Region:North America

Author(s):Geetanshi

Product Code:KRAB0036

Pages:94

Published On:August 2025

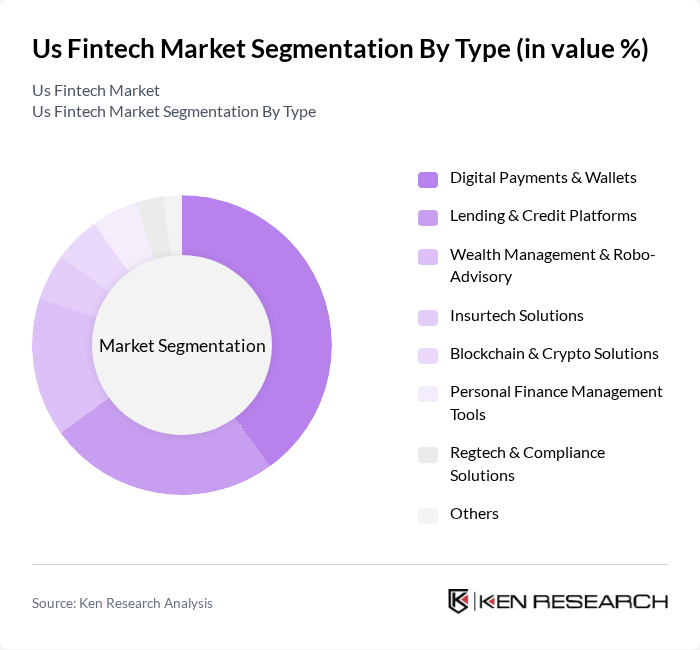

By Type:The segmentation by type includes various subsegments such as Digital Payments & Wallets, Lending & Credit Platforms, Wealth Management & Robo-Advisory, Insurtech Solutions, Blockchain & Crypto Solutions, Personal Finance Management Tools, Regtech & Compliance Solutions, and Others. Each of these subsegments plays a crucial role in shaping the overall market dynamics. Digital Payments & Wallets remain the largest segment, driven by the widespread adoption of contactless and mobile payment technologies. Lending & Credit Platforms are expanding due to increased demand for alternative financing, while Wealth Management & Robo-Advisory services are gaining traction among younger, tech-savvy investors. Insurtech and Regtech are also growing as regulatory requirements and digital insurance products become more prominent .

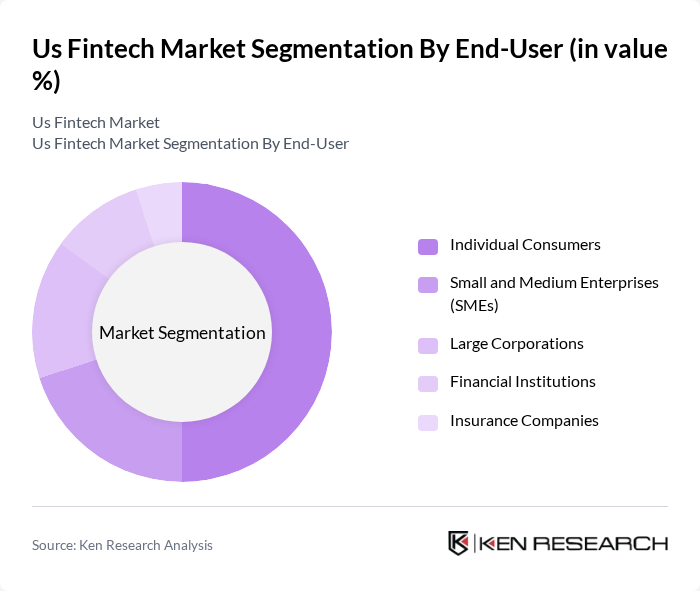

By End-User:The end-user segmentation encompasses Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Insurance Companies. Each of these segments has unique needs and preferences, influencing the types of fintech solutions they adopt. Individual Consumers drive demand for digital wallets and personal finance tools, while SMEs and Large Corporations increasingly utilize lending, payment, and compliance platforms. Financial Institutions and Insurance Companies are adopting fintech to streamline operations and enhance customer experience .

The Us Fintech Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (formerly Square, Inc.), Stripe, Inc., Robinhood Markets, Inc., SoFi Technologies, Inc., Chime Financial, Inc., Affirm Holdings, Inc., Plaid Inc., Coinbase Global, Inc., Credit Karma, Inc., LendingClub Corporation, Betterment LLC, Acorns Grow, Inc., Wise plc (formerly TransferWise Ltd.), Zelle (Early Warning Services, LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. fintech market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and blockchain technology is expected to enhance service delivery and operational efficiency. Additionally, the increasing focus on sustainable finance will likely shape product offerings, aligning with consumer values. As regulatory frameworks adapt to innovation, the market will see a surge in new entrants and partnerships, fostering a dynamic ecosystem that prioritizes customer-centric solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Payments & Wallets Lending & Credit Platforms Wealth Management & Robo-Advisory Insurtech Solutions Blockchain & Crypto Solutions Personal Finance Management Tools Regtech & Compliance Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Insurance Companies |

| By Application | Digital Payments Wealth Management Credit and Lending Insurance Services Fraud Monitoring & Risk Management |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Embedded Finance (B2B/B2C Integrations) |

| By Customer Segment | Retail Customers Institutional Clients High Net-Worth Individuals Underbanked/Unbanked Populations |

| By Pricing Model | Subscription-Based Transaction-Based Freemium Model Usage-Based Pricing |

| By Regulatory Compliance | KYC/AML Compliance GDPR/CCPA Compliance PCI DSS Compliance Federal/State Regulatory Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Payment Solutions | 120 | Product Managers, Marketing Directors |

| Peer-to-Peer Lending Platforms | 90 | Operations Managers, Risk Analysts |

| Wealth Management Apps | 60 | Financial Advisors, User Experience Designers |

| Insurtech Innovations | 50 | Underwriters, Claims Managers |

| Blockchain Applications in Finance | 70 | Blockchain Developers, Compliance Officers |

The US Fintech Market is valued at approximately USD 78 billion, reflecting significant growth driven by the adoption of digital payment solutions, neobanks, and personalized financial services. This valuation is based on a comprehensive five-year historical analysis.