Region:Global

Author(s):Shubham

Product Code:KRAA3183

Pages:81

Published On:August 2025

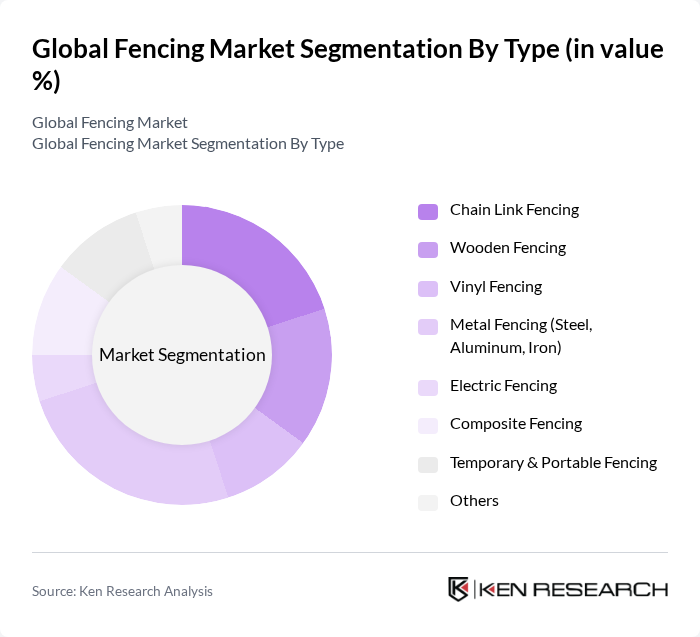

By Type:The fencing market can be segmented into various types, including Chain Link Fencing, Wooden Fencing, Vinyl Fencing, Metal Fencing (Steel, Aluminum, Iron), Electric Fencing, Composite Fencing, Temporary & Portable Fencing, and Others. Each type serves different consumer needs and preferences, influencing market dynamics. Metal fencing, particularly steel and aluminum, leads market share due to its durability, low maintenance, and suitability for both security and decorative purposes. Vinyl and composite fencing are gaining traction for their weather resistance and aesthetic appeal, while chain link and temporary fencing remain popular for cost-effective and flexible applications .

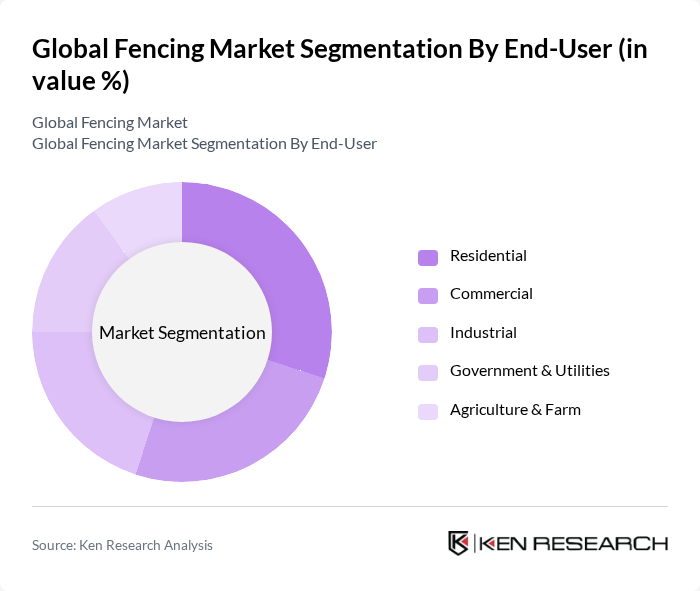

By End-User:The market can also be segmented based on end-users, which include Residential, Commercial, Industrial, Government & Utilities, and Agriculture & Farm. Each segment has unique requirements and preferences that drive the demand for specific fencing solutions. Residential applications lead the market, driven by new home construction and renovation activities, while commercial and industrial segments demand high-security and durable fencing systems. The agriculture and farm segment continues to require specialized fencing for livestock and crop protection .

The Global Fencing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ameristar Fence Products, Inc., Master Halco, Inc., Betafence NV, Barrette Outdoor Living, Inc., Fortress Building Products, Bekaert NV, Jacksons Fencing Ltd., Long Fence Company, Inc., Allied Tube & Conduit (Atkore International), SimTek Fence (now part of CertainTeed), Trex Company, Inc., CertainTeed Corporation, Ply Gem Holdings, Inc., Ametco Manufacturing Corporation, Tarter Farm and Ranch Equipment contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fencing market in None appears promising, driven by technological advancements and increasing urbanization. As cities expand, the demand for effective security solutions will likely rise, leading to innovations in fencing materials and designs. Furthermore, the integration of smart technology into fencing systems is expected to enhance security features, making them more appealing to consumers. This trend, combined with a focus on sustainability, will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Link Fencing Wooden Fencing Vinyl Fencing Metal Fencing (Steel, Aluminum, Iron) Electric Fencing Composite Fencing Temporary & Portable Fencing Others |

| By End-User | Residential Commercial Industrial Government & Utilities Agriculture & Farm |

| By Application | Security Fencing Decorative Fencing Agricultural & Farm Fencing Pool & Safety Fencing Highway & Infrastructure Fencing |

| By Material | Steel Aluminum Wood Vinyl Composite Concrete |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fencing Equipment Retailers | 100 | Store Managers, Sales Representatives |

| Fencing Coaches and Trainers | 60 | Head Coaches, Assistant Coaches |

| Competitive Fencers | 70 | Professional Athletes, Amateur Competitors |

| Fencing Club Administrators | 50 | Club Owners, Program Directors |

| Sports Equipment Manufacturers | 80 | Product Development Managers, Marketing Executives |

The Global Fencing Market is valued at approximately USD 34.7 billion, driven by factors such as urbanization, security concerns, and the growth of the construction industry. This valuation reflects a comprehensive analysis over the past five years.