Region:Global

Author(s):Shubham

Product Code:KRAD5430

Pages:97

Published On:December 2025

By Type:The DNA polymerases market is segmented into various types, including Taq DNA Polymerase, Pfu DNA Polymerase, High-Fidelity DNA Polymerases, Hot-Start DNA Polymerases, Reverse Transcriptase / RT-PCR Polymerases, Next-Generation Sequencing (NGS) Polymerases, Proprietary Enzyme Blends & Master Mix Polymerases, and Others. Among these, Taq DNA Polymerase is the most widely used due to its efficiency and reliability in PCR applications, making it a preferred choice for many laboratories and research institutions.

By End-User:The end-user segmentation includes Academic & Research Institutes, Pharmaceutical Companies, Biotechnology Companies, Clinical & Diagnostic Laboratories, Contract Research Organizations (CROs), Forensic Laboratories, Agricultural & Environmental Genomics Centers, and Others. Academic & Research Institutes dominate this segment due to their extensive use of DNA polymerases in various research applications, including genetic studies and molecular biology experiments.

The Global DNA Polymerases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., New England Biolabs Inc., F. Hoffmann-La Roche Ltd (Roche Diagnostics), QIAGEN N.V., Agilent Technologies Inc., Promega Corporation, Takara Bio Inc., Bio-Rad Laboratories Inc., Merck KGaA (including MilliporeSigma), Illumina Inc., GenScript Biotech Corporation, Jena Bioscience GmbH, Bioneer Corporation, Lucigen Corporation (a part of LGC Biosearch Technologies), Bioline (a Meridian Bioscience brand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DNA polymerases market in future appears promising, driven by technological advancements and increasing investments in biotechnology. The integration of artificial intelligence in genetic research is expected to enhance the efficiency of DNA polymerases, leading to improved outcomes in genetic testing and personalized medicine. Additionally, as awareness of genetic disorders continues to rise, the demand for high-fidelity enzymes will likely increase, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Taq DNA Polymerase Pfu DNA Polymerase High-Fidelity DNA Polymerases Hot-Start DNA Polymerases Reverse Transcriptase / RT-PCR Polymerases Next-Generation Sequencing (NGS) Polymerases Proprietary Enzyme Blends & Master Mix Polymerases Others |

| By End-User | Academic & Research Institutes Pharmaceutical Companies Biotechnology Companies Clinical & Diagnostic Laboratories Contract Research Organizations (CROs) Forensic Laboratories Agricultural & Environmental Genomics Centers Others |

| By Application | PCR & qPCR Amplification DNA Sequencing (Sanger & NGS) Molecular Cloning & Mutagenesis Gene Expression Analysis & RT-PCR Genotyping & SNP Analysis Molecular Diagnostics Others |

| By Source | Prokaryotic Polymerases Eukaryotic Polymerases Recombinant / Engineered Polymerases Others |

| By Formulation / Format | Standalone Enzymes (Concentrates) Master Mixes (Ready-to-Use Kits) Lyophilized / Stable Formulations Others |

| By Distribution Channel | Direct Sales (In-house Sales Force) Distributors & Channel Partners Online Company Webstores Third-Party E-commerce Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Academic Research Institutions | 100 | Research Scientists, Lab Managers |

| Biotechnology Firms | 80 | Product Development Managers, R&D Directors |

| Clinical Laboratories | 70 | Laboratory Technicians, Quality Control Managers |

| Pharmaceutical Companies | 90 | Regulatory Affairs Specialists, Product Managers |

| Diagnostic Companies | 60 | Business Development Managers, Technical Support Staff |

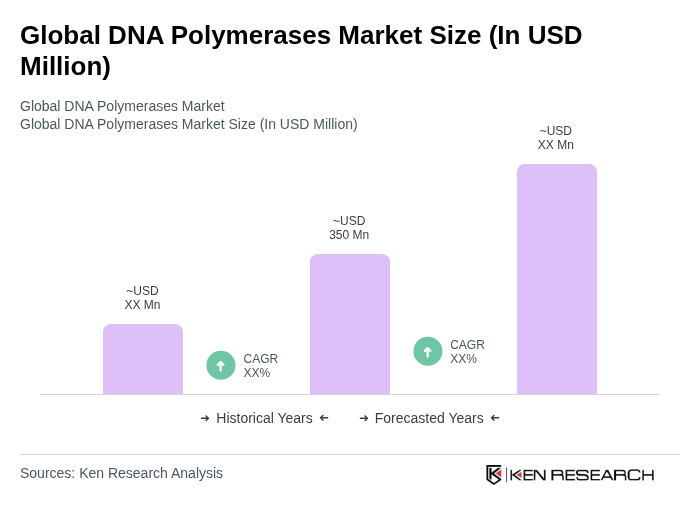

The Global DNA Polymerases Market is valued at approximately USD 350 million, driven by increasing demand for genetic testing, advancements in molecular biology techniques, and the rising prevalence of genetic disorders.