Region:Global

Author(s):Rebecca

Product Code:KRAA2386

Pages:100

Published On:August 2025

By Type:The market is segmented into various types, includingFull Truck Load (FTL),Less Than Truck Load (LTL),Intermodal Freight,Expedited Freight,Parcel/Last Mile Delivery, andOthers. Each segment addresses distinct logistics needs and operational efficiencies, with FTL and LTL dominating due to their widespread use in retail, manufacturing, and e-commerce supply chains. Intermodal freight is gaining traction for its cost-effectiveness and sustainability, while expedited freight and last mile delivery are increasingly important for time-sensitive and consumer-facing shipments.

TheFull Truck Load (FTL)segment is currently dominating the market due to its efficiency in transporting large volumes of goods over long distances. FTL is favored by businesses requiring dedicated truckloads, resulting in reduced transit times and lower costs per unit. The segment's growth is propelled by the rising demand for reliable and timely deliveries in retail and manufacturing, as well as technological advancements in logistics management systems that enhance operational capabilities and real-time tracking.

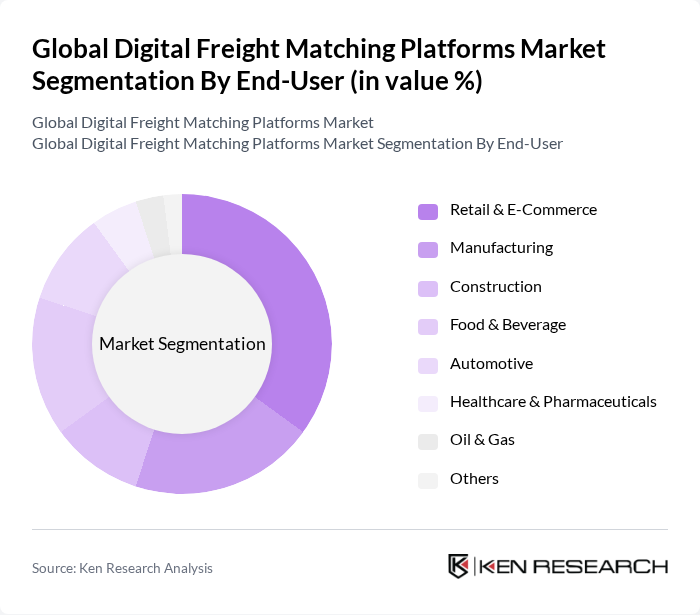

By End-User:The market is segmented by end-users, includingRetail & E-Commerce,Manufacturing,Construction,Food & Beverage,Automotive,Healthcare & Pharmaceuticals,Oil & Gas, andOthers. Each end-user segment has distinct logistics requirements, with retail and e-commerce leading due to the surge in online shopping and last-mile delivery needs. Manufacturing and automotive sectors drive demand for bulk and time-sensitive shipments, while food & beverage and healthcare require specialized handling and tracking.

TheRetail & E-Commercesegment leads the market, driven by the exponential growth of online shopping and the increasing need for efficient logistics solutions to handle last-mile deliveries. Rising consumer expectations for fast and reliable shipping have compelled retailers to adopt digital freight matching platforms to optimize supply chains, enhance visibility, and improve tracking. Technology integration in logistics operations continues to drive demand for these platforms across all major end-user segments.

The Global Digital Freight Matching Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargomatic, Convoy, Uber Freight, Transfix, Loadsmart, Freightos, DAT Solutions, project44, Trucker Path, Shipwell, Echo Global Logistics, XPO Inc., J.B. Hunt Transport Services, Schneider National, Flexport, C.H. Robinson, Freight Technologies, Inc. (Fr8App) contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital freight matching platforms is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize real-time tracking and visibility, platforms that integrate blockchain technology and AI will gain a competitive edge. Additionally, the emphasis on sustainability will push logistics providers to adopt greener practices, aligning with global environmental goals. This shift will create a more efficient, transparent, and eco-friendly logistics ecosystem, enhancing overall market growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Freight Expedited Freight Parcel/Last Mile Delivery Others |

| By End-User | Retail & E-Commerce Manufacturing Construction Food & Beverage Automotive Healthcare & Pharmaceuticals Oil & Gas Others |

| By Service Model | Subscription-Based Pay-Per-Use Freemium Transaction Fee-Based Others |

| By Geographic Coverage | Domestic Regional International/Global Others |

| By Technology Integration | API Integration Cloud-Based Solutions Mobile Applications Artificial Intelligence & Machine Learning Blockchain Others |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Startups Freight Brokers/3PLs Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Tiered Pricing Auction-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Matching Platforms | 60 | Platform Executives, Product Managers |

| Logistics Service Providers | 50 | Operations Managers, Business Development Leads |

| Shippers and Freight Owners | 40 | Supply Chain Directors, Procurement Managers |

| Technology Providers in Logistics | 40 | CTOs, Software Development Managers |

| Industry Analysts and Consultants | 40 | Market Analysts, Research Directors |

The Global Digital Freight Matching Platforms Market is valued at approximately USD 41 billion, driven by the increasing demand for efficient logistics solutions and the rapid expansion of e-commerce, among other factors.