Region:Global

Author(s):Dev

Product Code:KRAA3069

Pages:87

Published On:August 2025

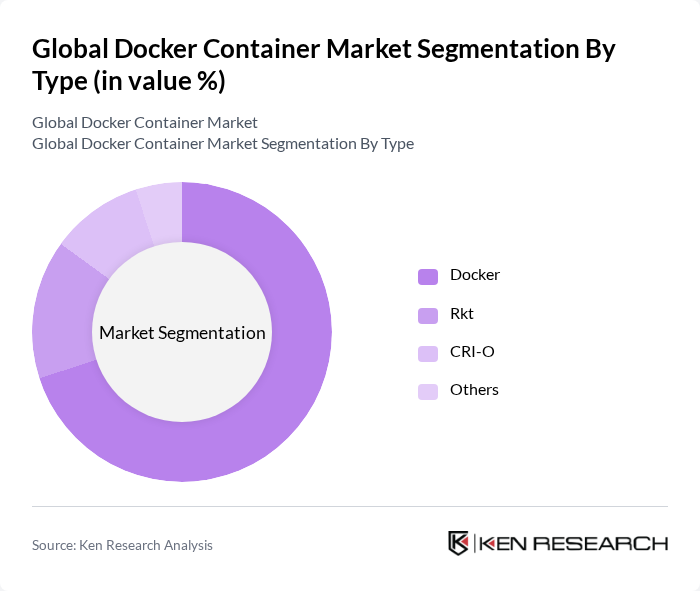

By Type:The Docker Container Market is segmented into four main types: Docker, Rkt, CRI-O, and Others. Among these, Docker remains the most widely used container technology due to its user-friendly interface, extensive ecosystem, and broad community support. Rkt and CRI-O are increasingly adopted in enterprise environments that prioritize security, compliance, and Kubernetes integration. The "Others" category includes emerging container runtimes and specialized solutions addressing niche requirements, such as lightweight edge deployments and advanced security features.

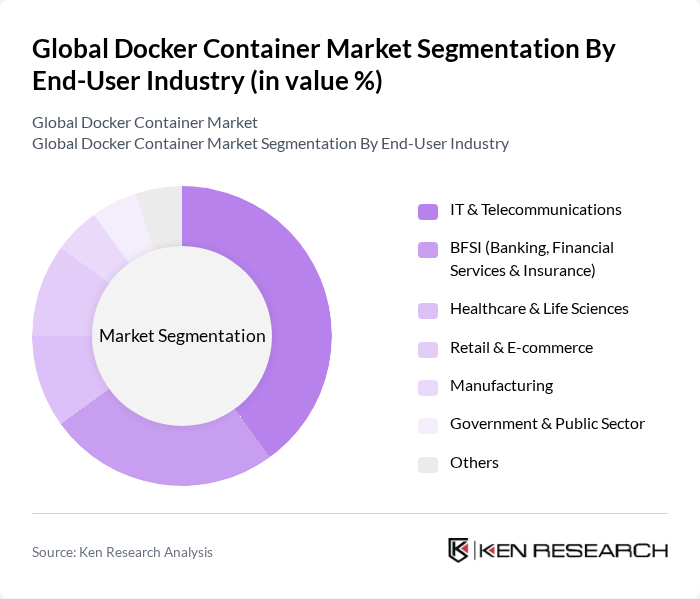

By End-User Industry:The Docker Container Market is utilized across various industries, including IT & Telecommunications, BFSI, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Government & Public Sector, and Others. The IT & Telecommunications sector leads the market, driven by high demand for agile development, rapid deployment, and multi-cloud strategies. BFSI follows closely, propelled by the need for secure, scalable, and compliant transaction processing. Healthcare & Life Sciences are expanding adoption for secure data management and regulatory compliance, while Retail & E-commerce leverage containers for scalable digital services and omnichannel experiences. Manufacturing and Government sectors increasingly utilize containers for automation, edge computing, and modernization of legacy systems.

The Global Docker Container Market is characterized by a dynamic mix of regional and international players. Leading participants such as Docker, Inc., Red Hat, Inc., VMware, Inc., IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Inc., Oracle Corporation, SUSE LLC, Rancher Labs, Inc. (a SUSE company), Mirantis, Inc., Pivotal Software, Inc. (now part of VMware), Sysdig, Inc., Portainer.io, JFrog Ltd., Google Kubernetes Engine (GKE), Amazon Elastic Kubernetes Service (EKS), Azure Kubernetes Service (AKS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Docker container market appears promising, driven by the increasing integration of artificial intelligence and machine learning into container orchestration tools. As organizations seek to enhance operational efficiency, the demand for automated solutions will likely rise. Additionally, the growing emphasis on sustainability in IT practices will push companies to adopt containerization as a means to optimize resource usage and reduce carbon footprints, aligning with global environmental goals and regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Docker Rkt CRI-O Others |

| By End-User Industry | IT & Telecommunications BFSI (Banking, Financial Services & Insurance) Healthcare & Life Sciences Retail & E-commerce Manufacturing Government & Public Sector Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Cloud |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Application | Application Development Testing & Deployment Continuous Integration/Continuous Deployment (CI/CD) Monitoring Data Management Security Others |

| By Component | Platform / Engine Orchestration & Management Monitoring & Logging Security Solutions Services |

| By Enterprise Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Docker Adoption | 120 | IT Managers, DevOps Engineers |

| Cloud Service Providers | 60 | Cloud Architects, Product Managers |

| Container Security Solutions | 50 | Security Analysts, Compliance Officers |

| Microservices Implementation | 40 | Software Developers, System Integrators |

| Container Orchestration Tools | 45 | Operations Managers, Technical Leads |

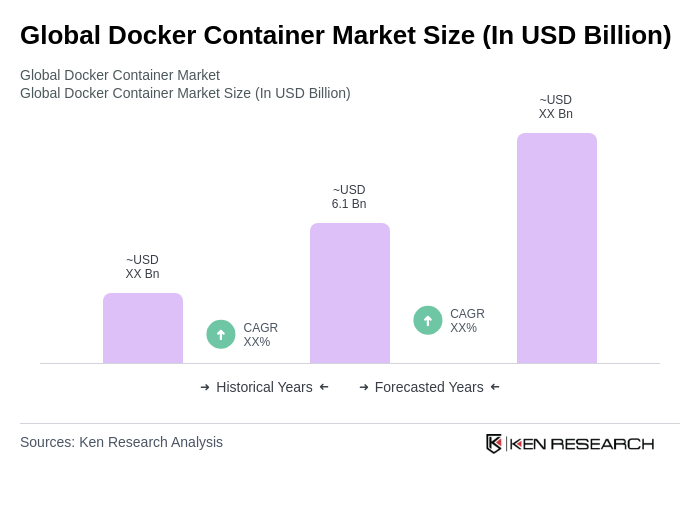

The Global Docker Container Market is valued at approximately USD 6.1 billion, reflecting significant growth driven by the adoption of cloud computing, container-first architectures, and microservices practices among organizations seeking enhanced scalability and reduced operational costs.