Region:Global

Author(s):Shubham

Product Code:KRAA3166

Pages:81

Published On:August 2025

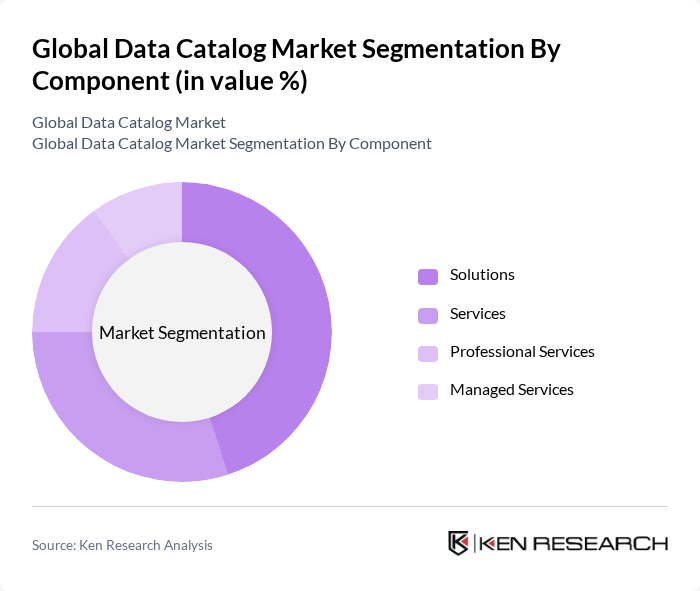

By Component:The market is segmented into Solutions, Services, Professional Services, and Managed Services.Solutionsare increasingly favored due to their ability to provide comprehensive data management, data lineage, and metadata management capabilities.Services, including consulting and support, are essential for implementation, integration, and ongoing maintenance.Professional Servicesare crucial for organizations seeking tailored deployments and advanced configurations, whileManaged Servicesoffer ongoing operational support, making them attractive for businesses looking to outsource data management functions.

By Deployment Model:The market is divided intoCloudandOn-Premisesdeployment models. The Cloud model is gaining traction due to its scalability, cost-effectiveness, rapid deployment, and ease of access, making it the preferred choice for many organizations. On-Premises solutions, while still relevant, are often selected by enterprises with stringent data security and regulatory requirements, resulting in continued demand across both models.

The Global Data Catalog Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alation Inc., Informatica LLC, Collibra NV, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Talend S.A., Atlan Technologies, AWS (Amazon Web Services) Data Catalog, Google Cloud Data Catalog, Dremio Corporation, TIBCO Software Inc., Snowflake Inc., and Data.World, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data catalog market is poised for significant transformation, driven by advancements in artificial intelligence and machine learning. As organizations increasingly adopt these technologies, data catalogs will evolve to offer enhanced automation and predictive analytics capabilities. Furthermore, the growing emphasis on data democratization will lead to the development of user-friendly interfaces, enabling non-technical users to access and utilize data effectively. These trends will shape the market landscape, fostering innovation and expanding the reach of data catalog solutions across various industries.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services Professional Services Managed Services |

| By Deployment Model | Cloud On-Premises |

| By Data Consumer | Business Intelligence Tools Enterprise Applications Mobile & Web Applications |

| By Metadata Type | Business Metadata Technical Metadata Operational Metadata |

| By Organization Size | Small & Medium Enterprises Large Enterprises |

| By End-User (Industry Vertical) | BFSI (Banking, Financial Services & Insurance) Retail & E-commerce IT & Telecom Healthcare & Life Sciences Manufacturing Transportation & Logistics Media & Entertainment Government & Defense Energy & Utilities Education Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Governance | 100 | Data Governance Officers, Compliance Managers |

| Cloud Data Catalog Solutions | 60 | IT Managers, Cloud Architects |

| Data Catalog Adoption in Healthcare | 50 | Healthcare IT Managers, Data Analysts |

| Retail Data Management Practices | 70 | Data Scientists, Retail Operations Managers |

| Financial Services Data Catalog Usage | 40 | Risk Management Officers, Financial Analysts |

The Global Data Catalog Market is valued at approximately USD 1.35 billion, reflecting a significant growth trend driven by the increasing need for effective data management, cloud adoption, and the integration of AI and machine learning capabilities.