Vietnam Digital Pathology Market Overview

- The Vietnam Digital Pathology Market is valued at USD 160 million, based on a five-year historical analysis and alignment with regional Asia–Pacific benchmarks and Vietnam-specific market coverage in syndicated studies. This growth is primarily driven by the increasing adoption of digital technologies in healthcare, the rising prevalence of chronic diseases such as cancer, and the need for efficient diagnostic solutions in tertiary hospitals and oncology centers. The integration of advanced imaging technologies, whole-slide imaging, and artificial intelligence–based image analysis into pathology workflows is further propelling market expansion by enabling high-throughput diagnostics, remote consultation, and quantitative tumor assessment.

- Key cities such as Ho Chi Minh City and Hanoi dominate the Vietnam Digital Pathology Market due to their robust healthcare infrastructure, concentration of central and specialized hospitals, and presence of leading medical universities and research institutes. These urban centers are also witnessing significant investments in healthcare technology and hospital digital transformation, including PACS, LIS, and hospital information systems, making them pivotal in the deployment and scaling of digital pathology solutions.

- The regulatory environment is increasingly supportive of healthcare digitization, with national e-health programs and technical standards creating an enabling framework for digital pathology integration in public facilities. In this context, the Ministry of Health has issued the Circular No. 54/2017/TT-BYT on Telemedicine, 2017, which sets requirements for telemedicine models, data transmission, image quality, information security, and professional responsibility for remote consultation and diagnosis, including the use of digital imaging systems in hospitals. These regulations, together with subsequent guidance on hospital information systems and electronic medical records, are encouraging hospitals to adopt interoperable digital imaging and archiving solutions, into which digital pathology platforms are increasingly being integrated.

