Global DIY Home Improvement Market Overview

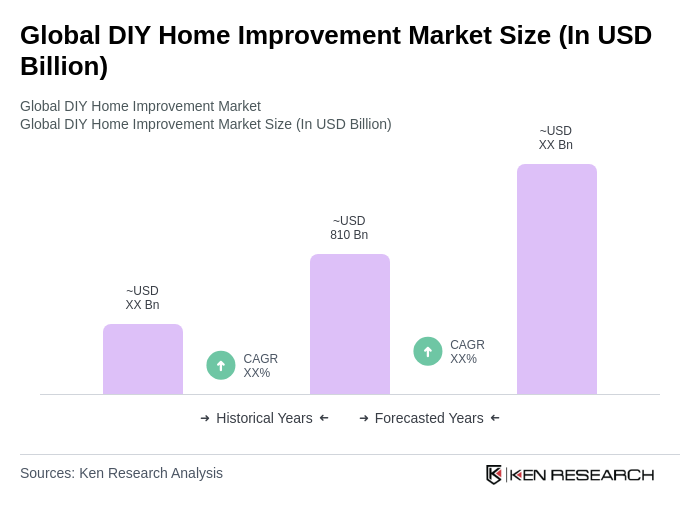

- The Global DIY Home Improvement Market is valued at USD 810 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in home renovation projects, the rise of e-commerce platforms, and a growing trend towards sustainable living. Key growth drivers include the surge in homeownership rates among younger generations, heightened demand for personalized living spaces, and the proliferation of online tutorials and communities that support DIY activities. The market has seen a significant uptick in demand for home improvement products as consumers invest in enhancing their living spaces.

- Key players in this market include the United States, Germany, and the United Kingdom. The dominance of these countries can be attributed to their strong retail infrastructure, high disposable incomes, and a culture that encourages home improvement and DIY projects. Additionally, the presence of major retail chains and a robust online shopping environment further solidify their market leadership. North America accounts for over 35% of the global DIY market share, with the United States leading due to high consumer awareness and widespread product availability.

- In 2023, the U.S. government implemented regulations aimed at promoting energy-efficient home improvements. The Inflation Reduction Act of 2022, issued by the U.S. Congress, introduced tax credits for homeowners who invest in energy-efficient appliances and materials, encouraging sustainable practices in the DIY home improvement sector. This regulation requires compliance with specific energy efficiency standards and provides incentives for upgrades such as insulation, windows, and HVAC systems, aiming to reduce energy consumption and promote environmentally friendly home renovations.

