Region:Middle East

Author(s):Rebecca

Product Code:KRAC0213

Pages:87

Published On:August 2025

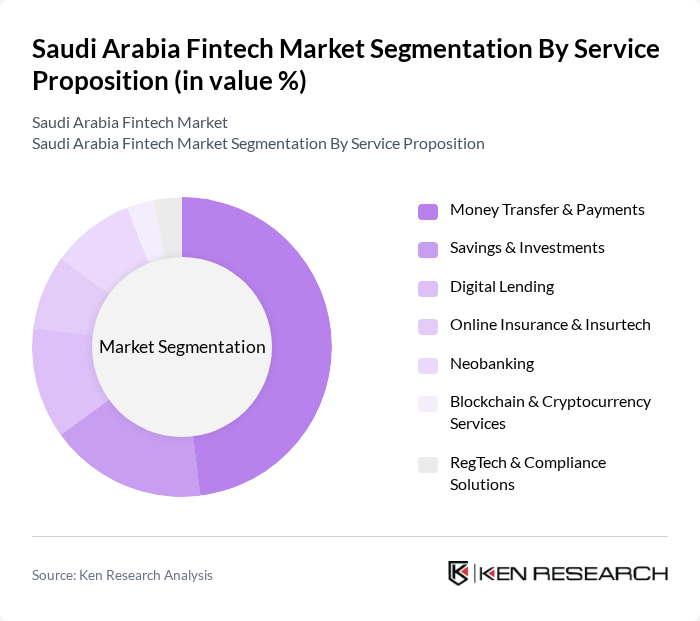

By Service Proposition:This segmentation includes various service offerings that cater to the diverse needs of consumers and businesses in the fintech landscape. The subsegments include Money Transfer & Payments, Savings & Investments, Digital Lending, Online Insurance & Insurtech, Neobanking, Blockchain & Cryptocurrency Services, and RegTech & Compliance Solutions. Each of these subsegments plays a crucial role in shaping the overall market dynamics.

Money Transfer & Payments is the leading segment, reflecting the dominance of digital payments and wallets in Saudi Arabia’s fintech landscape, followed by notable growth in Savings & Investments and Digital Lending .

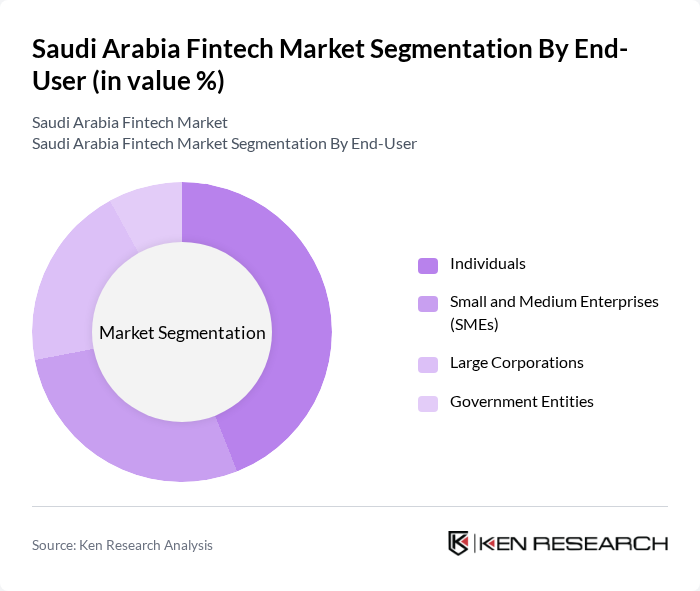

By End-User:This segmentation focuses on the different categories of users who utilize fintech services. The subsegments include Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each end-user segment has unique requirements and preferences, influencing the types of fintech solutions that are developed and offered in the market.

Individuals represent the largest end-user segment, driven by the widespread adoption of digital wallets and mobile banking, while SMEs are increasingly leveraging fintech for payment and financing solutions .

The Saudi Arabia Fintech Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Tamara, Tabby, PayTabs, Raqamyah, Lean Technologies, Rasanah Technologies LLC, SURE, Foodics, Sulfah, Alinma Bank, Riyad Bank, SABB (Saudi British Bank), Al Rajhi Bank, Arab National Bank, Banque Saudi Fransi, and National Commercial Bank (NCB) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi fintech market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning into financial services is expected to enhance customer experiences and operational efficiencies. Additionally, the rise of neobanks and digital wallets will likely reshape traditional banking paradigms, offering more personalized and accessible financial solutions. As the regulatory environment matures, it will further facilitate innovation and attract investment, positioning Saudi Arabia as a regional fintech hub.

| Segment | Sub-Segments |

|---|---|

| By Service Proposition | Money Transfer & Payments (Digital wallets, mobile payments, cross-border payments) Savings & Investments (Automated savings, robo-advisory, Shariah-compliant investments) Digital Lending (Consumer lending, SME lending, lending marketplaces) Online Insurance & Insurtech (Digital insurance platforms, policy comparison, personalized coverage) Neobanking (Digital-only banks, challenger banks) Blockchain & Cryptocurrency Services RegTech & Compliance Solutions |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Finance Management Business Financing E-commerce Transactions Cross-border Payments |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Investment Source | Venture Capital Private Equity Government Grants |

| By Customer Segment | Retail Customers Institutional Investors Corporate Clients |

| By Policy Support | Government Incentives Tax Benefits Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Payment Solutions Providers | 60 | CEOs, Product Managers |

| Digital Lending Platforms | 50 | Founders, Risk Assessment Officers |

| Insurtech Companies | 40 | Business Development Managers, Underwriters |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Consumer Insights on Fintech Adoption | 100 | End-users, Financial Advisors |

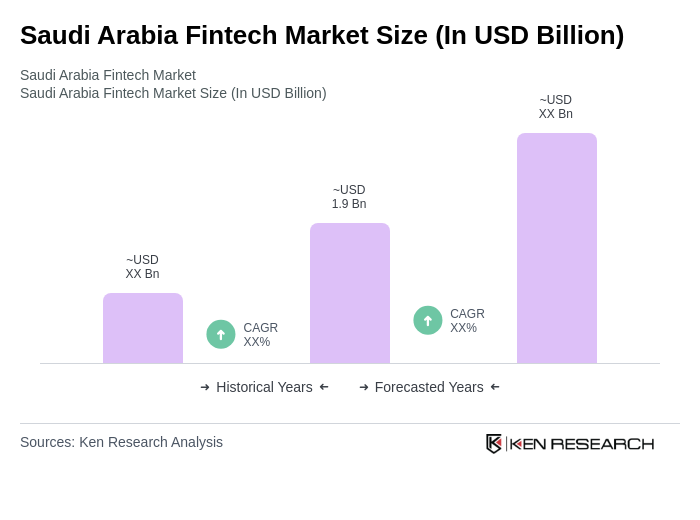

The Saudi Arabia Fintech Market is valued at approximately USD 1.9 billion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and government initiatives to foster innovation in the financial sector.