Region:North America

Author(s):Shubham

Product Code:KRAB0779

Pages:90

Published On:August 2025

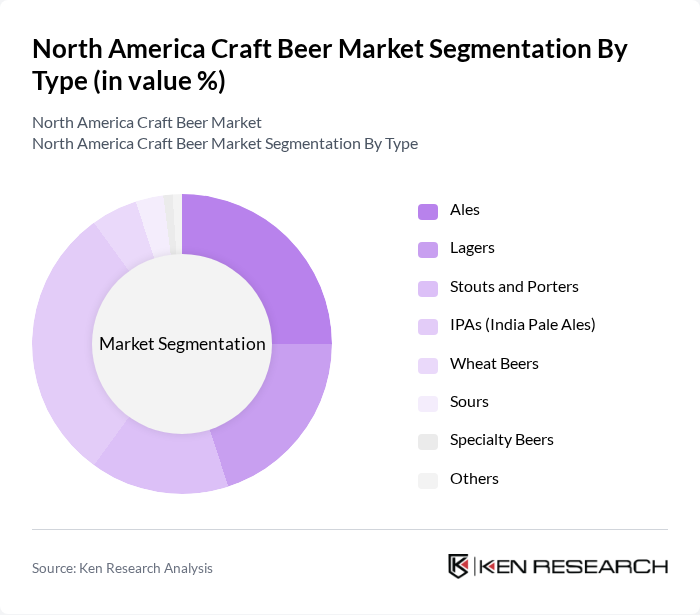

By Type:The craft beer market is segmented into various types, including Ales, Lagers, Stouts and Porters, IPAs (India Pale Ales), Wheat Beers, Sours, Specialty Beers, and Others. Among these, IPAs have gained immense popularity due to their bold flavors and high hop content, appealing particularly to younger consumers who favor innovative and unique beer experiences. Ales and Lagers also maintain significant market shares, driven by their traditional appeal and versatility in food pairings. The market continues to see diversification with the introduction of low-alcohol, non-alcoholic, and flavored craft beer variants to meet evolving consumer preferences .

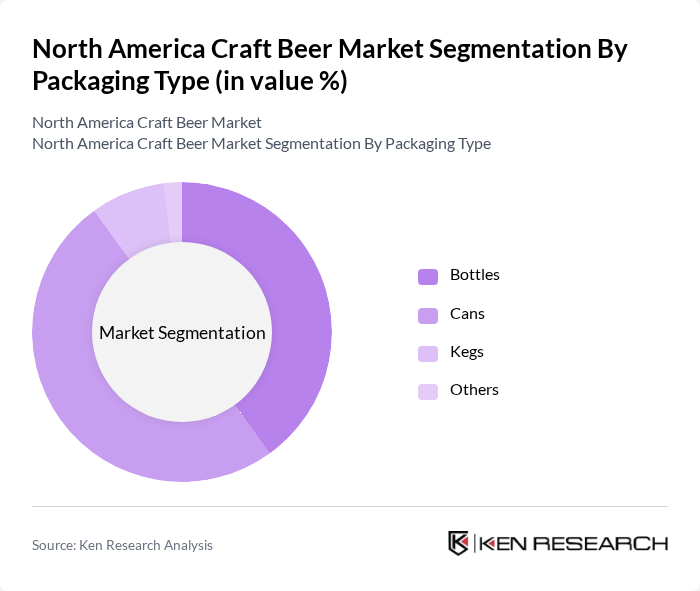

By Packaging Type:The market is also segmented by packaging type, which includes Bottles, Cans, Kegs, and Others. Cans have become increasingly popular due to their lightweight nature, portability, and ability to preserve the beer's freshness. Bottles remain a traditional choice, especially for premium craft beers, while kegs are favored for on-tap experiences in bars and restaurants. The shift towards cans reflects changing consumer preferences for convenience and sustainability, as well as the growing adoption of recyclable packaging materials by craft brewers .

The North America Craft Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Beer Company, Sierra Nevada Brewing Co., New Belgium Brewing Company, Stone Brewing, Lagunitas Brewing Company, Dogfish Head Craft Brewery, Bell's Brewery, Founders Brewing Co., Deschutes Brewery, Oskar Blues Brewery, Firestone Walker Brewing Company, SweetWater Brewing Company, Victory Brewing Company, Brooklyn Brewery, Elysian Brewing Company, Goose Island Beer Co., Great Lakes Brewing Company, Rogue Ales & Spirits, Boulevard Brewing Company, Alaskan Brewing Co. contribute to innovation, geographic expansion, and service delivery in this space.

The North America craft beer market is poised for continued growth, driven by evolving consumer preferences and a strong emphasis on local production. As more consumers seek unique and high-quality beverages, craft breweries are likely to expand their offerings and explore innovative brewing techniques. Additionally, the rise of e-commerce platforms will facilitate broader distribution, allowing smaller breweries to reach new customers. Sustainability initiatives will also play a crucial role in shaping the market, as environmentally conscious consumers increasingly favor brands that prioritize eco-friendly practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Ales Lagers Stouts and Porters IPAs (India Pale Ales) Wheat Beers Sours Specialty Beers Others |

| By Packaging Type | Bottles Cans Kegs Others |

| By Distribution Channel | On-Trade (Bars, Restaurants, Pubs) Off-Trade (Retail Stores, Supermarkets, E-commerce) Others |

| By Region | United States (Northeast, Midwest, South, West) Canada Mexico |

| By Consumer Demographics | Age Group (21–35, 36–49, 50+) Gender Income Level Others |

| By Occasion | Social Gatherings Celebrations Casual Drinking Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Brewery Owners | 60 | Founders, CEOs, and Operations Managers |

| Craft Beer Consumers | 120 | Regular Craft Beer Drinkers, Occasional Consumers |

| Retailers of Craft Beer | 50 | Store Managers, Beverage Buyers |

| Industry Experts and Analysts | 40 | Market Analysts, Consultants, Trade Association Representatives |

| Distributors of Craft Beer | 45 | Distribution Managers, Sales Representatives |

The North America Craft Beer Market is valued at approximately USD 1.7 billion, reflecting a significant growth trend driven by consumer preferences for unique and locally brewed beers, as well as the rise of craft breweries across the region.