Global DIY Home Improvement Market Segmentation

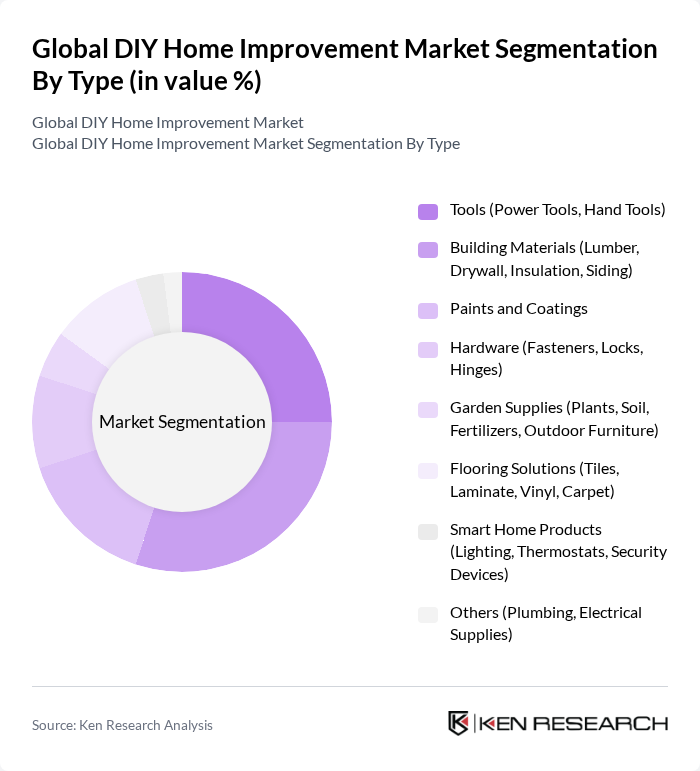

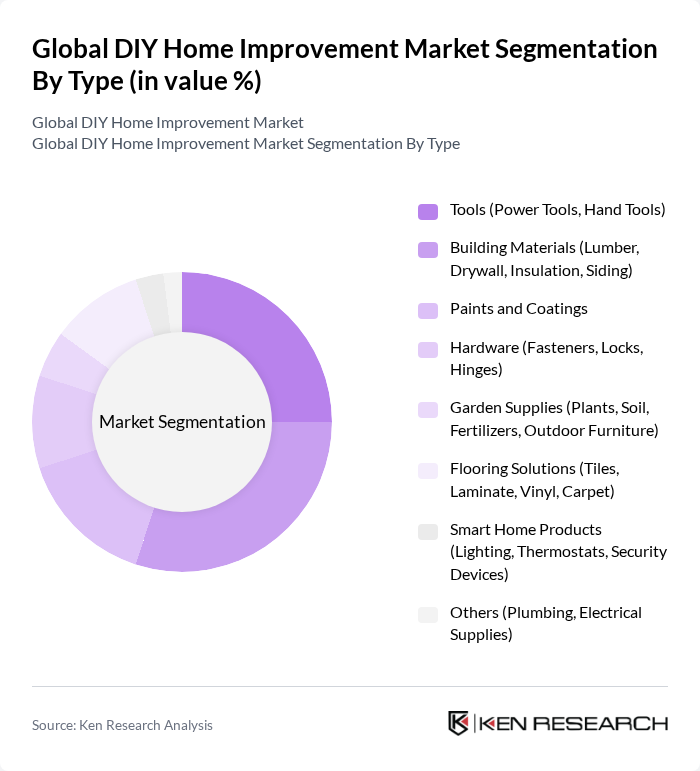

By Type:The market is segmented into various types, including Tools, Building Materials, Paints and Coatings, Hardware, Fixtures and Fittings, Garden Supplies, Flooring Solutions, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, catering to different consumer needs and preferences. Building materials hold the largest share, reflecting their necessity across all project types, while tools and paints/coatings remain essential for both novice and experienced DIY consumers.

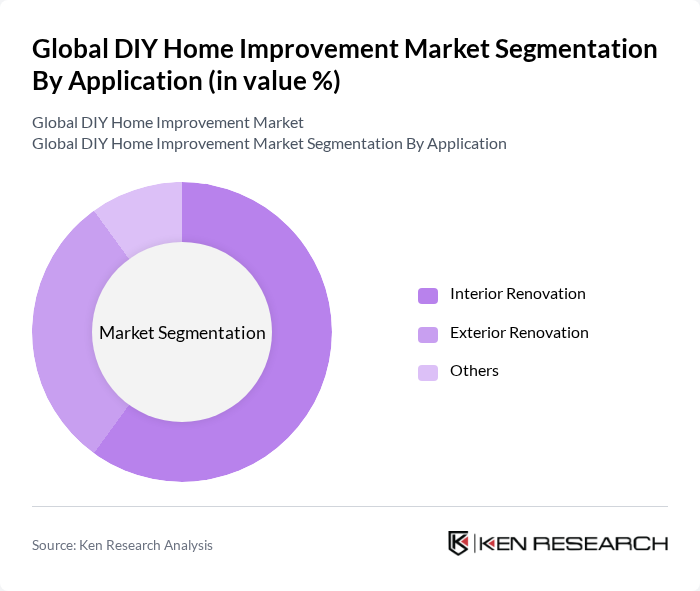

By Application:The applications of DIY home improvement products are categorized into Interior Renovation, Exterior Renovation, and Others. Each application serves distinct consumer needs, with interior renovations often being more popular due to the immediate impact on living spaces. Interior renovation projects, such as painting, furniture assembly, and flooring upgrades, account for the majority of DIY activities, while exterior renovations focus on landscaping, outdoor structures, and facade improvements.

