Region:Global

Author(s):Shubham

Product Code:KRAA1788

Pages:93

Published On:August 2025

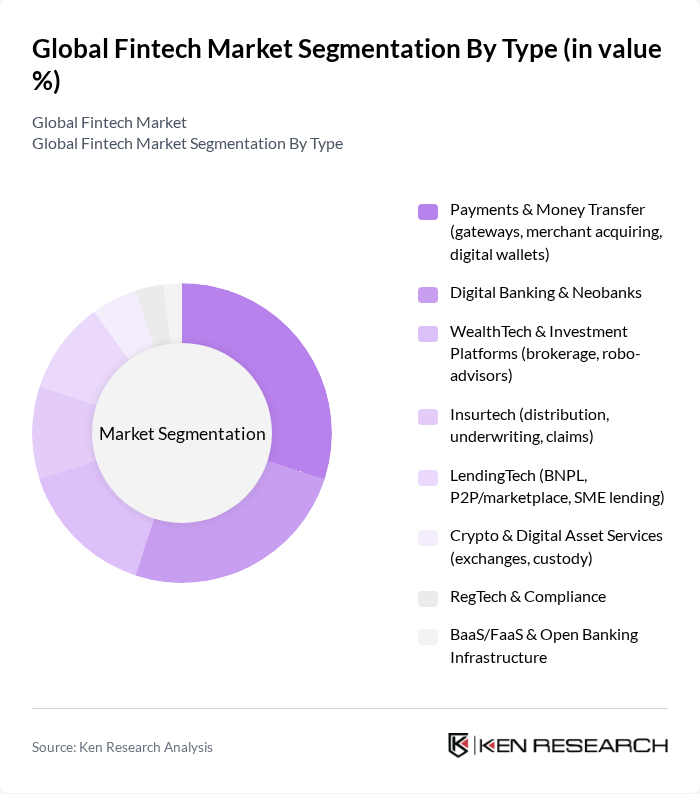

By Type:The fintech market can be segmented into various types, including Payments & Money Transfer, Digital Banking & Neobanks, WealthTech & Investment Platforms, Insurtech, LendingTech, Crypto & Digital Asset Services, RegTech & Compliance, and BaaS/FaaS & Open Banking Infrastructure. Each of these segments plays a crucial role in shaping the overall market dynamics.

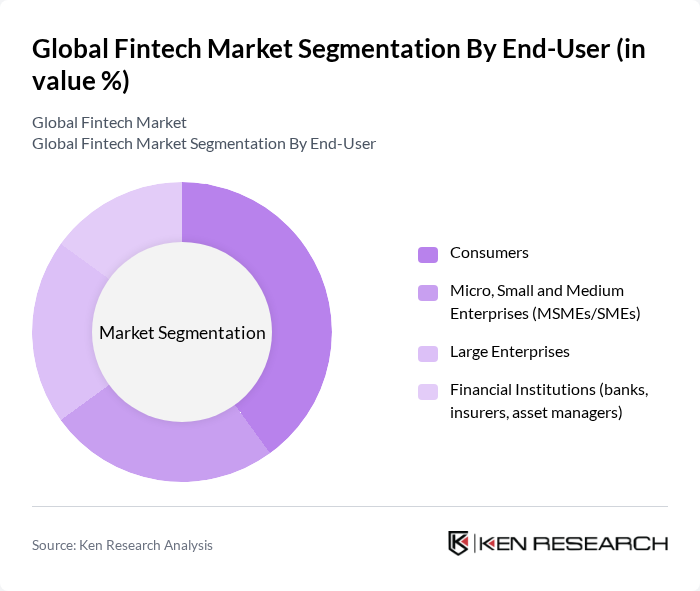

By End-User:The end-user segmentation of the fintech market includes Consumers, Micro, Small and Medium Enterprises (MSMEs/SMEs), Large Enterprises, and Financial Institutions (banks, insurers, asset managers). Each segment has unique needs and preferences that drive the demand for fintech solutions, with consumers and SMEs driving adoption of digital wallets, instant payments, and alternative lending, and financial institutions accelerating partnerships via APIs and open banking.

The Global Fintech Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (Square), Stripe, Inc., Adyen N.V., Robinhood Markets, Inc., Revolut Ltd, Wise plc (formerly TransferWise), SoFi Technologies, Inc., Plaid Inc., Chime Financial, Inc., Affirm Holdings, Inc., Credit Karma, LLC (a Intuit company), N26 GmbH, Zelle (Early Warning Services, LLC), Coinbase Global, Inc., Ant Group Co., Ltd., Paytm (One97 Communications Ltd.), Nubank (Nu Holdings Ltd.), Klarna Bank AB, M-Pesa (Safaricom Plc / Vodacom Group Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The fintech landscape is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment solutions become ubiquitous, the integration of AI and machine learning will enhance personalization and efficiency in financial services. Additionally, the focus on sustainable finance is expected to shape product offerings, aligning with global sustainability goals. The collaboration between fintech firms and traditional banks will likely foster innovation, creating a more inclusive financial ecosystem that addresses diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Payments & Money Transfer (gateways, merchant acquiring, digital wallets) Digital Banking & Neobanks WealthTech & Investment Platforms (brokerage, robo-advisors) Insurtech (distribution, underwriting, claims) LendingTech (BNPL, P2P/marketplace, SME lending) Crypto & Digital Asset Services (exchanges, custody) RegTech & Compliance BaaS/FaaS & Open Banking Infrastructure |

| By End-User | Consumers Micro, Small and Medium Enterprises (MSMEs/SMEs) Large Enterprises Financial Institutions (banks, insurers, asset managers) |

| By Application | Digital Payments & Wallets Digital Banking Wealth Management & Brokerage Insurance (policy distribution, claims, analytics) Risk, Compliance & Identity (KYC/AML, fraud) |

| By Distribution Channel | Online Platforms Mobile Applications Embedded Finance/Partner Channels (OEMs, marketplaces) Direct Sales |

| By Business Model | B2B (Business to Business) B2C (Business to Consumer) B2B2C (Embedded/Platform) C2C (Consumer to Consumer) |

| By Service Type | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) On-Premises/Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Payments Solutions | 150 | Product Managers, Business Development Executives |

| Digital Lending Platforms | 100 | Credit Analysts, Risk Management Officers |

| Insurtech Innovations | 80 | Insurance Underwriters, Claims Managers |

| Blockchain Applications in Finance | 70 | Blockchain Developers, Financial Analysts |

| Regtech Solutions | 60 | Compliance Officers, Regulatory Affairs Specialists |

The Global Fintech Market is valued at approximately USD 220 billion, driven by the increasing adoption of digital payment solutions, neobanks, and the demand for financial inclusion across various demographics.