Region:Central and South America

Author(s):Shubham

Product Code:KRAC0610

Pages:92

Published On:August 2025

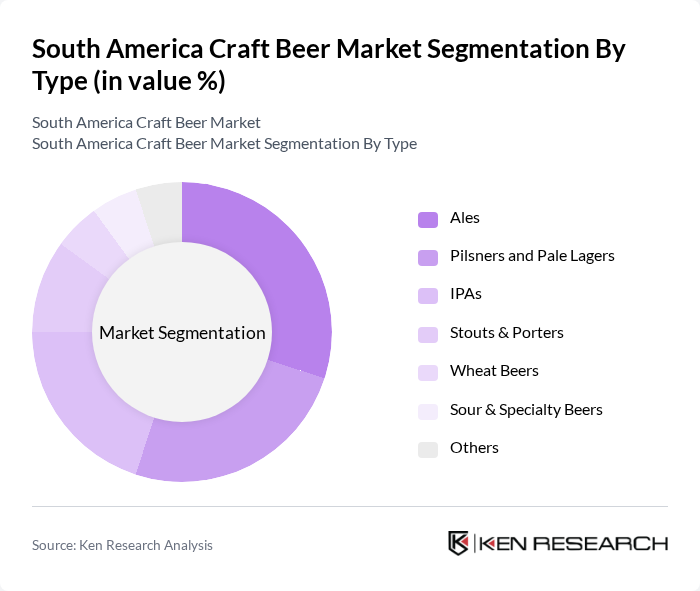

By Type:The craft beer market can be segmented into various types, including Ales, Pilsners and Pale Lagers, IPAs, Stouts & Porters, Wheat Beers, Sour & Specialty Beers, and Others. Ales are particularly popular due to their diverse flavor profiles and brewing techniques, while IPAs have gained a strong following among craft beer enthusiasts for their hoppy characteristics. The market is characterized by a growing trend towards unique and innovative flavors, with consumers increasingly seeking out specialty beers.

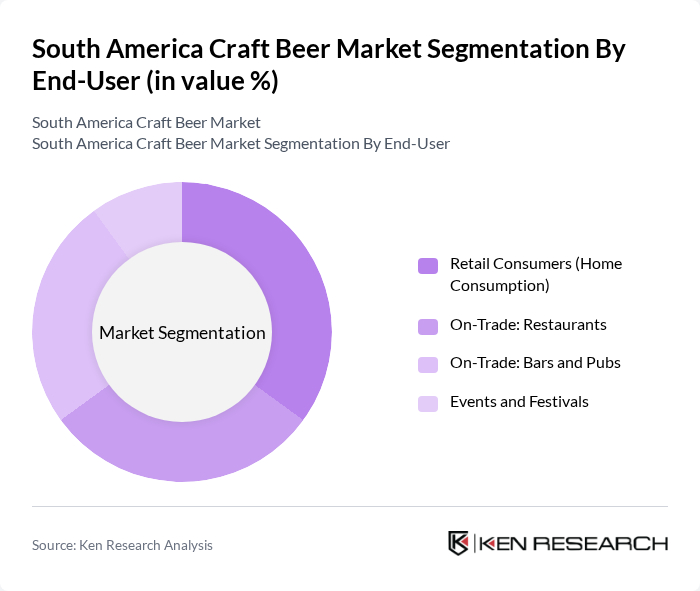

By End-User:The end-user segmentation includes Retail Consumers (Home Consumption), On-Trade: Restaurants, On-Trade: Bars and Pubs, and Events and Festivals. The retail consumer segment has seen growth supported by wider retail placement and e-commerce availability of craft SKUs, while on-trade consumption in restaurants and bars remains strong, aided by beer-and-food pairings and rotating tap programs.

The South America Craft Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ambev S.A. (Brazil), Cervejaria Colorado (Brazil), Wäls Brewery (Cervejaria Wäls, Brazil), Colorado’s parent: Anheuser-Busch InBev (AB InBev) – Craft Portfolio (Regional), Grupo Petrópolis (Brazil) – Black Princess/Therezópolis, Heineken Brasil – Baden Baden (Brazil), Cervejaria Bodebrown (Brazil), Cervejaria Praya (Brazil), Cervecería y Maltería Quilmes (AB InBev, Argentina) – Patagonia, Cervecería Antares (Argentina), Otro Mundo Brewing Company (Argentina), Cervecería Kunstmann (Chile), Cervecería Tübinger (Chile), Backus y Johnston (AB InBev, Peru) – Sierra Andina partnerships/portfolio, Cervecería Sierra Andina (Peru), Apostol Cerveza Artesanal (Colombia), Bogotá Beer Company (BBC, Colombia), 3B – Backer (Cervejaria Backer, Brazil), Cervecería Minerva (Mexico-origin, LATAM exports), Cervecería Barbarian (Peru) contribute to innovation, geographic expansion, and service delivery in this space.

The South American craft beer market is poised for continued growth, driven by evolving consumer preferences and innovative brewing techniques. As local breweries increasingly adopt sustainable practices, the market is likely to attract environmentally conscious consumers. Additionally, the rise of craft beer tourism, with an estimated 1.8 million tourists visiting breweries in the near future, will further enhance market visibility. The integration of technology in brewing and distribution will also play a crucial role in shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ales Pilsners and Pale Lagers IPAs Stouts & Porters Wheat Beers Sour & Specialty Beers Others |

| By End-User | Retail Consumers (Home Consumption) On-Trade: Restaurants On-Trade: Bars and Pubs Events and Festivals |

| By Distribution Channel | On-Trade Off-Trade: Supermarkets and Hypermarkets Off-Trade: Specialty Bottle Shops Off-Trade: Online Retail/E-commerce Direct-to-Consumer (Brewery Taprooms and Subscriptions) |

| By Packaging Type | Bottles Cans Kegs Crowlers/Growlers |

| By Price Range | Premium Mid-Range Budget |

| By Flavor Profile | Fruity Spicy Herbal Malty Hoppy/Bitter Sour/Tart |

| By Region | Brazil Argentina Chile Colombia Peru Rest of South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Brewery Owners | 60 | Founders, CEOs, and Operations Managers |

| Craft Beer Consumers | 120 | Regular Craft Beer Drinkers, Enthusiasts |

| Retailers of Craft Beer | 70 | Store Managers, Beverage Buyers |

| Industry Experts and Analysts | 40 | Market Analysts, Consultants, and Academics |

| Distributors and Wholesalers | 50 | Distribution Managers, Sales Representatives |

The South America Craft Beer Market is valued at approximately USD 1.6 to 1.8 billion, reflecting a significant growth trend driven by consumer preferences for artisanal and locally brewed beers, as well as craft beer tourism.