Region:Global

Author(s):Shubham

Product Code:KRAE0504

Pages:81

Published On:December 2025

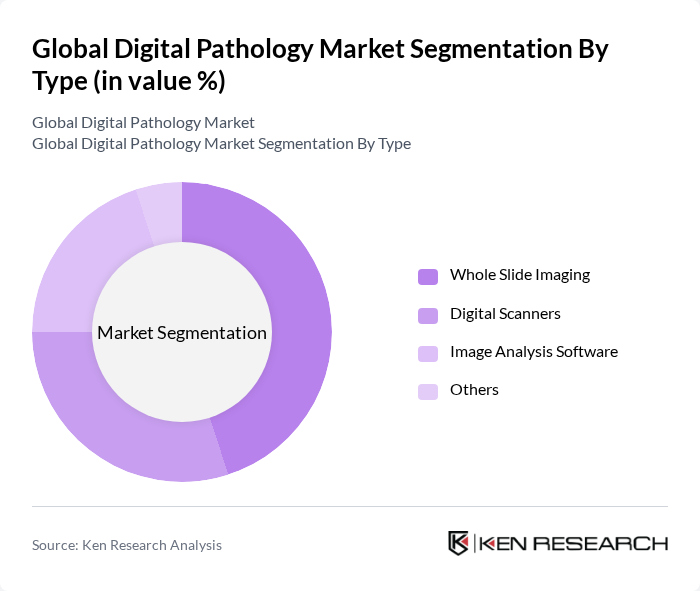

By Type:The digital pathology market is segmented into various types, including Whole Slide Imaging, Digital Scanners, Image Analysis Software, and Others. Among these, Whole Slide Imaging is the leading sub-segment due to its ability to provide high-resolution images that facilitate accurate diagnosis and analysis. The demand for digital scanners is also significant, driven by the need for efficient and rapid scanning of pathology slides. Image analysis software is gaining traction as it enhances diagnostic accuracy through advanced algorithms and AI integration.

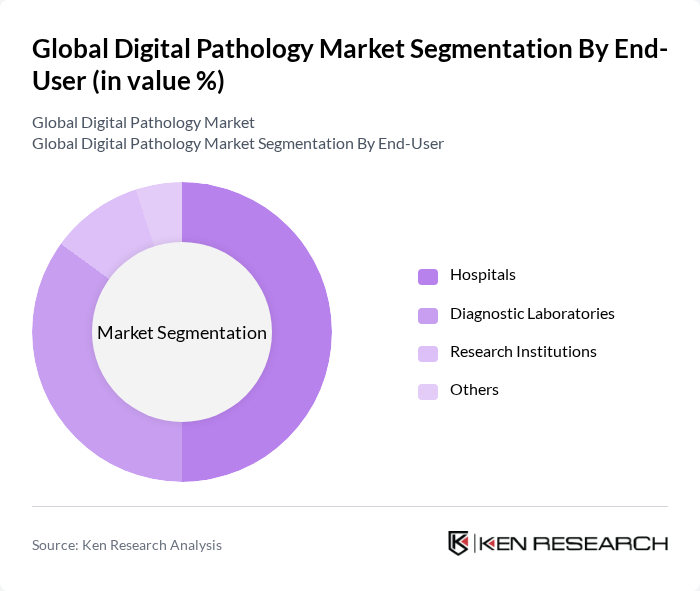

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, and Others. Hospitals dominate the market due to their high volume of pathology tests and the need for efficient diagnostic processes. Diagnostic laboratories are also significant users, as they require advanced digital pathology solutions to enhance their diagnostic capabilities. Research institutions are increasingly adopting digital pathology for research and development purposes, particularly in cancer research.

The Global Digital Pathology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Leica Biosystems, 3DHISTECH, Aperio Technologies, Hamamatsu Photonics, Sectra AB, PathAI, Proscia, Visiopharm, Olympus Corporation, F. Hoffmann-La Roche AG, Canon Medical Systems, Quest Diagnostics, Siemens Healthineers, and GE Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital pathology market in future appears promising, driven by technological advancements and increasing healthcare demands. The integration of AI and machine learning into diagnostic processes is expected to enhance accuracy and efficiency significantly. Additionally, as healthcare systems continue to embrace telehealth, the need for digital pathology solutions will likely grow. This evolution will foster innovation and collaboration among stakeholders, paving the way for a more efficient healthcare landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Slide Imaging Digital Scanners Image Analysis Software Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Others |

| By Application | Cancer Diagnosis Drug Development Education and Training Others |

| By Technology | Digital Imaging Artificial Intelligence Cloud Computing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type | Public Sector Private Sector Non-Profit Organizations Others |

| By Service Type | Consulting Services Implementation Services Maintenance Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Pathology Labs | 150 | Laboratory Directors, Pathology Technologists |

| Research Institutions | 100 | Research Scientists, Lab Managers |

| Healthcare IT Departments | 80 | IT Managers, System Administrators |

| Medical Device Manufacturers | 70 | Product Development Managers, Sales Executives |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Global Digital Pathology Market is valued at approximately USD 1.85 billion. This growth is driven by the increasing prevalence of cancer and chronic diseases, which necessitate faster and more accurate diagnostic solutions.