Vietnam Digital Pathology Market Segmentation

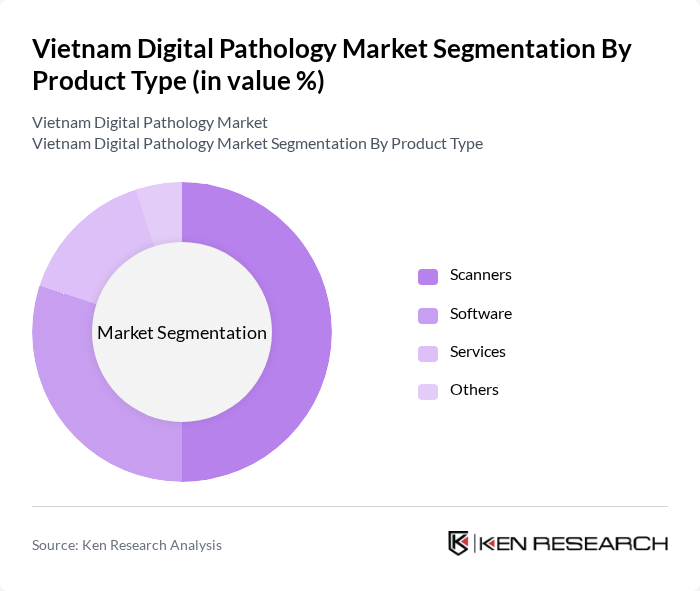

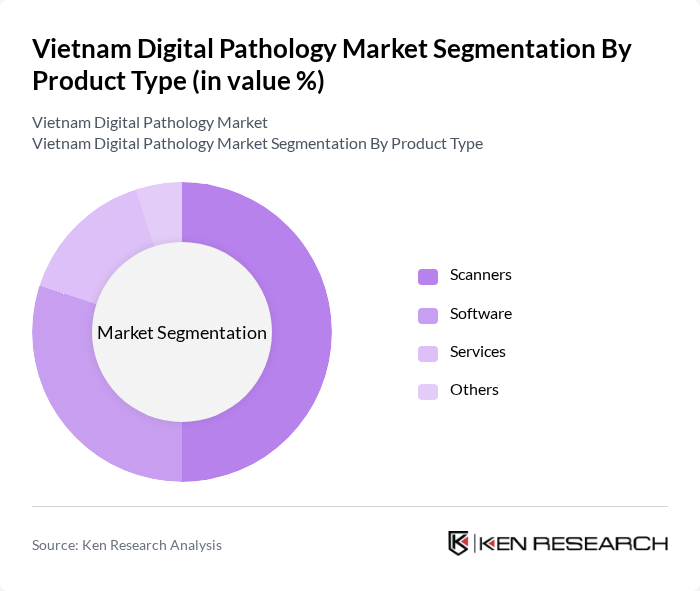

By Product Type:The product type segmentation includes scanners, software, services, and others. Among these, scanners are leading the market due to their essential role in digitizing pathology slides, which enhances diagnostic capabilities, supports telepathology, and improves workflow efficiency in high-volume laboratories. The demand for high-resolution whole-slide imaging, automated high-throughput scanning, and reliable image archiving is driving growth in this subsegment, particularly in oncology-focused centers and university hospitals. Software solutions are also gaining traction as they facilitate image management, LIS and HIS integration, algorithm-based image analysis, and remote consultation, and their role is expanding as artificial intelligence tools are validated for routine clinical use; however, scanners currently hold a more significant share of capital expenditure in new deployments in Vietnam.

