Region:Global

Author(s):Dev

Product Code:KRAA2597

Pages:89

Published On:August 2025

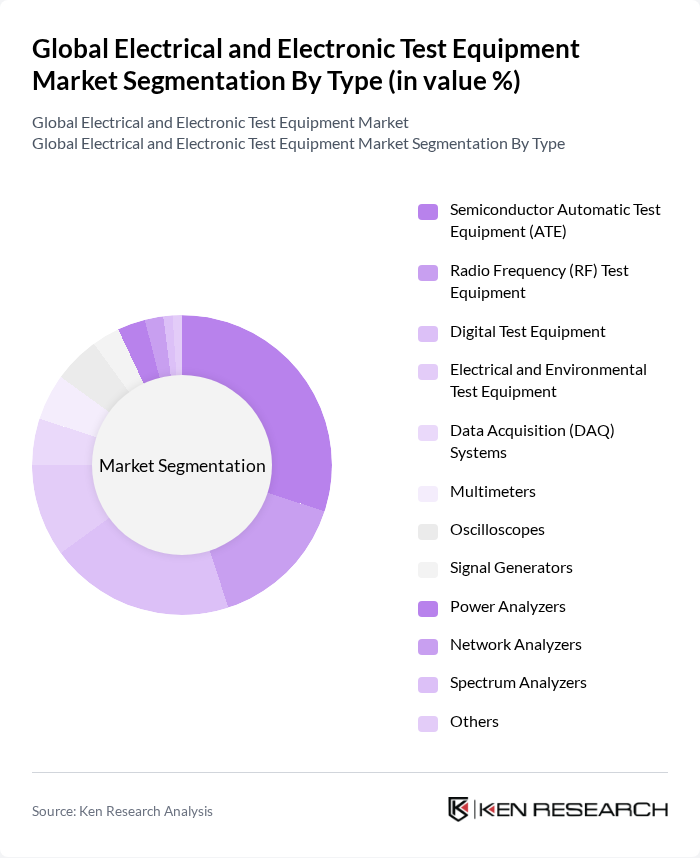

By Type:The market is segmented into various types of electrical and electronic test equipment, including Semiconductor Automatic Test Equipment (ATE), Radio Frequency (RF) Test Equipment, Digital Test Equipment, Electrical and Environmental Test Equipment, Data Acquisition (DAQ) Systems, Multimeters, Oscilloscopes, Signal Generators, Power Analyzers, Network Analyzers, Spectrum Analyzers, and Others. Among these,Semiconductor ATEis a leading segment due to the growing semiconductor industry and the increasing complexity of electronic devices, which require precise and automated testing solutions. The rise of wide bandgap semiconductors and the adoption of advanced manufacturing processes have further accelerated demand for high-performance ATE systems.

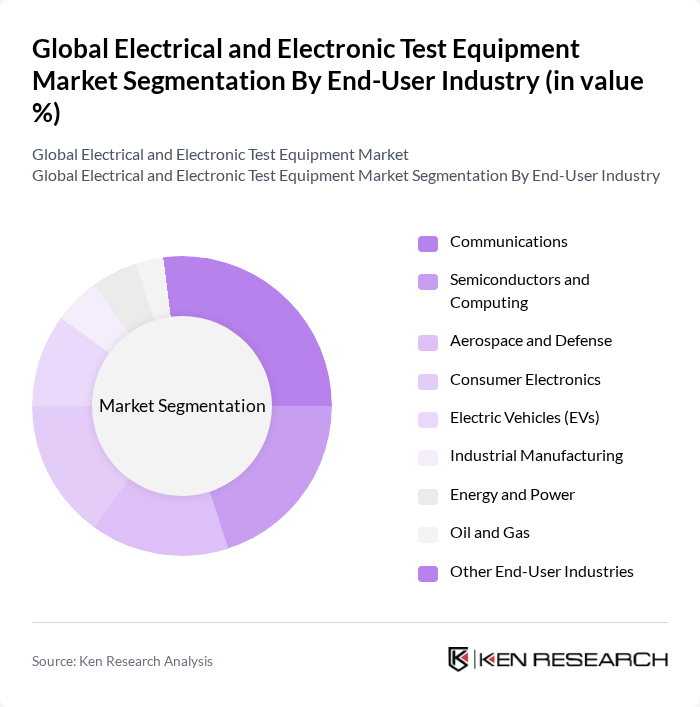

By End-User Industry:The market is segmented by end-user industries, including Communications, Semiconductors and Computing, Aerospace and Defense, Consumer Electronics, Electric Vehicles (EVs), Industrial Manufacturing, Energy and Power, Oil and Gas, and Other End-User Industries. TheCommunicationssector is a dominant segment, driven by the rapid expansion of telecommunications infrastructure, deployment of 5G networks, and the increasing demand for high-speed data transmission. The semiconductor and computing segment is also significant, supported by ongoing innovation in chip design and manufacturing. Aerospace and defense, consumer electronics, and electric vehicles continue to be major contributors due to stringent testing requirements and the proliferation of advanced electronic systems.

The Global Electrical and Electronic Test Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Keysight Technologies, Tektronix, Inc., Fluke Corporation, National Instruments Corporation, Anritsu Corporation, Rohde & Schwarz GmbH & Co. KG, Yokogawa Electric Corporation, B&K Precision Corporation, Chroma ATE Inc., Testo SE & Co. KGaA, AMETEK, Inc., Hioki E.E. Corporation, Gossen Metrawatt GmbH, Extech Instruments (a FLIR company), Kikusui Electronics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrical and electronic test equipment market appears promising, driven by ongoing technological innovations and increasing regulatory requirements. As industries prioritize quality assurance and compliance, the demand for advanced testing solutions is expected to rise. Furthermore, the integration of AI and automation in testing processes will enhance efficiency and accuracy, positioning companies to better meet market demands. The focus on sustainability will also shape product development, encouraging manufacturers to adopt eco-friendly testing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Semiconductor Automatic Test Equipment (ATE) Radio Frequency (RF) Test Equipment Digital Test Equipment Electrical and Environmental Test Equipment Data Acquisition (DAQ) Systems Multimeters Oscilloscopes Signal Generators Power Analyzers Network Analyzers Spectrum Analyzers Others |

| By End-User Industry | Communications Semiconductors and Computing Aerospace and Defense Consumer Electronics Electric Vehicles (EVs) Industrial Manufacturing Energy and Power Oil and Gas Other End-User Industries |

| By Application | Research and Development Quality Control Maintenance and Repair Production Testing Field Testing |

| By Distribution Channel | Direct Sales Online Retail Distributors Resellers |

| By Region | North America Europe Asia Australia and New Zealand Latin America Middle East and Africa |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Analog Testing Equipment Digital Testing Equipment Hybrid Testing Equipment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Test Equipment | 50 | Network Engineers, Product Development Managers |

| Automotive Testing Solutions | 40 | Quality Assurance Engineers, R&D Managers |

| Consumer Electronics Testing | 45 | Manufacturing Engineers, Compliance Officers |

| Industrial Test Equipment | 40 | Operations Managers, Technical Directors |

| Medical Device Testing Equipment | 40 | Regulatory Affairs Specialists, Product Managers |

The Global Electrical and Electronic Test Equipment Market is valued at approximately USD 28.7 billion, driven by the increasing demand for advanced testing solutions across various industries, including telecommunications, automotive, and consumer electronics.