Global DIY Home Improvement Market Competitive Landscape

The Global DIY Home Improvement Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Home Depot, Inc., Lowe's Companies, Inc., Ace Hardware Corporation, Menards, Inc., Kingfisher plc, Travis Perkins plc, B&Q plc, OBI Group Holding SE & Co. KGaA, Sika AG, Saint-Gobain S.A., The Sherwin-Williams Company, RPM International Inc., PPG Industries, Inc., Masco Corporation, Ferguson plc, Groupe Adeo, Wesfarmers Limited (Bunnings Warehouse), HORNBACH Holding AG & Co. KGaA, BAUHAUS AG, Mr. Bricolage Group, Maxeda DIY Group, Intergamma BV, Kesko Corporation, REWE Group, BAUVISTA GmbH & Co. KG, HELLWEG Die Profi-Baumärkte GmbH & Co. KG, hagebau connect GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

Global DIY Home Improvement Market Industry Analysis

Growth Drivers

- Increasing Consumer Interest in Home Renovation:The DIY home improvement sector is experiencing a surge, with 60% of homeowners in None indicating plans to undertake renovation projects in future. This trend is driven by a desire for personalized living spaces and increased home value. According to the National Association of Home Builders, the average expenditure on home renovations is projected to reach USD 16,000 per household, reflecting a robust commitment to home improvement activities.

- Rise in Disposable Income:In None, the average disposable income is expected to rise by 4.5% in future, reaching approximately USD 36,000 per capita. This increase allows consumers to allocate more funds toward home improvement projects. As financial stability grows, homeowners are more willing to invest in DIY projects, leading to a projected increase in spending on home improvement supplies and tools, which is anticipated to exceed USD 11 billion in the region.

- Growth of E-commerce Platforms:The e-commerce sector for DIY home improvement products in None is projected to grow by 25% in future, driven by increased online shopping convenience. With over 70% of consumers preferring to shop online for home improvement supplies, platforms like Amazon and local e-commerce sites are expanding their offerings. This shift not only enhances accessibility but also encourages impulse purchases, significantly boosting overall market sales.

Market Challenges

- Supply Chain Disruptions:The DIY home improvement market in None faces significant supply chain challenges, with delays reported in 40% of shipments in future. Factors such as global shipping issues and local logistics inefficiencies have led to increased lead times for essential materials. This disruption can hinder project timelines and increase costs, ultimately affecting consumer satisfaction and market growth.

- Fluctuating Raw Material Prices:The cost of raw materials, such as lumber and steel, has seen volatility, with prices increasing by 16% in future. This fluctuation poses a challenge for DIY enthusiasts and retailers alike, as unpredictable costs can deter consumers from starting projects. Additionally, manufacturers may face squeezed profit margins, leading to potential price increases that could further impact consumer spending in future.

Global DIY Home Improvement Market Future Outlook

The DIY home improvement market in None is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, eco-friendly products are expected to gain traction, appealing to environmentally conscious consumers. Furthermore, the integration of smart home technologies will enhance DIY projects, making them more efficient and appealing. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Companies can capitalize on the growing middle class in None, where home ownership is increasing. With an estimated 1.6 million new households expected in future, there is a substantial opportunity for DIY retailers to introduce tailored products and services that cater to this expanding demographic, potentially increasing market share significantly.

- Development of Eco-Friendly Products:The demand for sustainable home improvement solutions is rising, with 56% of consumers in None expressing interest in eco-friendly products. By developing and marketing green alternatives, companies can tap into this growing segment, enhancing brand loyalty and attracting environmentally conscious consumers, which could lead to a 21% increase in sales for eco-friendly lines.