Region:Global

Author(s):Shubham

Product Code:KRAA3172

Pages:96

Published On:August 2025

By Type:The cruise tourism market is segmented into various types, including Ocean Cruises, River Cruises, Expedition Cruises, Luxury Cruises, Family Cruises, Themed Cruises, Ultra-Luxury Cruises, Adventure Cruises, and Others. Among these, Ocean Cruises dominate the market due to their extensive itineraries, larger passenger capacities, and broad appeal across demographics. River Cruises are gaining traction for their unique experiences and scenic routes, while Luxury and Ultra-Luxury Cruises cater to affluent travelers seeking exclusive, personalized experiences. Expedition Cruises are increasingly popular for adventure seekers, offering specialized journeys to remote destinations with onboard experts and sustainability-focused amenities .

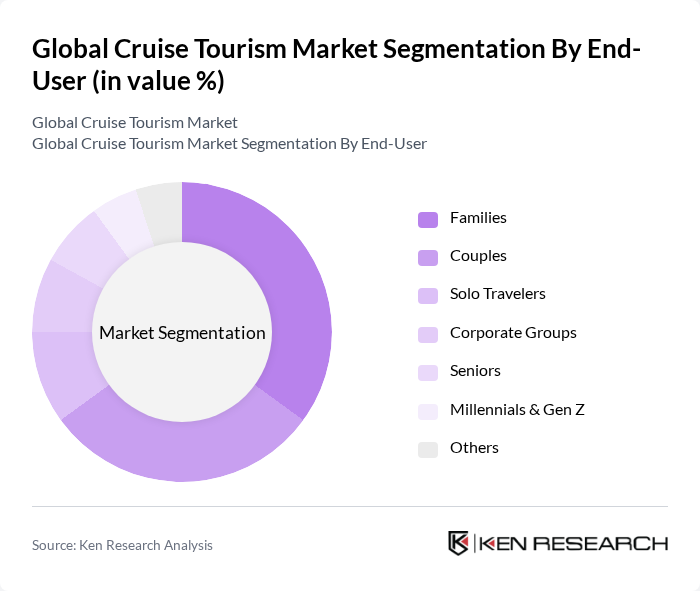

By End-User:The end-user segmentation includes Families, Couples, Solo Travelers, Corporate Groups, Seniors, Millennials & Gen Z, and Others. Families and Couples are the leading segments, driven by the appeal of family-friendly amenities, diverse entertainment options, and romantic getaway packages. Millennials and Gen Z are increasingly participating in cruise tourism, seeking unique experiences, social activities, and technology-driven amenities onboard. Corporate Groups utilize cruises for retreats and team-building events, while Seniors favor cruises for their comfort, safety, and curated itineraries .

The Global Cruise Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carnival Corporation & plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd., MSC Cruises S.A., Genting Hong Kong Limited, Disney Cruise Line, Holland America Line, Princess Cruises, Celebrity Cruises, AIDA Cruises, Costa Cruises, Viking Cruises, Seabourn Cruise Line, P&O Cruises, Cunard Line contribute to innovation, geographic expansion, and service delivery in this space.

The cruise tourism market is poised for a dynamic evolution, driven by changing consumer preferences and technological advancements. As travelers increasingly seek personalized and immersive experiences, cruise lines are expected to innovate their offerings. Enhanced digital engagement strategies will play a crucial role in attracting younger demographics. Furthermore, sustainability initiatives will likely become a focal point, as companies strive to meet regulatory demands while appealing to environmentally conscious consumers, shaping the future landscape of cruise tourism.

| Segment | Sub-Segments |

|---|---|

| By Type | Ocean Cruises River Cruises Expedition Cruises Luxury Cruises Family Cruises Themed Cruises Ultra-Luxury Cruises Adventure Cruises Others |

| By End-User | Families Couples Solo Travelers Corporate Groups Seniors Millennials & Gen Z Others |

| By Duration | Short Cruises (1-3 days) Medium Cruises (4-7 days) Long Cruises (8-14 days) Extended Cruises (15+ days) Others |

| By Destination | Caribbean Mediterranean Alaska Asia-Pacific Northern Europe South America Antarctica Others |

| By Booking Channel | Direct Booking Travel Agents Online Travel Agencies Cruise Line Websites Mobile Apps Others |

| By Age Group | Children (0-12 years) Teens (13-19 years) Young Adults (20-35 years) Adults (36-60 years) Seniors (60+ years) Others |

| By Price Range | Budget Cruises Mid-Range Cruises Premium Cruises Luxury Cruises Ultra-Luxury Cruises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Cruise Market | 60 | C-suite Executives, Marketing Directors |

| Family Cruise Packages | 100 | Travel Agents, Family Travelers |

| Adventure and Expedition Cruises | 50 | Outdoor Enthusiasts, Tour Operators |

| Emerging Markets in Cruise Tourism | 40 | Regional Tourism Boards, Market Analysts |

| Onboard Experience and Services | 70 | Cruise Passengers, Hospitality Managers |

The Global Cruise Tourism Market is valued at approximately USD 74 billion, reflecting a robust recovery and growth driven by increasing disposable incomes, a trend towards experiential travel, and the expansion of cruise itineraries to new destinations.