Region:Global

Author(s):Shubham

Product Code:KRAA2666

Pages:87

Published On:August 2025

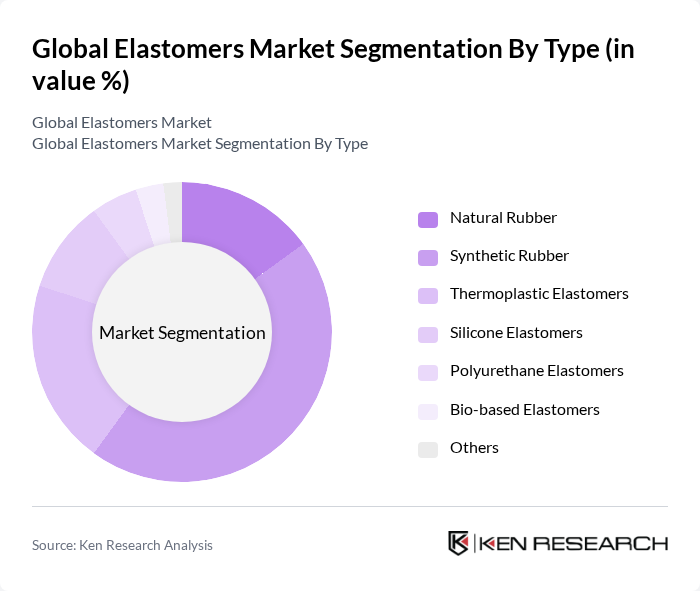

By Type:The elastomers market is segmented into Natural Rubber, Synthetic Rubber, Thermoplastic Elastomers, Silicone Elastomers, Polyurethane Elastomers, Bio-based Elastomers, and Others. Among these,Synthetic Rubberis the leading subsegment, favored for its durability, flexibility, and resistance to extreme temperatures. Major end-use sectors such as automotive and construction drive demand for synthetic rubber, while natural rubber remains significant but is increasingly supplemented by synthetic alternatives offering enhanced performance. The market is also witnessing growing interest in bio-based elastomers as sustainability becomes a priority .

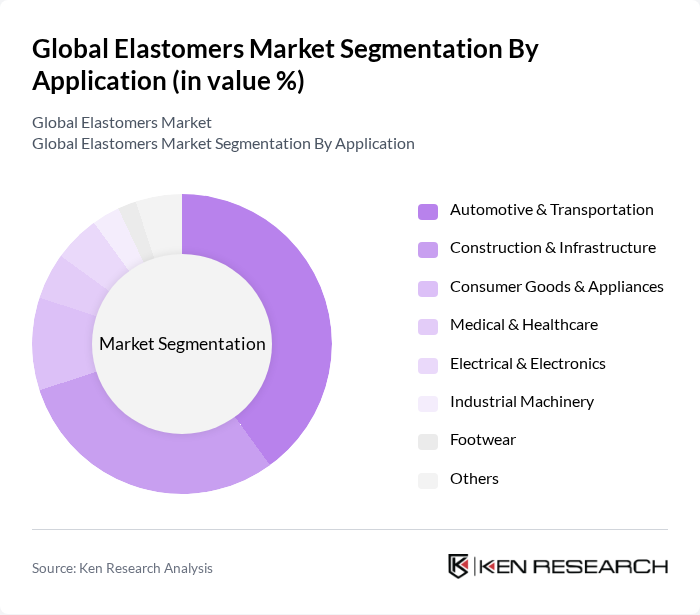

By Application:The elastomers market is also segmented by application, including Automotive & Transportation, Construction & Infrastructure, Consumer Goods & Appliances, Medical & Healthcare, Electrical & Electronics, Industrial Machinery, Footwear, and Others. TheAutomotive & Transportationsegment is the largest, propelled by rising vehicle production and the need for high-performance, lightweight materials that enhance fuel efficiency and durability. Construction & Infrastructure follows, with elastomers used extensively for sealants, adhesives, and waterproofing. The medical and healthcare sector is expanding its use of elastomers, particularly in medical devices and equipment, driven by advances in biocompatible and specialty elastomers .

The Global Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Dow Chemical Company, BASF SE, DuPont de Nemours, Inc., ExxonMobil Chemical Company, Lanxess AG, Covestro AG, Huntsman Corporation, Kraton Corporation, LG Chem Ltd., Mitsui Chemicals, Inc., Solvay S.A., Trelleborg AB, SABIC, Wacker Chemie AG, Asahi Kasei Corporation, Kumho Petrochemical Co., Ltd., Sinopec (China Petroleum & Chemical Corporation), Arlanxeo, ZEON Corporation, and JSR Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the elastomers market is poised for transformation, driven by technological advancements and evolving consumer preferences. The integration of smart technologies into elastomer applications is expected to enhance product functionality, while the shift towards sustainable materials will likely reshape manufacturing processes. Additionally, the increasing focus on health and safety in various industries will drive innovation in elastomer formulations, ensuring compliance with emerging regulations and meeting consumer demands for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Rubber Synthetic Rubber Thermoplastic Elastomers Silicone Elastomers Polyurethane Elastomers Bio-based Elastomers Others |

| By Application | Automotive & Transportation Construction & Infrastructure Consumer Goods & Appliances Medical & Healthcare Electrical & Electronics Industrial Machinery Footwear Others |

| By End-User | Automotive Manufacturers Construction Firms Electronics Companies Healthcare Providers Footwear Manufacturers Industrial Equipment Manufacturers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Sheets Films Molds Pellets & Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Elastomer Applications | 100 | Product Engineers, Procurement Managers |

| Construction Material Usage | 60 | Project Managers, Material Suppliers |

| Consumer Goods Manufacturing | 50 | Operations Managers, Product Development Leads |

| Medical Device Applications | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Specialty Elastomer Innovations | 40 | R&D Directors, Innovation Managers |

The Global Elastomers Market is valued at approximately USD 98 billion, reflecting strong demand across various sectors such as automotive, construction, and healthcare, driven by the unique properties of elastomers and advancements in manufacturing technologies.