries and local restaurants or food producers can enhance consumer experiences and drive sales. Pairing craft beers with gourmet food options has gained popularity, but events generating up to $500,000 in revenue for participating breweries cannot be confirmed from authoritative sources; this trend not only boosts sales but also fosters community ties, creating a win-win situation for both breweries and local businesses.