Region:Global

Author(s):Geetanshi

Product Code:KRAA2818

Pages:85

Published On:August 2025

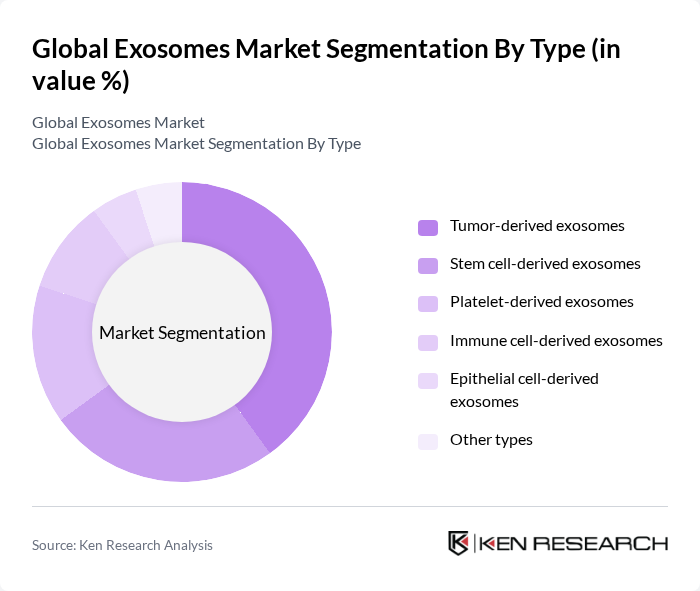

By Type:The market is segmented into various types of exosomes, including tumor-derived, stem cell-derived, platelet-derived, immune cell-derived, epithelial cell-derived, and other types. Each type serves distinct purposes in diagnostics and therapeutics, with tumor-derived exosomes currently leading the market due to their significant role in cancer research and treatment. Stem cell-derived exosomes are increasingly utilized in regenerative medicine and tissue repair, while platelet- and immune cell-derived exosomes are gaining traction in immunotherapy and inflammation studies .

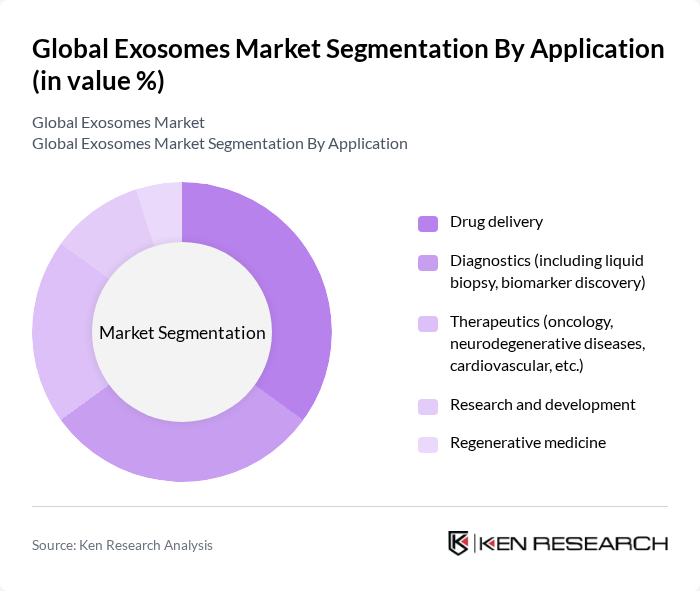

By Application:The applications of exosomes include drug delivery, diagnostics (including liquid biopsy and biomarker discovery), therapeutics (oncology, neurodegenerative diseases, cardiovascular, etc.), research and development, and regenerative medicine. Drug delivery is the leading application, driven by the need for targeted therapies and the growing interest in using exosomes as natural carriers for drug delivery. Diagnostics, particularly liquid biopsy for cancer detection, is rapidly expanding, while regenerative medicine and R&D are benefiting from innovations in exosome isolation and characterization .

The Global Exosomes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Exosome Diagnostics, Inc., Codiak BioSciences, Inc., Aethlon Medical, Inc., PureTech Health PLC, Evox Therapeutics Ltd., Capricor Therapeutics, Inc., Medigene AG, System Biosciences, LLC, Exosome Plus, Inc., NanoSomix, Inc., Tessa Therapeutics Pte Ltd., Lonza Group AG, Miltenyi Biotec GmbH, Thermo Fisher Scientific, Inc., Bio-Techne Corporation, QIAGEN N.V., Danaher Corporation, Fujifilm Holdings Corporation, Abcam plc, RoosterBio, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the exosomes market appears promising, driven by ongoing research and technological advancements. The integration of artificial intelligence in exosome research is expected to streamline discovery processes, enhancing the efficiency of therapeutic development. Additionally, the growing focus on regenerative medicine is likely to open new avenues for exosome applications, particularly in tissue repair and healing. As awareness and understanding of exosome potential increase, the market is poised for significant growth, attracting investments and fostering innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Tumor-derived exosomes Stem cell-derived exosomes Platelet-derived exosomes Immune cell-derived exosomes Epithelial cell-derived exosomes Other types |

| By Application | Drug delivery Diagnostics (including liquid biopsy, biomarker discovery) Therapeutics (oncology, neurodegenerative diseases, cardiovascular, etc.) Research and development Regenerative medicine |

| By End-User | Hospitals Research laboratories Pharmaceutical & biotechnology companies Academic institutions Diagnostic centers |

| By Source | Human sources Animal sources Synthetic sources |

| By Delivery Method | Intravenous Local administration Oral delivery |

| By Storage Method | Cryopreservation Lyophilization (freeze-drying) Refrigeration |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Nordics, etc.) Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, etc.) Latin America (Brazil, Argentina, etc.) Middle East & Africa (South Africa, Saudi Arabia, UAE, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotechnology Firms Developing Exosome Therapies | 60 | R&D Directors, Product Managers |

| Clinical Research Organizations (CROs) Involved in Exosome Studies | 50 | Clinical Trial Managers, Regulatory Affairs Specialists |

| Academic Institutions Conducting Exosome Research | 40 | Principal Investigators, Research Scientists |

| Pharmaceutical Companies Utilizing Exosome Technologies | 55 | Business Development Managers, Licensing Executives |

| Healthcare Providers Implementing Exosome-Based Diagnostics | 45 | Laboratory Directors, Pathologists |

The Global Exosomes Market is valued at approximately USD 265 million, driven by advancements in biotechnology, increased research in drug delivery systems, and the rising prevalence of chronic diseases. This market is expected to grow significantly in the coming years.