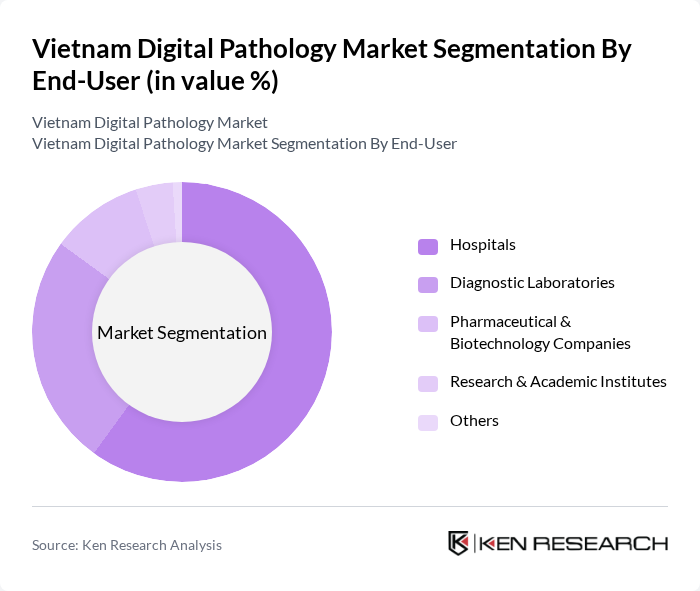

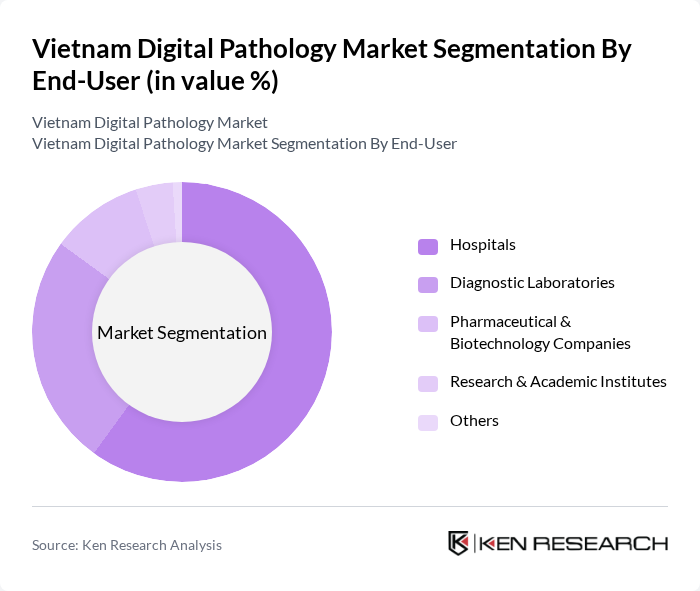

By End-User:The end-user segmentation encompasses hospitals, diagnostic laboratories, pharmaceutical and biotechnology companies, research and academic institutes, and others. Hospitals are the dominant end-user in the market, driven by the increasing need for accurate and timely diagnostics to manage rising cancer and chronic disease caseloads, and by the concentration of pathology departments in large public and private hospitals. The growing number of hospitals adopting digital pathology solutions to support multidisciplinary tumor boards, teleconsultation between provincial and central hospitals, and integration with PACS and electronic medical records is a significant factor contributing to their market leadership. Diagnostic laboratories are also expanding their digital capabilities, especially reference labs and private chains that seek to centralize slide reading and offer remote services, but hospitals currently represent the largest share of installed systems and related spending in Vietnam.

Vietnam Digital Pathology Market Competitive Landscape

The Vietnam Digital Pathology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Leica Biosystems, 3DHISTECH, Hamamatsu Photonics, Aperio Technologies (Leica), Sectra AB, PathAI, Proscia, Visiopharm, Indica Labs, Glencoe Software, QIAGEN, Olympus Corporation, Canon Medical Systems, Roche Diagnostics contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Digital Pathology Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as cancer and diabetes in Vietnam is a significant growth driver for the digital pathology market. According to the World Health Organization, approximately 80% of deaths in Vietnam are attributed to chronic diseases, with cancer cases projected to reach 300,000 in the future. This alarming trend necessitates advanced diagnostic tools, thereby increasing the demand for digital pathology solutions that enhance disease detection and management.

- Advancements in Imaging Technology:The digital pathology market in Vietnam is propelled by rapid advancements in imaging technologies, including high-resolution scanners and AI-driven analysis tools. The Vietnamese government has invested over $15 billion in healthcare technology improvements, which includes digital imaging systems. These innovations not only improve diagnostic accuracy but also streamline workflows, making them essential for modern healthcare facilities aiming to enhance patient outcomes.

- Rising Demand for Remote Diagnostics:The COVID-19 pandemic has accelerated the demand for remote diagnostics in Vietnam, with telehealth consultations increasing by 300% in the future. As healthcare providers seek to minimize in-person visits, digital pathology solutions that facilitate remote analysis and consultations are becoming increasingly vital. This shift is supported by a government initiative to expand telemedicine services, aiming to reach 70% of the population in the future, further driving market growth.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the digital pathology market in Vietnam is the high initial investment required for advanced imaging systems and software. The cost of implementing a digital pathology system can exceed $500,000, which poses a barrier for many healthcare facilities, particularly in rural areas. This financial hurdle limits the widespread adoption of digital pathology solutions, hindering overall market growth.

- Lack of Trained Professionals:The shortage of trained professionals in digital pathology is a significant challenge in Vietnam. Currently, there are only about 1,500 pathologists in the country, with a growing need for specialists skilled in digital technologies. This gap in expertise can lead to underutilization of digital pathology systems, as healthcare providers struggle to find qualified personnel to operate and interpret results from these advanced technologies.

Vietnam Digital Pathology Market Future Outlook

The future of the digital pathology market in Vietnam appears promising, driven by technological advancements and increasing healthcare investments. By the future, the Vietnamese government plans to allocate an additional $500 million towards digital health initiatives, enhancing infrastructure and training programs. As telemedicine continues to expand, the integration of digital pathology into routine diagnostics will likely become standard practice, improving patient care and operational efficiency across healthcare facilities nationwide.

Market Opportunities

- Expansion of Telemedicine Services:The ongoing expansion of telemedicine services presents a significant opportunity for digital pathology in Vietnam. With the government aiming to increase telehealth access to 70% of the population in the future, digital pathology can play a crucial role in remote diagnostics, enabling timely and accurate disease management, particularly in underserved areas.

- Development of AI-Driven Solutions:The development of AI-driven solutions in digital pathology offers substantial market opportunities. As AI technologies advance, they can enhance diagnostic accuracy and efficiency, reducing the workload on pathologists. With Vietnam's healthcare expenditure projected to reach $20 billion in the future, investments in AI-driven digital pathology solutions can significantly improve patient outcomes and operational efficiencies.